Auto body insurance coverage safeguards vehicle owners against financial strain caused by structural and aesthetic damage, including repairs for dents, panel replacements, frame adjustments, and paint restoration. Insurance companies assign adjusters who, in collaboration with approved collision centers, assess damage, verify costs against policy limits, and ensure transparent communication about coverage and potential out-of-pocket expenses. These professionals hold final authority in claim processing, navigating repair estimates, and adhering to policy terms, providing policyholders peace of mind throughout the process.

“Unraveling the process behind major auto body insurance claims is crucial for every vehicle owner. This article guides you through the intricate details, starting with an overview of auto body insurance coverage and its various aspects. We then explore the role of insurance companies in claim approval, delving into their assessment methods. The central focus lies in understanding who holds the final authority for major claims decisions, shedding light on the key players and factors influencing these approvals.”

- Understanding Auto Body Insurance Coverage

- The Role of Insurance Companies in Claim Approval

- Who Holds Final Authority for Major Claims Decision?

Understanding Auto Body Insurance Coverage

Auto body insurance coverage is designed to protect vehicle owners from financial burdens arising from damage to their car’s structure and appearance. This includes repairs related to car bodywork, such as dent removal, panel replacement, and frame straightening, as well as restoration of the car paint finish. Understanding what is covered under your policy is crucial when navigating the claims process after an accident.

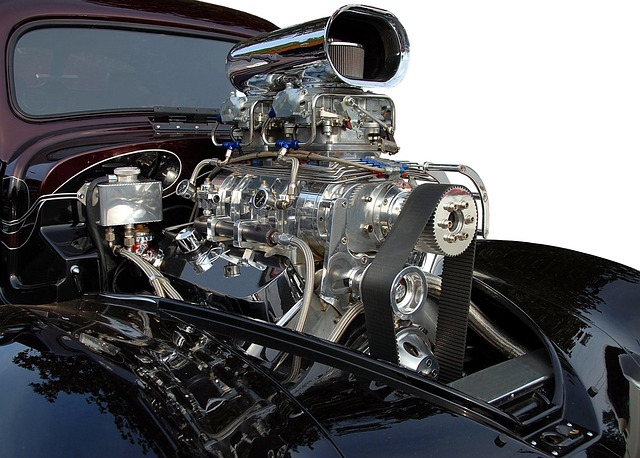

When a policyholder files an auto collision claim, the insurance company assigns an adjuster who assesses the damage to the vehicle. The adjuster determines the cost of repairs at approved auto collision centers, ensuring that the work meets industry standards. This process involves estimating the price of materials and labor required for car paint repair and other necessary bodywork services. Policyholders can rest assured that their claims are handled by professionals who prioritize accurate assessments and transparent communication about coverage limits and potential out-of-pocket expenses.

The Role of Insurance Companies in Claim Approval

Insurance companies play a pivotal role in the auto body insurance claims approval process. When an individual files a claim for car bodywork services or automotive collision repair, the insurer assesses the damage, verifies the cost of repairs against the policy’s coverage limits, and determines the appropriate reimbursement or settlement amount. They work closely with collision repair centers to ensure accurate estimates and adherence to repair standards.

The approval authority involves a thorough review of the claim, including examining photographs of the damaged vehicle, consulting with in-house adjusters, and sometimes engaging external experts for complex cases. This meticulous process guarantees that claims are settled fairly and promptly, providing peace of mind to policyholders while ensuring financial responsibility within the scope of auto body insurance coverage.

Who Holds Final Authority for Major Claims Decision?

When it comes to major auto body insurance claims, understanding who holds the final authority is crucial for policyholders navigating the claims process. While insurance companies have their own assessment teams, the decision-maker for final approval often lies with an independent appraiser or a designated adjuster from the insurer. This individual is responsible for thoroughly reviewing the damage to the vehicle, considering repair estimates, and ensuring compliance with the terms of the auto body insurance coverage.

The role of these professionals is to ensure fair compensation for the vehicle owner while managing the financial aspects of the claim. They carefully assess the extent of the auto body work required, compare repair quotes from trusted auto collision centers, and make informed decisions based on the available evidence. This process helps in timely processing of claims, facilitating the necessary vehicle repair or replacement as per the policy terms.

In navigating the process of auto body insurance claims, understanding the role of insurance companies and their approval mechanisms is crucial. Auto body insurance coverage plays a vital part in ensuring repairs are made efficiently after an accident. While insurers have specific guidelines for claim approval, the final authority often rests with underwriters or designated adjusters. By familiarizing themselves with these processes, policyholders can better prepare and ensure their claims are handled smoothly, ultimately facilitating faster repairs and reduced inconvenience.