Insurance claim management partners are vital links between adjusters and policyholders, streamlining claims handling through expert knowledge of policies, regulations, and procedures. They facilitate repairs, including specialized services like Mercedes Benz repair, reducing adjusters' workload while ensuring high-quality customer service. Effective communication and collaboration between adjusters and their partners leads to faster claim processing, informed decision-making, and enhanced trust within the industry. This partnership is a key strategy for enhancing efficiency and customer satisfaction in insurance claim management.

Adjusters rely on strong insurance claim management partners for seamless operations and improved outcomes. This article explores why these partnerships are vital, focusing on three key aspects: understanding the role of insurance claim management partners, the transformative power of effective communication and collaboration, and streamlining processes to achieve faster settlements and elevated customer satisfaction. By delving into these areas, we highlight the essential contribution of robust insurance claim management strategies.

- Understanding the Role of Insurance Claim Management Partners

- The Impact of Effective Communication and Collaboration

- Streamlining Processes for Faster Settlement and Enhanced Customer Satisfaction

Understanding the Role of Insurance Claim Management Partners

Insurance claim management partners play a pivotal role in streamlining the complex process of handling insurance claims efficiently. They act as a crucial liaison between insurance adjusters and policyholders, ensuring smooth communication and timely resolution. These partners are well-versed in navigating the intricacies of various insurance policies, regulations, and procedures, making them invaluable assets.

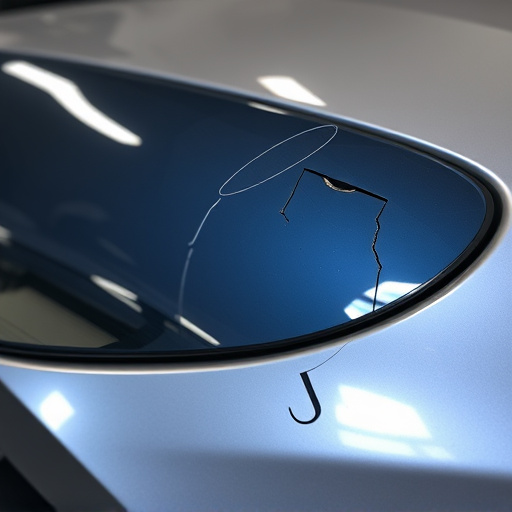

Their expertise extends to facilitating repairs, such as coordinating with trusted automotive experts for bumper repair or even comprehensive Mercedes Benz repair, following a collision. By managing these aspects, they alleviate adjusters’ workloads, enabling them to focus on assessing damages, calculating compensation, and providing policyholders with accurate information. Effective collaboration between insurance companies and these partners ultimately enhances customer satisfaction, ensuring that claims are processed promptly and repairs are of the highest quality.

The Impact of Effective Communication and Collaboration

Effective communication and collaboration between adjusters and their insurance claim management partners are paramount for successful claim resolution. When adjusters work closely with experienced professionals, they gain access to specialized knowledge that streamlines the process. This partnership ensures that every aspect of a claim—from assessing damages in complex cases like automotive repair or fender repairs, to coordinating vehicle restoration services—is handled efficiently. By fostering open lines of communication, adjusters can make informed decisions, provide accurate estimates, and ultimately, deliver superior customer service while minimizing delays.

Collaborative efforts lead to faster turnaround times, which is crucial in meeting policyholder expectations. When adjusters rely on strong claim management partners, they can better navigate the intricacies of insurance policies and legal requirements. This partnership benefits both parties, ensuring that claims are settled accurately and promptly, fostering trust, and strengthening professional relationships within the industry.

Streamlining Processes for Faster Settlement and Enhanced Customer Satisfaction

Effective insurance claim management is a double-edged sword that benefits both adjusters and policyholders alike. By partnering with skilled professionals in this domain, adjusters can significantly streamline processes, leading to faster settlements. This efficiency is crucial as it reduces the time between an incident and its resolution, which is vital for maintaining customer satisfaction. When claims are processed swiftly, policyholders feel appreciated and supported, fostering a positive perception of the insurance company.

Moreover, strong claim management partners bring expertise in various specialized areas, such as automotive collision repair and car body repair. This knowledge ensures that complex cases are handled competently, minimizing errors and delays associated with intricate auto body painting and restoration processes. Such partnerships ultimately contribute to a seamless and stress-free experience for all parties involved, reinforcing the reputation of both the insurance provider and their chosen partners.

Insurance claim management partners play a pivotal role in ensuring smooth, efficient, and customer-centric claims processes. By fostering effective communication and collaboration, these partners streamline operations, leading to faster settlement times and heightened client satisfaction. In today’s competitive landscape, insurers that value and invest in robust insurance claim management strategies stand to gain significant advantages, ultimately solidifying their reputation for excellence and reliability.