Low-interest repair financing options are reshaping vehicle ownership by offering convenient, accessible solutions for unexpected repairs, such as Mercedes Benz repair and vehicle paint repair. These plans, tailored for digital convenience, empower drivers to maintain their cars without high debt, fostering a healthier automotive industry through encouraged maintenance. Both homeowners and contractors benefit from improved cash flow management and access to new projects, while individuals can focus on vehicle restoration with minimal budget disruptions, ensuring prompt and reliable transportation through quality collision repair services.

In today’s digital era, understanding access to low-interest repair financing options can revolutionize how folks navigate property maintenance. This article explores the benefits of these innovative financial tools, specifically focusing on their impact for both property owners and contractors. By delving into the advantages and ease they offer, we’ll uncover how these repair financing options transform traditional repair experiences, making them smoother and more manageable.

- Understanding Low-Interest Repair Financing Options

- Advantages for Property Owners and Contractors

- Navigating Repairs with Ease: How These Options Can Transform Your Experience

Understanding Low-Interest Repair Financing Options

Low-interest repair financing options have emerged as a game-changer for many vehicle owners, offering a practical solution to cover unexpected repair costs without breaking the bank. These financing plans are designed to provide accessibility to essential repair financing options, allowing individuals to maintain their vehicles and avoid being deterred by financial constraints. In today’s digital era, where convenience is paramount, these low-interest options cater to folks who value timely mercedes benz repair or vehicle paint repair without incurring substantial debts.

Whether it’s a minor accident causing damage to the body shop services or a necessary overhaul, low-interest financing ensures that repairs can be conducted promptly. By spreading out the cost over time and at a reduced interest rate, vehicle owners can focus on getting their cars back in top shape rather than worrying about immediate financial burdens. This approach not only benefits individual drivers but also fosters a healthier automotive industry by encouraging timely maintenance and repairs.

Advantages for Property Owners and Contractors

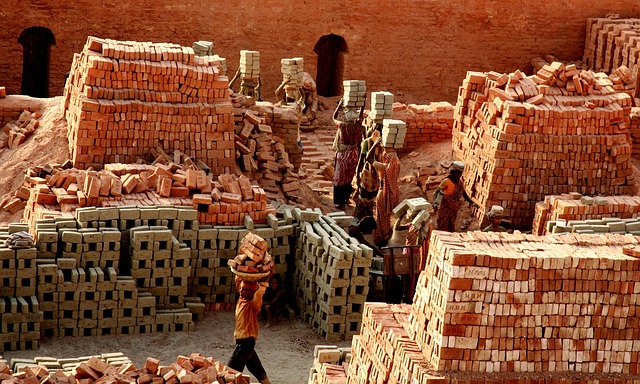

For property owners, low-interest repair financing options offer a range of benefits that extend beyond mere financial relief. By availing these services, homeowners can significantly enhance the value and aesthetics of their properties. With access to affordable funds, they can undertake much-needed repairs, upgrades, or renovations, ensuring their homes remain in top condition. This is particularly advantageous when preparing for future sales or simply maintaining a comfortable living environment.

Contractors also stand to gain from these financing schemes. They can secure projects that might have otherwise been out of reach due to upfront cost constraints. Low-interest rates enable contractors to offer competitive quotes, attract more clients, and foster long-term relationships with property owners. Moreover, these options provide contractors with the flexibility to manage cash flow better, allowing them to allocate resources efficiently for various tasks, including auto body work, car paint repair, or car damage repair services.

Navigating Repairs with Ease: How These Options Can Transform Your Experience

Navigating repairs can often feel like a daunting task, especially when unexpected damages arise. However, with low-interest repair financing options available, this process becomes significantly easier and less stressful for many individuals. These options allow you to focus on getting your vehicle back in top condition without the immediate financial burden of paying for extensive repairs out of pocket.

Low-interest financing plans offer a range of benefits tailored to suit various needs. For instance, if you’re dealing with complex tasks like auto body restoration or collision repair services, these financing options can help distribute costs over time, making it more manageable. Furthermore, they often come with flexible terms and conditions, allowing you to choose a repayment schedule that aligns with your financial comfort level. This flexibility ensures that getting your vehicle fixed doesn’t have to disrupt your budget or daily life, enabling you to promptly restore your reliable transportation through quality collision repair services and auto body painting when needed.

Low-interest repair financing options have transformed the way property owners and contractors approach home improvements. By offering accessible and affordable solutions, these options alleviate financial strain, making it easier to navigate necessary repairs. For homeowners, this means less stress and more control over their living spaces. Contractors, too, benefit from increased flexibility and project stability. Ultimately, understanding and utilizing these repair financing alternatives can lead to smoother, more satisfying home restoration experiences for all involved.