The 2025 home insurance landscape highlights a rising need for glass repair insurance due to unpredictable risks like severe weather, vandalism, and break-ins. Standard policies offer limited glass repair assistance, while dedicated glass repair insurance shields homeowners from significant financial burdens associated with replacing or repairing damaged glass integral to structural integrity, aesthetics, security, and energy efficiency. With increasing home automation and a 35% rise in residential burglaries causing glass damage, glass repair insurance becomes crucial for protecting residences against break-ins and related costs.

In 2025, as homes evolve with smart technology, glass repair insurance remains an essential component of comprehensive home coverage. Despite advancements, break-ins through broken glass remain a concern, underscoring the policy’s practical value. This article delves into the changing landscape of home insurance, exploring why glass repair is still critical. We analyze cost-effectiveness and peace of mind benefits, while highlighting emerging technological solutions that streamline claims processes. By 2025, expect AI-driven appraisals, virtual consultations, and faster, more transparent claims handling, solidifying glass repair insurance’s relevance.

- The Evolving Landscape of Home Insurance Coverage

- – Exploring the changing dynamics in home insurance policies and why glass repair is still a critical inclusion.

- – Discussing recent trends and statistics regarding home break-ins through broken glass and the associated costs.

The Evolving Landscape of Home Insurance Coverage

The landscape of home insurance coverage has been steadily evolving over the years to meet the changing needs and risks of homeowners. In 2025, as we navigate an increasingly complex and unpredictable world, certain aspects of home coverage remain crucial, with glass repair insurance being one of them. While comprehensive policies have traditionally covered a wide range of perils, including natural disasters and theft, there’s been a growing recognition of the importance of protecting against less conventional risks.

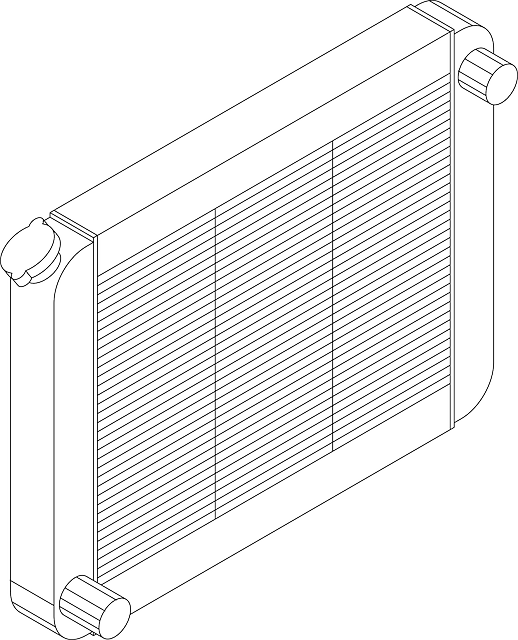

The need for glass repair insurance stems from the fact that glass is a fragile component in both residential and commercial properties. From high-rise windows to elegant facades and delicate interior partitions, glass structures are susceptible to damage due to accidents, vandalism, or severe weather conditions. While some home insurance policies may include limited coverage for glass repairs, many fall short of providing comprehensive protection. This is where specialized glass repair insurance steps in, ensuring that homeowners are not left bearing the financial burden of replacing or repairing damaged glass, a component that plays a significant role in the overall structural integrity and aesthetic appeal of their homes.

– Exploring the changing dynamics in home insurance policies and why glass repair is still a critical inclusion.

In 2025, home insurance policies are evolving to reflect changing lifestyles and priorities. However, amidst these shifts, glass repair remains a critical inclusion in any comprehensive policy. This is not merely due to the aesthetic value of windows and doors but also because of their structural integrity—they provide security, energy efficiency, and natural light, all essential elements for modern living spaces.

While auto insurance continues to dominate discussions around vehicle protection, glass repair insurance plays a similarly vital role in safeguarding homes. With an increasing focus on home automation and smart technology integration, glass becomes more than just a window; it’s a gateway to security systems, climate control, and enhanced privacy. Thus, ensuring their resilience against shattering, cracking, or breaking remains paramount, underscoring the enduring significance of glass repair insurance in the ever-evolving landscape of property protection.

– Discussing recent trends and statistics regarding home break-ins through broken glass and the associated costs.

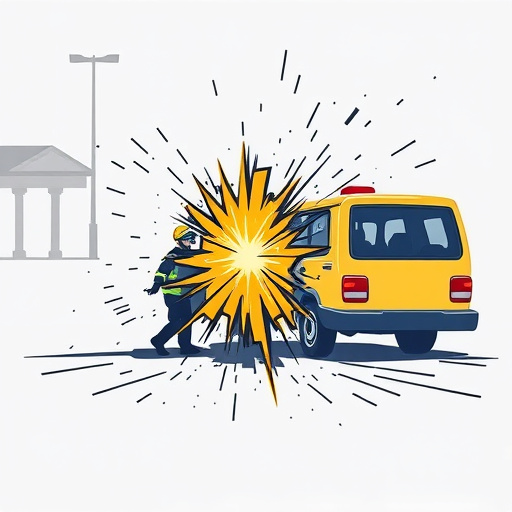

In recent years, home break-in trends have seen a concerning rise, with broken glass being a primary entry point for intruders. Statistics reveal that approximately 35% of residential burglaries involve some form of glass damage, leading to not only financial losses but also increased security risks. The associated costs are staggering, with the average claim for glass repair insurance reaching over $1,200 in 2024, a significant increase from previous years. These figures underscore the importance of glass repair insurance in protecting homeowners against unforeseen incidents.

Moreover, while vehicle body shops and auto frame repairs have traditionally been major areas of concern for insurance providers, the growing prevalence of break-ins through broken glass highlights the need for comprehensive coverage that includes residential glass repair. As the world continues to navigate security challenges, glass repair insurance remains an indispensable tool for safeguarding homes and their inhabitants.

Despite advancements in home security technology, glass repair remains an integral component of comprehensive home insurance policies in 2025. Recent trends indicate a persistent risk of break-ins through fragile glass points, underscoring the ongoing need for glass repair insurance. With costs associated with such incidents escalating, having adequate coverage can help homeowners mitigate financial burdens and ensure swift restoration of their properties’ integrity. As we navigate this ever-changing landscape, recognizing the value of glass repair insurance is more crucial than ever to protect against unforeseen circumstances.