Auto body insurance coverage is vital for storm damage repairs, offering protection against perils not covered by standard policies. Understanding your specific policy terms related to wind damage, debris impact, and water infiltration ensures proper compensation for eligible repairs. Reviewing policy documents, documenting damage with photos/videos, and pre-approving minor repairs with insurers can streamline the claims process and facilitate faster vehicle restoration.

- Understanding Auto Body Insurance Coverage

- What Constitutes Storm Damage According to Your Policy

- Tips for Effective Claims Processing and Repairs Post-Storm

Understanding Auto Body Insurance Coverage

Auto Body Insurance Coverage plays a pivotal role in ensuring adequate compensation for storm-related car damage. Understanding what your policy covers is essential before initiating repairs at a car body shop. Most auto insurance policies have specific provisions for damages caused by natural disasters like storms, including wind, hail, and flooding. These usually fall under comprehensive coverage, which protects against perils not included in your standard liability or collision coverage.

Comprehensive coverage can be a lifesaver when it comes to fixing everything from minor dents and scratches to more severe issues like frame straightening. It covers the cost of car collision repair, ensuring you’re not left with a hefty bill. This is particularly important because, while some policies may offer limited coverage for storm damage, others might require separate deductibles or have specific exclusions. Therefore, reviewing your policy details is crucial to navigate the process effectively and ensure your auto body insurance coverage meets your needs during these challenging times.

What Constitutes Storm Damage According to Your Policy

Storm damage can include a range of issues, from broken windows and shattered glass to extensive car body repairs. According to your auto body insurance coverage, this may encompass both structural and cosmetic damages. Many policies cover the cost of dent removal and car body repair, which is crucial for restoring your vehicle to its pre-storm condition. In terms of specific inclusions, ensure you understand what your policy covers in case of high-wind damage, flying debris impact, or water infiltration, as these can lead to varying degrees of storm-related repairs.

Your auto collision center should be able to guide you through the process, helping you navigate claims and ensuring that you receive compensation for all eligible storm damage repairs. Remember that the extent of coverage depends on your policy’s terms and conditions, so reviewing your policy document is essential before initiating any repair work.

Tips for Effective Claims Processing and Repairs Post-Storm

After a storm, navigating the process of claims processing and repairs can be overwhelming. To ensure a smooth experience, it’s crucial to understand your auto body insurance coverage and the steps involved. First, review your policy documents carefully to grasp what is covered under storm damage repairs. Many policies include comprehensive or collision coverage which specifically addresses these unforeseen events.

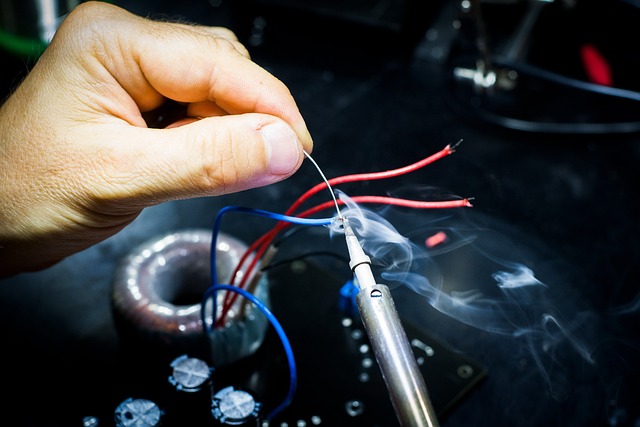

Next, document all damage thoroughly with photos and videos before making any repairs. This visual evidence will be invaluable when submitting your claim. For minor issues like a car dent repair or bumper repair, consider reaching out to your insurance provider for pre-approval, ensuring you understand the process and potential deductibles. Remember, efficient communication can expedite the claims process, leading to faster repairs and getting your vehicle back on the road in no time.

When navigating storm damage repairs, understanding your auto body insurance coverage is key. By comprehending what constitutes storm damage according to your policy and adopting effective claims processing tips, you can ensure a smoother, more efficient restoration process. Remember, knowing your coverage options allows for quicker decision-making and peace of mind during challenging times.