Collision insurance claims protect auto owners from financial shock after accidents, with a process that involves reporting, inspection, repair, and understanding deductibles. Policyholders initiate claims by reporting incidents and paying out-of-pocket deductibles for covered damages, as per their policy's terms. Adjusters inspect cars, estimate repairs, and communicate costs. Reputable auto body shops perform collision repairs using industry standards, ensuring vehicle safety and aesthetic restoration. Keyword focus: collision insurance claims.

Collision insurance claims are an essential aspect of auto ownership, offering protection against unexpected vehicle damage. However, understanding when deductibles apply can be complex. This article guides you through the process, starting with the fundamentals of collision insurance claims. We then explore various scenarios where deductibles come into play, providing clarity on rules and regulations. Finally, we outline what to expect during a collision repair coverage claim, empowering you with knowledge for smooth navigation.

- Understanding Collision Insurance Claims: The Basics

- When Deductibles Come Into Play: Scenarios and Rules

- Navigating the Process: What to Expect During a Collision Repair Coverage Claim

Understanding Collision Insurance Claims: The Basics

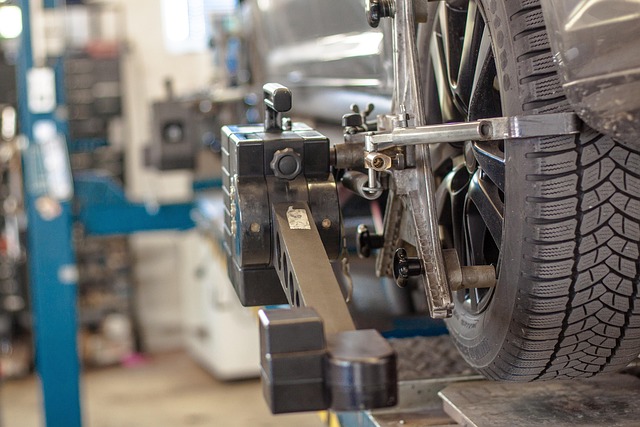

Collision insurance claims are a crucial aspect of auto ownership, designed to protect against financial strain during unforeseen vehicle accidents. When a policyholder is involved in a collision, they file a claim with their insurance provider, who assesses the damage and determines the necessary repairs. This process involves several key steps. Initially, the policyholder reports the incident, providing details about the accident and any resulting damages to their vehicle. The insurer then dispatches an adjuster to inspect the car, evaluating the extent of the harm.

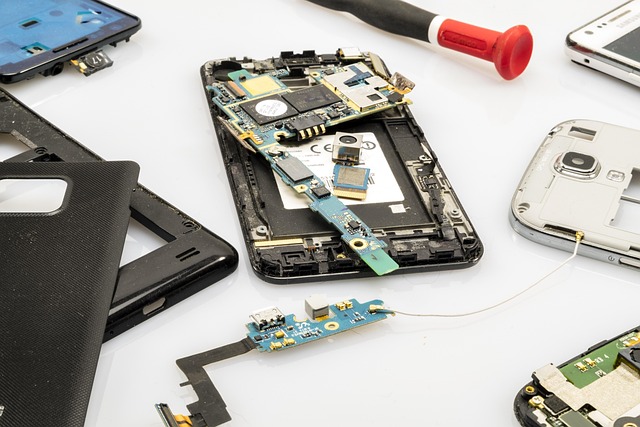

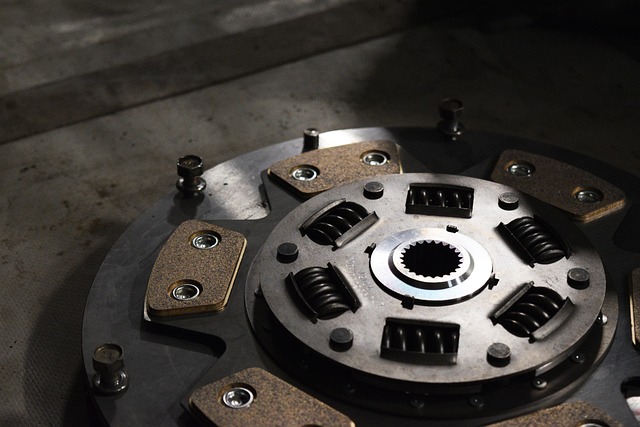

During this assessment, the adjuster considers both visible damage to the car’s exterior—like dents or cracked windows—and potential internal issues. Once the scope of work is established, the policyholder can begin the repair process. Many vehicle body shops, offering auto body services and expert car body restoration, collaborate with insurance companies to facilitate claims. These shops ensure that repairs are completed according to industry standards and manufacturer guidelines, ultimately helping policyholders navigate the collision insurance claim process smoothly.

When Deductibles Come Into Play: Scenarios and Rules

When deductibles come into play for collision insurance claims, it’s crucial to understand when and how they apply. Deductibles are a set amount that policyholders must pay out-of-pocket before their insurance covers the rest of the repair costs. This mechanism serves as a financial deterrent for minor incidents and encourages responsible driving behavior.

There are several scenarios where deductibles come into play. For instance, if you’re involved in a collision due to driver error or negligence, such as rear-ending another vehicle at a stop light, your deductible will apply. Similarly, deductibles are triggered when damage is caused by non-covered perils like storms, floods, or acts of vandalism. However, if the collision is the result of another driver’s negligence and you have comprehensive coverage, your insurance may waive the deductible to expedite the car body restoration process. Keep in mind that rules vary across insurers, so reviewing your policy for specific deductibles related to collision insurance claims, auto bodywork, and car paint repair is essential before filing a claim.

Navigating the Process: What to Expect During a Collision Repair Coverage Claim

When you’re dealing with a car collision, navigating the process of a collision insurance claim can seem daunting. However, understanding what to expect can make it smoother. After filing your claim, an adjuster from your insurance company will assess the damage to your vehicle. They’ll inspect the car’s exterior and interior, taking note of any dents, cracks, or missing parts. This step is crucial as it determines the extent of repairs needed.

During this process, you can expect clear communication from your insurer. They’ll provide you with information on estimated repair costs, potential deductibles, and an approximate timeline for the repair work. It’s also a good time to ask questions and clarify any doubts. Once approved, your vehicle will be taken to trusted auto body services for repairs. From there, it undergoes meticulous car collision repair and even auto detailing to ensure your car not only drives safely but also looks as good as new.

Collision insurance claims are designed to help cover the cost of repairs after a vehicle accident, but understanding deductibles is crucial. By familiarizing yourself with when deductibles apply and the process involved, you can navigate collision repair coverage smoothly. Remember that each policy has unique rules, so always review your specific details. Knowing what to expect beforehand ensures a less stressful experience during an otherwise challenging time.