A claims documentation service revolutionizes insurance and collision repair by simplifying complex paperwork, speeding up claim processing, and enhancing customer satisfaction. This service automates administrative tasks, reduces human error, and efficiently manages records for both minor and extensive repairs. By optimizing operations and ensuring accurate data capture, it benefits businesses and clients alike, minimizing risks and leading to quicker payouts.

In today’s complex insurance landscape, efficient claims management is paramount to reducing administrative risks. A robust claims documentation service plays a pivotal role in streamlining processes, mitigating errors, and enhancing overall operational efficiency. This article delves into the multifaceted benefits of leveraging such services, exploring how they simplify administrative tasks, reduce risk, and ultimately improve customer satisfaction. From understanding the intricacies of claims management to implementing best practices, we provide insights for professionals seeking to optimize their operations through effective claims documentation service integration.

- The Role of Claims Documentation Service in Streamlining Processes

- – Understanding the complexity of claims management

- – How a claims documentation service simplifies administrative tasks

The Role of Claims Documentation Service in Streamlining Processes

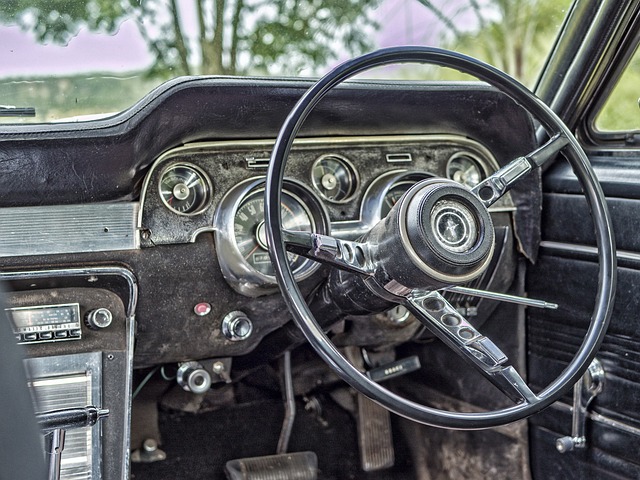

A claims documentation service plays a pivotal role in streamlining processes within insurance companies and collision repair shops alike. By efficiently managing and organizing all documents related to claims, this service significantly reduces administrative burdens. In the fast-paced environment of auto frame repair or vehicle paint repair, having a well-structured documentation system is vital for ensuring accuracy, speed, and customer satisfaction.

It allows for quick retrieval of records, facilitating faster decision-making during complex claim assessments. This efficiency isn’t just about saving time; it translates into cost savings for businesses and potentially quicker payouts for clients. Whether dealing with minor dents and scratches or extensive collision repair, a robust claims documentation service enhances the overall process, fostering a seamless experience for all parties involved.

– Understanding the complexity of claims management

The process of claims management is a intricate dance that requires meticulous attention to detail and a deep understanding of legalities. In the world of insurance, where every claim is unique, navigating this complex landscape can be challenging for both insurers and policyholders. From assessing damage to verifying accounts, multiple steps are involved in processing a claim, each carrying its own set of risks. This is particularly evident in sectors like auto maintenance, where claims related to accidents or collisions involve intricate procedures such as dent removal and subsequent repair, adding another layer of complexity.

A claims documentation service plays a pivotal role in streamlining this process by providing specialized support. It ensures that all necessary paperwork is completed accurately and promptly, reducing the administrative burden on both parties. For collision repair shops, for instance, efficient claims documentation can mean faster turnaround times, improved customer satisfaction, and smoother operations. By leveraging such services, businesses can focus their efforts on delivering quality service while minimizing exposure to potential risks associated with claim management.

– How a claims documentation service simplifies administrative tasks

A claims documentation service plays a pivotal role in simplifying and streamlining administrative tasks associated with managing and processing insurance claims. By leveraging specialized software and expertise, these services automate much of the tedious paperwork and data entry that traditionally falls on insurance adjusters’ shoulders. This not only reduces human error but significantly speeds up the entire claims process.

Imagine the administrative burden involved in handling a large volume of car scratch repair or vehicle bodywork claims, including gathering documents, verifying details, and preparing accurate reports. A claims documentation service efficiently manages this through digital data capture, secure storage, and automated workflows. This ensures that every piece of information related to an auto painting claim is meticulously documented, readily accessible, and correctly formatted, thereby facilitating smoother settlements and enhancing the overall customer experience.