Insurance-approved repairs prioritize safety, cost-efficiency, and effectiveness in vehicle restoration after damage, ensuring high quality and affordability standards. Auto collision repair facilities submit detailed estimates for approval by insurance adjusters, who assess feasibility and recommend only approved techniques. Understanding policy specifics, choosing in-network body shops, considering vehicle make/model and damage extent, and selecting insurance-recommended repairs guarantees safety, durability, and skilled technicians using high-quality materials.

Understanding the basics of insurance-approved repair options is essential for any policyholder looking to navigate the claims process effectively. This guide delves into the intricacies of these repairs, including what they are and how they get approved, to help you make informed decisions. By exploring the different types of insurance-recommended repair options available, you can ensure your vehicle receives the best care while adhering to your policy terms.

- What Are Insurance-Approved Repair Options?

- How Do These Repairs Get Approved?

- Choosing the Right Repair Option for Your Policy

What Are Insurance-Approved Repair Options?

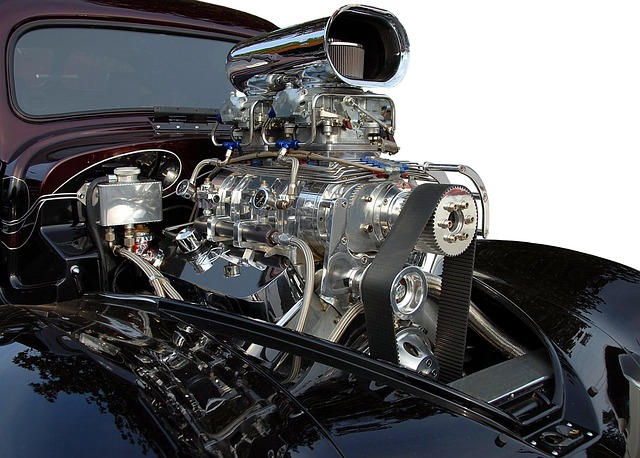

Insurance-approved repair options refer to the set of services and procedures that insurance companies approve as valid methods for restoring a vehicle to its pre-incident condition after a collision or damage. These options are carefully selected based on their effectiveness, cost-efficiency, and alignment with safety standards. When you file a claim for car bodywork repairs, your insurer will typically provide a list of trusted collision repair services that meet their criteria.

This process ensures that the vehicle body repair is carried out using approved techniques and materials, guaranteeing both quality and affordability. By adhering to insurance-recommended repair procedures, owners can ensure that their claims are settled smoothly while maintaining the safety and value of their vehicles.

How Do These Repairs Get Approved?

When it comes to insurance-approved repairs, the process begins with understanding the specific guidelines and criteria set by insurance companies and regulatory bodies. These entities establish standards for what constitutes acceptable repair methods, ensuring that vehicle restoration meets safety and quality requirements. Auto collision repair facilities and automotive body shops must adhere to these regulations to receive approval for their work.

The approval process involves submitting detailed estimates, proposals, or plans for the proposed repairs. Insurance adjusters review these documents carefully, examining every aspect of the recommended auto body restoration. They assess whether the chosen techniques align with industry best practices and if they will effectively restore the vehicle to its pre-incident condition. This meticulous evaluation guarantees that only insurance-recommended repair options are considered, ensuring a seamless and reliable recovery process for policyholders.

Choosing the Right Repair Option for Your Policy

When selecting an insurance-approved repair option, it’s crucial to understand your policy’s specifics. Different policies may have varying levels of coverage for different types of repairs, such as car body repair or auto glass repair. It’s essential to read and comprehend your policy documents thoroughly before making a decision. Body shop services that are in network with your insurer often streamline the process, ensuring cost savings and efficient claims handling.

Consider your vehicle’s make and model, along with the extent of the damage, when choosing between replacement parts and repair services. Insurance-recommended repairs prioritize safety and durability, so opt for high-quality materials and skilled technicians for complex tasks like body work or auto glass replacement. This ensures not only compliance but also long-lasting results.

Understanding insurance-approved repair options is essential for making informed decisions after a loss. By familiarizing yourself with these processes, you can efficiently navigate your policy and choose the best course of action for your property. Remember, selecting the right insurance recommended repair option can significantly impact your claim’s outcome and restoration process, ensuring your peace of mind and a swift return to normalcy.