Policy limits play a pivotal role in determining financial compensation for collision insurance claims, affecting maximum payouts for vehicle repairs, medical expenses, property damage, and legal fees. Understanding these limits is essential for policyholders to navigate claims effectively and secure adequate reimbursement for eligible accident-related costs. By reviewing their coverage, documenting repair costs from multiple shops, and keeping detailed records of medical bills, individuals can maximize compensation despite restrictions and ensure a fair process for all associated damages, including vehicle body repair and auto glass replacement.

In the intricate web of insurance, policy limits play a pivotal role in shaping the financial outcomes of accident claims. When a collision occurs, understanding these limits is crucial for both policyholders and insurers. This article delves into the dynamics of how policy restrictions influence collision insurance claims. We explore practical strategies to navigate these constraints and maximize payouts while unraveling the implications on claimants’ compensation. By shedding light on this aspect, we aim to empower individuals navigating the complexities of accident-related financial settlements, particularly in the realm of collision insurance claims.

- Understanding Policy Limits and Their Role in Accident Claims

- Impact of Policy Limits on Collision Insurance Claims

- Strategies for Maximizing Payouts Despite Policy Restrictions

Understanding Policy Limits and Their Role in Accident Claims

When it comes to accident claims, policy limits play a pivotal role in determining the financial compensation individuals receive for their losses. Collision insurance claims, in particular, are subject to these constraints set by insurance policies. Each policy has specific limits that dictate the maximum amount an insured person can recover for damages resulting from a collision or accident. These limits cover various aspects, including medical expenses, property damage, and legal fees. Understanding and being aware of these policy limits is crucial for anyone considering filing a collision insurance claim, as it directly impacts the potential payout.

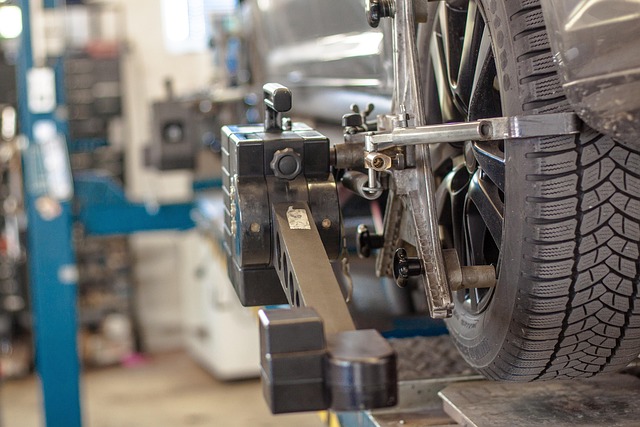

For instance, if you’re seeking compensation for your vehicle’s repair, such as a bumper repair or even more extensive auto body shop services, policy limits will determine how much the insurance company contributes to these repairs. It’s essential to review your policy and understand the coverage specifics to ensure you receive adequate reimbursement for all eligible expenses related to the accident. This knowledge empowers individuals to navigate their collision insurance claims effectively and advocate for the financial support they need during the recovery process.

Impact of Policy Limits on Collision Insurance Claims

When it comes to collision insurance claims, policy limits play a significant role in determining the compensation individuals receive for their vehicle repairs. These limits essentially cap the amount an insurance company is obligated to pay out for damages incurred during an accident. Understanding this aspect is crucial, especially when considering the extent of vehicle body repair and the services provided by a reputable body shop. Policy restrictions might limit the range of services covered, influencing the overall cost of repairing the vehicle to its pre-accident condition.

For instance, policy limits may cover only up to a certain dollar amount for repairs, which could include both external and internal damage. This means that if the total repair costs exceed this threshold, the insured party might have to shoulder the remaining expenses or seek alternative solutions, such as opting for less expensive vehicle repair services. It’s important for policyholders to be aware of these limitations to make informed decisions regarding their collision insurance coverage and choose providers that offer comprehensive body shop services to ensure a seamless restoration process.

Strategies for Maximizing Payouts Despite Policy Restrictions

When dealing with collision insurance claims, policy limits can significantly impact the final payout. However, there are strategic approaches to maximize compensation despite these restrictions. Policyholders should begin by thoroughly reviewing their coverage and understanding the specific exclusions and limitations. This awareness enables them to navigate the claim process more effectively.

One effective strategy is to document all repair costs meticulously, including estimates from multiple reputable auto body repair shops or glass repair services. This ensures transparency and provides a comprehensive view of restoration expenses. Additionally, keeping detailed records of any medical bills related to the accident can help ensure that these costs are covered up to the policy’s limit, ensuring the policyholder receives fair compensation for all associated damages, including vehicle body repair, auto glass repair, or car body repair.

Collision insurance claims are significantly influenced by policy limits, which can cap the amount of compensation available. Understanding these limits and their impact is crucial for anyone looking to navigate accident claim payouts effectively. By recognizing the restrictions, individuals can employ strategies to maximize their compensation despite these constraints. This includes thoroughly reviewing policies, seeking expert advice, and exploring alternative avenues for additional coverage. While policy limits present challenges, being informed and proactive allows for better outcomes in collision insurance claims.