Towing a vehicle to a collision center promptly after an accident is crucial for efficient insurance claims processing and professional car body restoration. Understanding cost factors, reviewing insurance policy terms regarding towing and auto body shop repairs, ensures policyholders are covered without unexpected expenses during the process. Approved towing services and reputable collision centers facilitate comprehensive collision repair, minimizing delays and costs while promoting seamless communication among stakeholders for quicker resolution and enhanced customer satisfaction.

Towing a vehicle to a collision center is more than just a convenience; it’s a crucial step in the insurance claims process. This efficient practice significantly impacts claim timing and overall efficiency, ensuring faster repairs and reduced downtime for vehicle owners.

In this article, we’ll explore how prompt towing to well-coordinated collision centers streamlines insurance claims, while also delving into cost considerations and understanding insurance coverage for these essential services.

- Understanding Towing to Collision Centers: A Necessary Step in Insurance Claims Process

- The Impact on Claim Timing and Efficiency: How Prompt Towing Can Streamline the Procedure

- Cost Considerations and Insurance Coverage: Demystifying Reimbursement for Towing Services

Understanding Towing to Collision Centers: A Necessary Step in Insurance Claims Process

Towing a vehicle to a collision center is an integral part of the insurance claims process after a road accident. It’s not just about convenience; it’s a necessary step that ensures proper and efficient handling of claims. When a car is involved in a collision, towing to a specialized facility facilitates the assessment and repair of damage, which is crucial for both the vehicle owner and their insurance provider.

This process allows for professional car body restoration and vehicle collision repair, ensuring that the car is not only safe to drive again but also restored to its pre-accident condition. Insurance companies often work with approved towing services and reputable collision centers to streamline claims, making it easier for policyholders to get their vehicles repaired without unnecessary delays or costs.

The Impact on Claim Timing and Efficiency: How Prompt Towing Can Streamline the Procedure

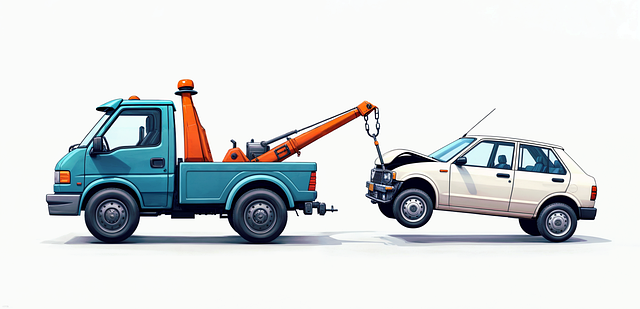

The speed at which a vehicle is towed to a collision center can significantly impact the efficiency and timing of insurance claims. Prompt towing can streamline the process by ensuring that the damaged vehicle arrives at the repair facility swiftly, minimizing the time lag between the incident and the official claim submission. This timeliness is crucial in expediting the assessment and repairs, thereby reducing overall claim processing duration.

When a vehicle is towed promptly, the collision center can begin its evaluation immediately, which includes detailed inspections, diagnostic testing, and estimating the scope of necessary repairs. Efficient towing ensures that the vehicle repair process starts without delay, facilitating faster communication between insurance providers, collision centers, and policyholders. This streamlined approach benefits everyone involved, leading to quicker resolution times and better customer satisfaction in the event of a collision or accident.

Cost Considerations and Insurance Coverage: Demystifying Reimbursement for Towing Services

When a vehicle collides and requires transport to a collision center for repairs, understanding cost considerations and insurance coverage is paramount. Towing to a collision center is often an integral part of the claims process, but it can significantly impact the overall expenses. Consumers should be aware that not all towing services are created equal; costs can vary based on distance, vehicle type, and even the time of day.

Insurance policies typically cover tow truck services as part of comprehensive or collision coverage, reimbursing policyholders for the cost of transporting their damaged vehicle to a reputable auto body shop for repairs. This reimbursement process is crucial in ensuring that vehicle owners do not bear the full financial burden of unexpected accidents. It’s important to review your insurance policy and understand the terms related to towing and car repair services to ensure you receive the proper coverage and reimbursement for any necessary vehicle transport and subsequent auto body shop repairs.

Towing a vehicle to a collision center is an integral part of the insurance claims process, significantly impacting claim timing and efficiency. Understanding the impact of prompt towing on streamlining procedures can save time and reduce costs for both insurers and policyholders. Proper communication and clear understanding of insurance coverage for towing services ensure fair reimbursement, making it a crucial step in facilitating faster repairs and getting vehicles back on the road.