Specialty collision hardware is tailored equipment crucial for meticulous car body restoration and precise auto glass repair, addressing unique challenges like dent removal, panel replacement, and windshield mending. Insurance coverage is vital, typically covering advanced safety systems and electronic modules. Effective claims management involves thorough inspection by qualified technicians, detailed documentation, prompt insurer contact, and seamless coordination between repair shops and insurers to ensure comprehensive coverage for specialized components.

Specialty collision hardware—from impact-resistant panels to advanced locking mechanisms—is transforming how we protect valuable assets. This article demystifies these specialized solutions, exploring their crucial role in mitigating damage during unexpected events. We delve into the insurance coverage aspects, highlighting key players and policy details that cater to specialty collision hardware. Additionally, we provide a step-by-step guide for navigating claims, offering effective management strategies for minimizing disruption and ensuring swift recovery.

- Understanding Specialty Collision Hardware: What It Is and Why It Matters

- Insurance Coverage for Specialty Collision Hardware: Key Players and Policy Details

- Navigating Claims: Steps to Effective Management of Specialty Collision Hardware Damage

Understanding Specialty Collision Hardware: What It Is and Why It Matters

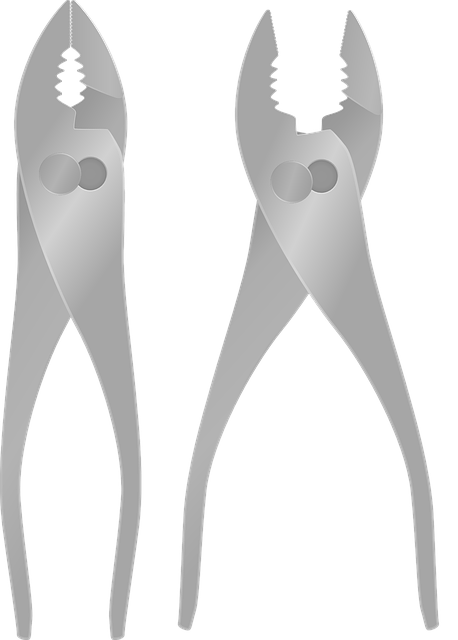

Specialty collision hardware refers to specialized equipment and tools designed for intricate car body restoration and precise auto glass repair, among other tasks. These aren’t your standard wrenches or hammers; they’re tailored for the unique challenges of restoring damaged vehicles to their original condition.

Understanding what makes up specialty collision hardware is crucial for both insurance providers and customers alike. It ensures that when a vehicle undergoes repairs, especially at a reputable auto repair shop, the work is carried out with the utmost care and expertise. This specialized equipment allows for more accurate and effective car body restoration, ensuring the safety and integrity of the vehicle post-repair, be it fixing dents, replacing panels or mending shattered windshields.

Insurance Coverage for Specialty Collision Hardware: Key Players and Policy Details

When it comes to specialty collision hardware, insurance coverage plays a pivotal role in ensuring that repairs are not only comprehensive but also financially feasible for vehicle owners. This includes a range of components specific to modern vehicles, such as advanced safety systems, complex electronic modules, and specialized parts required for precise automotive body shop repairs. Insurance policies typically cover the cost of replacing or repairing these intricate pieces, which can be especially crucial in cases of severe accidents involving bumper repair or other structural damage.

The key players in this process are insurance providers who offer tailored coverage for automotive collision repair needs. Policy details may vary, but commonly include provisions for labor costs, parts replacement, and even rental car coverage during the repair period. It’s essential for vehicle owners to understand their policy specifics, especially regarding deductibles, co-pays, and any limitations on the type of collision hardware that will be covered. This knowledge empowers them to make informed decisions when choosing a reputable automotive body shop capable of handling specialized repairs.

Navigating Claims: Steps to Effective Management of Specialty Collision Hardware Damage

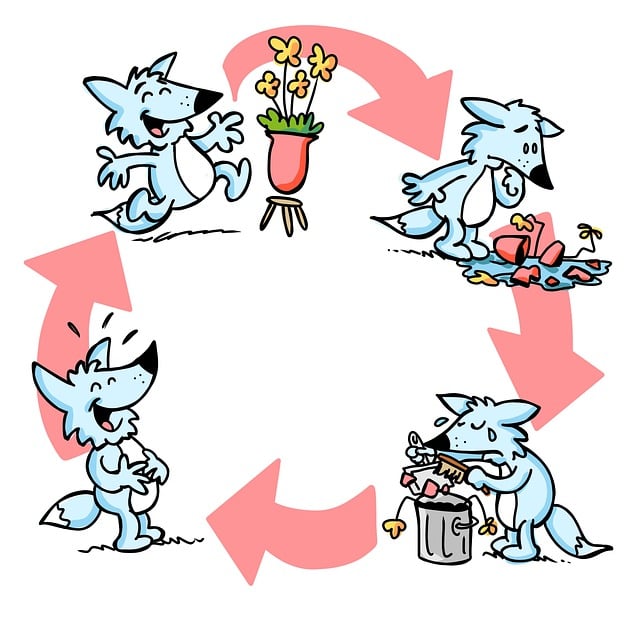

When dealing with specialty collision hardware damage, effective claims management is crucial. The first step is to assess the extent of the damage, which requires a thorough inspection from a qualified technician. This involves identifying unique components and their condition, as specialty hardware can range from custom car parts to specialized equipment. Once assessed, document all findings meticulously—this becomes a critical reference for the subsequent claim process.

The next step is to contact your insurance provider promptly. Inform them about the damage, providing detailed descriptions of the specialty collision hardware involved. Many insurers have dedicated claims teams who can guide you through this process. They will likely request relevant documents and photographs, ensuring all necessary information is provided. The auto repair shop or collision center handling the repairs should coordinate with your insurer to ensure seamless coverage for the specialized components under their care.

Specialty collision hardware plays a crucial role in mitigating risks and ensuring efficient repairs for unique vehicles. Understanding this specialized equipment and its corresponding insurance coverage is essential for owners and repair professionals alike. By familiarizing themselves with key players in the industry and following structured claims management steps, individuals can effectively navigate the process of managing specialty collision hardware damage, ultimately leading to smoother and more cost-efficient resolutions.