In the digital age, traditional insurance company negotiations are evolving dramatically due to technology and data analytics. Customers now have access to vast information and online platforms that enable them to understand coverage, compare rates, and negotiate terms directly, empowering policyholders and forcing insurers to adopt innovative strategies. Services like car repair and tire services are becoming integral parts of these negotiations as consumers demand transparency and personalized solutions. While this process offers advantages like higher settlements, it's time-consuming and requires understanding policies and effective communication; the benefits may not outweigh the effort or risks for less severe claims. Consumers are exploring alternative methods, such as online quote comparators, peer-to-peer (P2P) insurance models, and specialized auto collision centers, to secure better coverage and rates.

In today’s evolving insurance landscape, questioning the value of negotiations with insurers is pertinent. While traditional negotiation tactics have long been a go-to strategy for consumers seeking better coverage and rates, the industry’s dynamics are shifting. This article explores whether insurance company negotiations remain a worthwhile endeavor, delving into the changing strategies and offering insights on alternative approaches to secure optimal policies. By examining both the pros and cons, readers will gain a comprehensive understanding of navigating insurance markets effectively.

- The Changing Landscape of Insurance Negotiations

- Pros and Cons of Engaging in Insurance Company Negotiations

- Alternative Approaches to Securing Optimal Coverage and Rates

The Changing Landscape of Insurance Negotiations

In today’s digital era, the landscape of insurance company negotiations is undergoing a significant transformation. What was once a lengthy and often tedious process, filled with back-and-forth discussions over policy terms and claims settlements, is now evolving into a more streamlined and customer-centric experience. The rise of technology and data analytics has empowered both insurers and policyholders in unique ways.

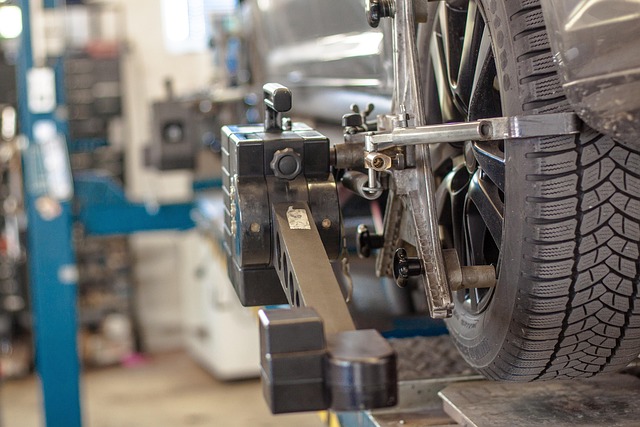

Customers now have access to a wealth of information and resources that allow them to better understand their coverage options, compare rates, and even negotiate terms directly through online platforms. Services like car paint repair, auto frame repair, and tire services are no longer mere add-ons; they’re becoming integral parts of the negotiation process as consumers demand transparency and comprehensive solutions tailored to their specific needs. This shift not only empowers policyholders but also pushes insurance companies to adopt more efficient and innovative strategies in order to stay competitive in the market.

Pros and Cons of Engaging in Insurance Company Negotiations

Engaging in insurance company negotiations can be a strategic move for policyholders looking to secure better compensation for their claims. The process offers several advantages, particularly when it comes to complex cases involving extensive repairs like automotive repair or auto body restoration. By negotiating, individuals can potentially receive higher settlements, ensuring they are adequately compensated for their vehicle’s paint repair and other associated damages. This approach allows for a more personalized experience, where policyholders can actively participate in deciding the outcome of their claim.

However, negotiations also present certain drawbacks. It requires significant time and effort to gather evidence, understand policies, and communicate effectively with insurance representatives. For less severe claims or those involving straightforward processes like minor vehicle paint repairs, the potential benefits might not outweigh the investment of time. Additionally, negotiations can be stressful and may lead to misunderstandings if not handled skillfully, potentially resulting in delayed settlements or even denied claims. Therefore, individuals must weigh these pros and cons carefully before deciding whether to engage in insurance company negotiations for their specific situation.

Alternative Approaches to Securing Optimal Coverage and Rates

In today’s digital era, many consumers are exploring alternative approaches to securing optimal coverage and rates beyond traditional insurance company negotiations. One notable shift is the rise of online platforms that compare quotes from multiple insurers simultaneously. These platforms not only save time but also provide a transparent view of market rates, allowing informed decisions without the pressure of direct company interactions.

Additionally, leveraging peer-to-peer (P2P) insurance models and specialized auto collision centers like vehicle body shops can offer tailored solutions. P2P insurance pools resources among members, potentially reducing costs for participants. Similarly, visiting reputable vehicle bodywork experts who understand the nuances of repair estimates can help negotiate fairer prices with insurers. These approaches demonstrate that consumers have options beyond traditional negotiations with insurance companies.

In a rapidly evolving landscape, questioning the value of insurance company negotiations is timely. While traditional negotiation tactics may not always yield expected results, exploring alternative approaches can empower individuals to secure optimal coverage and rates. Understanding the pros and cons of direct engagement and considering innovative strategies are key to navigating modern insurance markets. By leveraging these insights, consumers can make informed decisions, ensuring they receive fair treatment and tailored solutions without expending undue time on negotiations with insurance companies.