Accident insurance help is a vital safety measure for individuals and businesses facing vehicle incidents, offering financial protection through comprehensive coverage including repair costs, towing, legal assistance, and accurate damage assessments. Brokers play a key role in making this help accessible and tailored to needs, acting as intermediaries between clients and providers. They facilitate claims processes, locate reliable repair shops, and support policyholders in securing quality vehicle restoration, ensuring peace of mind. Brokers also optimize claim management by coordinating services, managing documentation, and resolving disputes, requiring strong organizational skills and industry connections.

Accident insurance helps individuals and businesses mitigate financial risks associated with unforeseen incidents. In this comprehensive overview, we explore the crucial role brokers play in facilitating access to accident insurance. Brokers act as intermediaries, matching clients with suitable policies from various providers. By understanding client needs and market offerings, they streamline the process, ensuring optimal coverage. This article delves into the benefits and challenges of broker involvement, highlighting their enhanced claim management capabilities.

- Understanding Accident Insurance: A Comprehensive Overview

- The Broker's Role: Facilitating Access to Accident Insurance

- Benefits and Challenges: How Brokers Enhance Claim Management

Understanding Accident Insurance: A Comprehensive Overview

Accident insurance help is a vital safety net for individuals and businesses facing unexpected vehicle incidents. This type of insurance provides financial protection and support during challenging times, covering various aspects of vehicle damage and related expenses. Understanding accident insurance requires grasping its multifaceted nature. It not only compensates for immediate repair costs but also includes services like towing, temporary transportation, and even legal assistance in certain cases.

The process involves evaluating the extent of damage to both the vehicle’s car bodywork and its mechanical components. Accurate assessment ensures fair compensation for repairs or replacements. Many policies also offer add-ons for specialized services, such as collision repair center treatments and custom vehicle bodywork enhancements. By understanding these comprehensive coverage options, individuals and businesses can make informed decisions to safeguard their financial interests in the event of an accident.

The Broker's Role: Facilitating Access to Accident Insurance

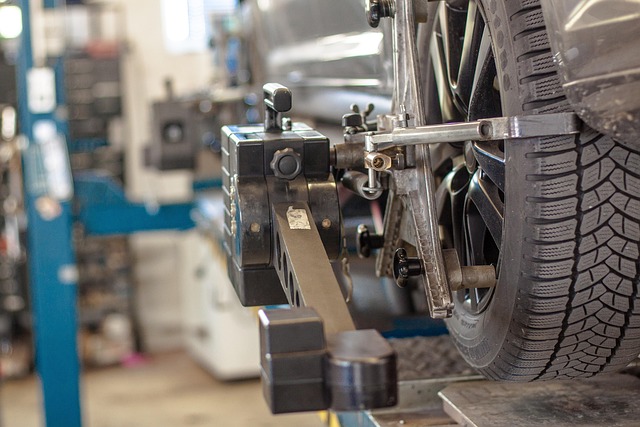

Brokers play a pivotal role in making accident insurance help readily available to individuals and businesses alike. They act as intermediaries between clients seeking vehicle repair services or car bodywork coverage and various insurance providers. By understanding the specific needs of their clients, brokers can match them with suitable policies that cater to both immediate accident-related expenses and long-term vehicle restoration goals.

Through their extensive network and expertise, brokers facilitate access to comprehensive accident insurance plans, ensuring policyholders receive the necessary support during challenging times. This includes coordinating claims processes, helping with paperwork, and even assisting in finding reliable vehicle repair shops or car bodywork specialists when needed. By leveraging these resources, brokers ensure clients can access not just emergency services but also quality vehicle restoration if required, ultimately enhancing peace of mind for policyholders.

Benefits and Challenges: How Brokers Enhance Claim Management

Brokers play a pivotal role in enhancing claim management processes for accident insurance help, offering both substantial benefits and unique challenges. Their expertise lies in streamlining the often complex and delicate process of handling insurance claims, particularly in the event of accidents involving vehicles. By acting as intermediaries between policyholders and insurance companies, brokers ensure that claims are processed efficiently, maximising compensation for clients while navigating intricate legal and procedural requirements.

One significant advantage is their ability to facilitate faster settlements. Brokers have in-depth knowledge of various auto detailing, automotive collision repair, and automotive body shop services, enabling them to recommend reliable and cost-effective solutions for vehicle restoration post-accident. This not only expedites the claims process but also ensures policyholders receive high-quality repairs, enhancing their overall satisfaction with the insurance company’s response to their accident insurance help needs. However, brokers must overcome challenges such as coordinating with diverse service providers, ensuring accurate documentation, and managing potential disputes, thereby requiring excellent organizational skills and industry connections.

Accident insurance help is crucial for individuals seeking financial security during unforeseen events. Brokers play a pivotal role in facilitating access to these policies, simplifying complex processes, and enhancing claim management. By understanding the broker’s role, both professionals and clients can navigate the landscape of accident insurance with greater confidence, ensuring peace of mind when it matters most.