The process of submitting automotive repair claims to insurance companies is complex and slow due to varying insurer documentation requirements, a wide range of potential claims, adherence to safety standards, and intricate investigation procedures. This complexity leads to lengthy negotiations over policy terms, particularly in complex claims like auto repairs, where disputes arise over the necessity and cost of services. Delays are further exacerbated by modern automotive repair services requiring validation against original equipment manufacturer (OEM) standards, causing frustration for policyholders caught in these protracted insurance company negotiations.

Insurance company negotiations and claim results can be delayed by several factors, often stemming from complexities inherent in the claims process. This article delves into three primary causes: Complexities in Document Preparation and Submission, Diverse Interpretation of Policy Terms and Conditions, and Time-Consuming Investigation and Verification Processes. Understanding these challenges is crucial for both policyholders and insurers to streamline negotiations and expedite claim resolutions. By examining these aspects, we aim to provide insights that can enhance efficiency within the insurance sector.

- Complexities in Document Preparation and Submission

- Diverse Interpretation of Policy Terms and Conditions

- Time-Consuming Investigation and Verification Processes

Complexities in Document Preparation and Submission

The process of preparing and submitting claims to insurance companies can be complex, often serving as a significant delay in negotiations and final results. This complexity arises from several factors unique to the insurance industry. For instance, different insurers have varying requirements for documentation, which can lead to confusion and delays if not met accurately. Additionally, the vast array of potential claims, ranging from minor fender benders to severe automotive collisions, requires insurance adjusters to meticulously review every detail.

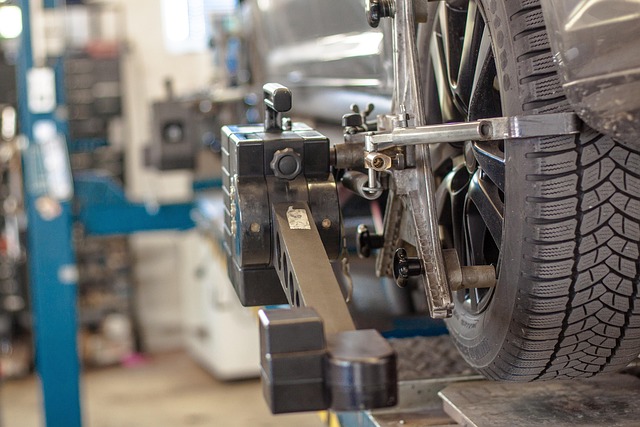

In the case of automotive collision repair or tire services, the process is further complicated by the need for detailed estimates, parts sourcing, and ensuring that repairs meet specific safety standards. Auto body shops, as key service providers, must navigate these complexities while also managing client expectations, which can extend the time between claim submission and resolution.

Diverse Interpretation of Policy Terms and Conditions

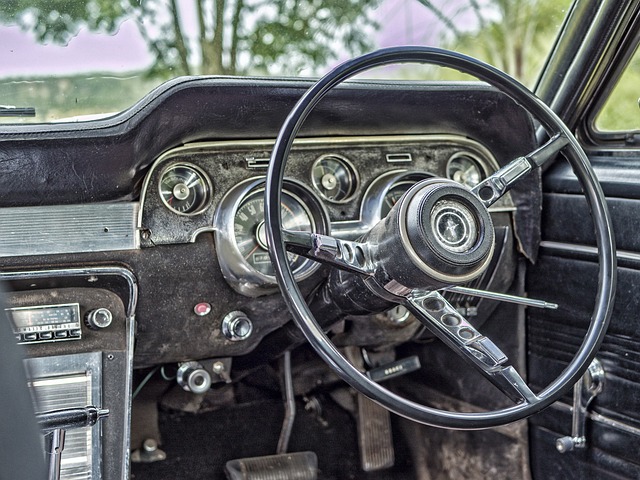

The process of insurance company negotiations can be significantly hindered by diverse interpretations of policy terms and conditions. When policyholders file claims, both parties often have differing viewpoints on what constitutes a valid claim, especially in cases involving complex or extensive repairs like those required at an auto repair shop. Insurance companies may dispute the necessity of certain auto maintenance services or the cost of car repair services, arguing over whether they align with the policy’s coverage. This discrepancy can lead to lengthy negotiations and delayed claim results.

Such delays are particularly common in auto insurance claims, where policyholders seek compensation for vehicle damages after accidents or natural disasters. The interpretation of terms such as “reasonable and necessary repairs” can vary widely between insurance adjusters and auto repair professionals. Policyholders might find themselves caught in a web of back-and-forth communications, trying to align expectations with their insurer’s stringent criteria for approving car repair services—a process that can be time-consuming and stressful.

Time-Consuming Investigation and Verification Processes

The insurance company negotiations process can be significantly delayed by intricate investigation and verification procedures. These steps are essential to ensure accuracy in claim assessments, but they often involve extensive documentation, expert opinions, and on-site inspections. Every car repair, especially those related to automotive collision repairs, requires meticulous scrutiny to verify the extent of damage and the validity of charges. This time-consuming nature is a primary factor contributing to longer wait times for policyholders seeking compensation.

Moreover, the complexity of modern automotive repair services adds another layer of verification challenges. With advanced technology and specialized components, ensuring that replacement parts meet original equipment manufacturer (OEM) standards becomes crucial. Insurance companies must validate every detail, from diagnostic reports to the quality of car repair services, before approving claims, leading to further delays in resolving negotiations.

Insurance company negotiations and claim results are often delayed by complex document preparation, diverse interpretations of policy terms, and time-consuming investigation processes. By streamlining document submission, promoting clarity in policy language, and optimizing verification methods, insurers can significantly expedite these crucial steps, ensuring faster compensation for policyholders. This not only improves customer satisfaction but also enhances the overall efficiency of the claims process.