Insurance Claim Management relies heavily on comprehensive documentation, including incident reports, photographs, repair estimates, and medical records, for fair assessment and settlement. Proper documentation streamlines processes, protects policyholder rights, and enhances communication between stakeholders. To optimize insurance claim management, adopt structured approaches using standardized forms, digital documentation, efficient protocols (defined turnaround times, valid criteria), consistent approval processes, and regular training to ensure transparency.

Understanding the intricacies of insurance claim documentation is vital for both policyholders and insurers. This comprehensive guide delves into the fundamentals of this process, exploring what constitutes insurance claim documentation and its pivotal role in effective claim management. We dissect the key components that ensure smooth handling, offering best practices to streamline the entire process. By mastering these principles, individuals can navigate the complexities of insurance claims with confidence, fostering a more efficient and transparent insurance claim management system.

- What is Insurance Claim Documentation?

- Key Components of Effective Claims

- Best Practices for Streamlining Claim Management

What is Insurance Claim Documentation?

Insurance claim documentation is a critical component of the insurance claim management process. It refers to the collection, compilation, and submission of records and information related to an insured event or loss. When you file an insurance claim, whether for health issues, property damage, or accidents like automotive collisions, the documents provided form the backbone of the assessment and settlement procedure. These documents ensure that both the insurer and the policyholder have a clear understanding of the circumstances surrounding the incident.

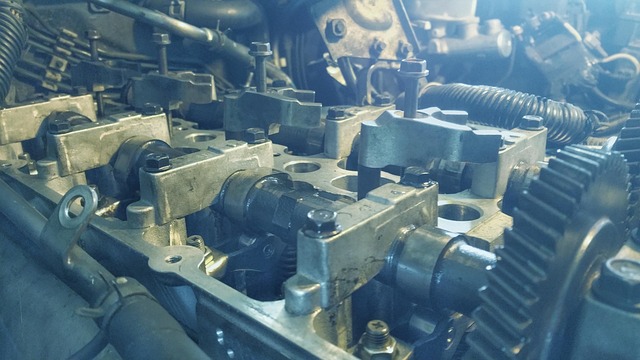

For instance, in the case of automotive collision repair, detailed documentation is essential to support the claim for car bodywork or restoration. This includes photographs capturing the damage, estimates from authorized repair shops, and medical records (if applicable) for personal injury claims. Effective insurance claim documentation not only facilitates smoother claim processing but also safeguards the rights of policyholders, ensuring they receive fair compensation for their losses.

Key Components of Effective Claims

When it comes to effective insurance claim management, proper documentation is paramount. Key components include a detailed description of the incident, supporting evidence such as photographs and reports from experts like tire services or auto body restoration specialists, and comprehensive records of all expenses incurred. These elements form the backbone of a successful claim, ensuring a clear narrative that facilitates swift and accurate processing by insurance providers.

Additionally, incorporating information about alternative repair methods like paintless dent repair can be beneficial. This not only showcases a broader understanding of modern repair techniques but also demonstrates proactive engagement with the claims process. Ultimately, meticulous documentation translates into smoother interactions between policyholders, insurers, and service providers, ultimately leading to faster resolutions for all parties involved in insurance claim management.

Best Practices for Streamlining Claim Management

To streamline insurance claim management, a structured approach is key. Start by encouraging clear and detailed communication between policyholders, insurers, and auto repair shops (including specialists like auto body services and bodywork professionals). Standardized forms and templates can facilitate this, ensuring everyone involved uses consistent language to describe damages and repairs needed. Digital documentation, such as online claim submission platforms, electronic signatures, and cloud-based storage, enhances efficiency by reducing paperwork and enabling quick access to records.

Additionally, establishing clear protocols for evaluating and approving claims can prevent delays. This includes defining reasonable turnaround times for assessments, setting criteria for what constitutes a valid claim, and implementing consistent approval processes. Regular training sessions for all parties involved—policyholders, adjusters, and auto repair shop staff—can further ensure everyone understands their roles and responsibilities, fostering transparency throughout the insurance claim management process.

Mastering insurance claim documentation is paramount for efficient claim management. By understanding key components and implementing best practices, individuals can navigate the process with confidence. Familiarizing oneself with the fundamentals empowers a smoother journey, ensuring claims are handled effectively and promptly. Streamlining these procedures benefits both policyholders and insurers, fostering a more transparent and responsive insurance claim management system.