Building insurance adjuster liaison success relies on establishing trust through empathetic communication. Adjusters facilitate transparent relationships between insured individuals and companies, encouraging clients to share detailed claim information, including car body restoration needs. Clear, concise exchanges, active listening, and demonstrable empathy strengthen rapport, ensuring policyholders feel heard and assured their interests are prioritized. This process involves seamless collaboration with internal teams, streamlining complex claims, and providing timely services like bodywork repairs, ultimately enhancing customer satisfaction and efficient claim resolution.

“Uncovering the secrets of exceptional insurance adjuster performance, this article delves into the critical elements that define successful liaision processes. From fostering trust and mastering communication arts to navigating complex policy landscapes, professionals elevate their craft. We explore key strategies such as active listening for empathy, comprehensive knowledge of policies and regulations, and efficient case management. By implementing these tactics, insurance adjusters ensure accurate claims, build strong client relationships, and deliver outstanding service.”

- Building Trust and Effective Communication

- – Establishing rapport with clients and colleagues

- – Active listening techniques for empathetic engagement

Building Trust and Effective Communication

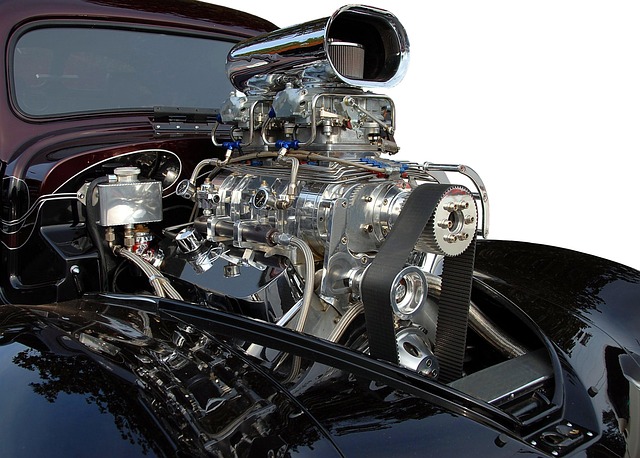

Building trust and establishing effective communication are pivotal aspects of a successful insurance adjuster liaison process. Insurance adjusters serve as the bridge between insured individuals and insurance companies, and cultivating a rapport is essential to ensure a smooth claims journey. By fostering an environment of transparency and open dialogue, adjusters can gain the trust of clients, who may be vulnerable during the aftermath of an incident. This trust is pivotal in encouraging policyholders to share relevant details about their claims, including any necessary documentation related to car body restoration or auto bodywork services.

Effective communication involves clear, concise, and empathetic exchanges. Adjusters should actively listen to clients’ concerns, accurately understanding the extent of damage, whether it pertains to a minor scratch on a car’s body or extensive repairs required for more severe incidents. Demonstrating empathy and professionalism helps build rapport, assuring policyholders that their interests are prioritized. This communication is further strengthened through timely updates and keeping clients informed about the progress of their claims, including any discussions related to car bodywork services.

– Establishing rapport with clients and colleagues

Building strong relationships is a cornerstone for successful insurance adjuster liaisons. Establishing rapport with both clients and colleagues fosters an environment of trust and collaboration. When engaging with clients, adjusters should adopt an empathetic approach, actively listening to their concerns and demonstrating genuine care. This can involve clear communication, providing reassurance during stressful situations, and offering personalized solutions tailored to each claim’s unique circumstances. By creating a safe and open dialogue, insurance adjusters can gather essential information, streamline the claims process, and ultimately enhance client satisfaction.

Moreover, effective rapport-building extends beyond client interactions, as it also strengthens relationships with internal teams. Adjusters working closely with colleagues, such as appraisers or legal professionals, can improve collaboration through mutual respect, knowledge sharing, and open discussions. This teamwork is vital for navigating complex claims, ensuring the timely delivery of services like car paint repairs or bumper replacements, and providing efficient tire services when needed. Such harmonious relationships contribute to a more seamless and successful insurance adjuster liaison process.

– Active listening techniques for empathetic engagement

Successful insurance adjuster liaison processes rely heavily on active listening techniques for empathetic engagement. By focusing on the policyholder’s concerns and experiences, adjusters can build trust and ensure a more positive interaction. This involves not just hearing the words but comprehending the underlying emotions and frustrations. For instance, when dealing with claims related to auto detailing or vehicle dent repair, an adjuster should show genuine interest in the extent of damage and its impact on the policyholder’s daily life, rather than merely processing the claim as a transaction.

Empathetic engagement also means responding sensitively to every interaction. Policyholders often come to adjusters after experiencing significant disruptions, such as accidents involving auto body work. Active listening helps adjusters provide immediate reassurance and validate the policyholder’s feelings, fostering a collaborative atmosphere. This not only improves customer satisfaction but also facilitates smoother claim resolution by ensuring all parties feel heard and understood throughout the process.

Successful insurance adjuster liaison processes hinge on building trust through effective communication. By establishing strong rapport both with clients and colleagues, and employing active listening techniques for empathetic engagement, adjusters can navigate complex claims scenarios with grace. This approach fosters positive relationships, enhances claim accuracy, and ultimately improves customer satisfaction, solidifying the adjuster’s role as a reliable guide throughout the process.