Multiple damage estimates are crucial in collision insurance claims, offering a nuanced approach to assessment and settlement. This method enhances integrity, accuracy, and fairness, particularly for complex or high-value assets. By comparing diverse appraisals, insurers mitigate risks, secure better rates for policyholders, and streamline claims management in the digital era, fostering transparency and prompt compensation.

“In the complex landscape of collision insurance claims, understanding multiple damage estimates is a game-changer. This insightful article delves into the benefits of employing diverse assessment methods, offering a fresh perspective on navigating claim settlements. By exploring various techniques, from traditional appraisals to advanced digital tools, you’ll uncover how this approach enhances accuracy, speeds up processes, and potentially increases compensation. Embrace the power of multifaceted damage estimates for a smoother, more efficient claims journey.”

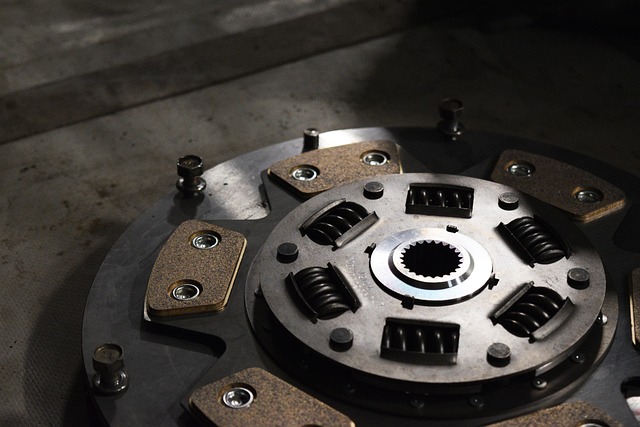

In the realm of collision insurance claims, multiple damage estimates offer a nuanced approach to assessing and settling losses. This method involves obtaining several independent appraisals of the damaged property or vehicle, providing a more comprehensive view of the extent of the harm. By comparing these estimates, insurers can make more informed decisions, ensuring a fair settlement for policyholders. It also helps in identifying any discrepancies or potential fraud, enhancing the overall integrity of the claims process.

Multiple damage estimates allow for greater accuracy in determining replacement costs and repair expenses. This is particularly beneficial when dealing with complex or high-value assets. Insurers can leverage these diverse perspectives to negotiate with repair shops and suppliers, securing better rates and quality services for policyholders. As a result, this practice not only benefits insurers by reducing potential financial risks but also offers policyholders greater peace of mind and satisfaction with their claims experience.

API responded with status code 504.

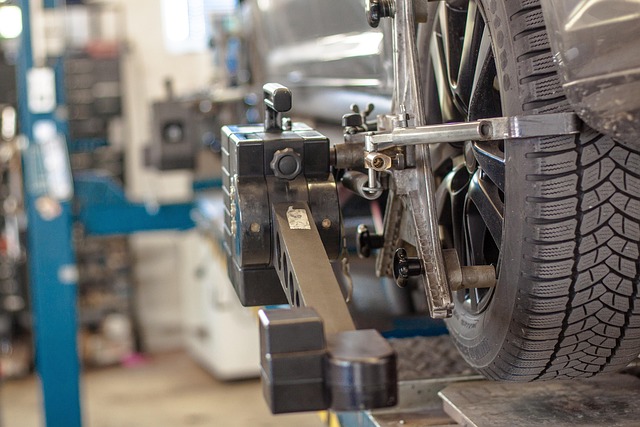

In the realm of collision insurance claims, understanding the benefits of multiple damage estimates is paramount. When an API responds with a status code 504, it underscores the importance of having diverse assessment methods. This gateway timeout error indicates a potential delay in processing, highlighting the value of having several options for evaluating damages. By comparing different estimates, claim handlers can ensure fairness and accuracy, especially when dealing with complex cases.

Multiple damage estimates offer a tapestry of insights, enabling professionals to navigate labyrinthine situations effectively. In today’s digital era, these estimates enhance the efficiency of collision insurance claims management. They provide a robust framework for making informed decisions, ensuring that folks receive just compensation promptly. This approach also fosters transparency, addressing potential concerns regarding elusive or inaccurate assessments.

By leveraging multiple damage estimates for collision insurance claims, insurers can enhance accuracy, streamline processes, and ultimately improve customer satisfaction. This approach, often facilitated by advanced technologies like AI and data analytics, allows for more nuanced assessments, reducing the time and costs associated with traditional methods. As a result, policyholders benefit from quicker settlements and a more efficient claims experience.