Out-of-pocket repair costs refer to the unexpected expenses individuals face for fixing damaged assets, such as cars and homes, ranging from simple repairs to complex restoration. For auto collision repairs, these costs may include deductibles and additional expenses not covered by standard insurance. Collision repair centers provide estimates to help plan budgets. Understanding these costs is vital for effective financial navigation after potential damages. Proactive maintenance through regular checks and service histories, along with adequate insurance coverage like comprehensive and collision policies, can significantly reduce this financial burden.

In today’s world, unexpected appliance failures or vehicle breakdowns can significantly impact your finances. Understanding out-of-pocket repair costs (OOPRC) is crucial for effective financial management. This article delves into the intricacies of OOPRC, providing insights on calculation, preparation, and mitigation strategies. Learn how to navigate these expenses through insurance, maintenance plans, and proactive steps, ensuring you’re not left with a hefty bill when the unexpected strikes.

- What are Out-of-Pocket Repair Costs?

- How to Calculate and Prepare for Potential Expenses

- Mitigating Financial Impact: Insurance, Maintenance, and Proactive Steps

What are Out-of-Pocket Repair Costs?

Out-of-pocket repair costs refer to the expenses that an individual is responsible for paying out of their own pocket when it comes to fixing damage to their property, be it a car, home, or any other asset. This can include various types of repairs, ranging from simple fixations to complex restoration processes such as car body restoration. When you’re dealing with unexpected damages, these costs can often come as a financial surprise, especially if they’re not covered by insurance policies.

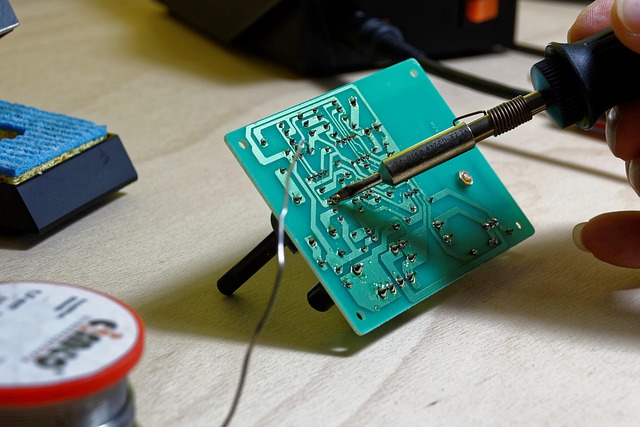

In the case of auto collision repair, for instance, out-of-pocket expenses might include deductibles on your insurance policy, as well as any additional costs that aren’t covered under standard coverage. Collision repair centers typically provide estimates for these repairs, helping individuals plan and budget accordingly. Understanding out-of-pocket repair costs is crucial to navigate financial implications effectively, ensuring that you’re prepared for potential damages and their associated expenses.

How to Calculate and Prepare for Potential Expenses

Understanding out-of-pocket repair costs is essential for anyone looking to maintain their vehicle’s condition. To calculate potential expenses, start by assessing the extent of damage. Minor issues like a few scratches or dents might be suitable for cost-effective solutions like paintless dent repair, which avoids extensive painting and can significantly reduce out-of-pocket costs. However, more severe damages, such as major body work or engine repairs, will likely require substantial financial investment.

Preparation involves setting aside an emergency fund specifically for vehicle maintenance and repairs. Researching collision repair services in your area and understanding their pricing structures can help you make informed decisions. Additionally, comparing quotes from different repair shops allows you to find the best value without compromising quality. Remember, while paintless dent repair might be cost-efficient for minor damages, complex auto painting jobs could significantly impact your out-of-pocket expenses.

Mitigating Financial Impact: Insurance, Maintenance, and Proactive Steps

Understanding the financial implications of out-of-pocket repair costs is crucial for anyone owning a vehicle. One effective way to mitigate this impact is through insurance coverage, specifically comprehensive and collision policies that can cover unexpected repairs, including vehicle bodywork and paint repair. These policies significantly reduce the immediate financial strain by shifting a portion of these costs onto your insurer.

Proactive maintenance is another strategy to minimize out-of-pocket repair costs. Regular checks and servicing can help identify potential issues early on, preventing them from escalating into costly repairs. Additionally, keeping detailed records of service histories can assist when filing insurance claims or visiting an auto repair shop. By taking these steps, you empower yourself to better navigate the financial landscape of vehicle ownership and reduce the impact of unforeseen out-of-pocket repair costs.

Understanding and preparing for out-of-pocket repair costs is essential in navigating the financial implications of home ownership. By calculating potential expenses, considering insurance options, implementing regular maintenance, and taking proactive steps, homeowners can mitigate the financial impact of unexpected repairs. Awareness and planning are key to ensuring these costs don’t become a burden but rather a manageable aspect of homeownership.