Understanding auto body shop insurance requirements is vital for safeguarding operations, mitigating risks, and fostering customer trust. Each state dictates unique coverage needs, including minimum liability limits, deductibles, and optional extras like equipment or business interruption coverage. Comprehensive policies protect shops from various scenarios beyond accidents, such as natural disasters and business interruptions, ensuring peace of mind for both businesses and clients.

“Navigating the complex landscape of auto body shop insurance can be a daunting task, especially with varying state or regional requirements. This comprehensive guide aims to demystify the process and ensure business owners stay protected. We’ll explore the essential aspects of understanding auto body shop insurance, delving into state-specific mandates and offering insights on comprehensive coverage options. By the end, you’ll be equipped with knowledge to make informed decisions regarding your shop’s financial security.”

- Understanding Auto Body Shop Insurance Requirements

- State-Specific Coverage Mandates and Options

- Additional Considerations for Comprehensive Protection

Understanding Auto Body Shop Insurance Requirements

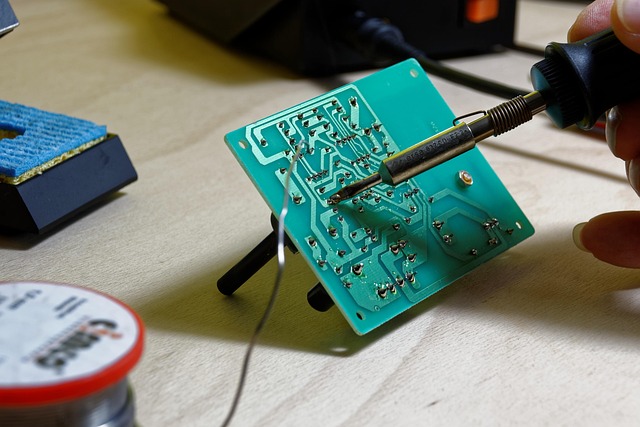

Understanding Auto Body Shop Insurance Requirements is a critical step for any business in the automotive industry, especially those specializing in car collision repair and vehicle body repair. Each state or region has its own set of regulations that dictate the types and levels of insurance coverage needed to operate legally and protect against potential risks and liabilities. These requirements cover various aspects, including property damage, personal injury, and even specific work-related perils unique to the auto body shop environment.

Auto body shops engaged in car body restoration must be aware that their insurance policies should not only meet state mandates but also account for the inherent risks associated with their services. This includes considerations such as the cost of repairing or replacing damaged vehicles, medical expenses for injured customers or employees, and legal fees resulting from lawsuits. By ensuring compliance with these requirements, auto body shops can safeguard their operations, mitigate financial losses, and maintain customer trust in their ability to provide quality car collision repair and vehicle body repair services.

State-Specific Coverage Mandates and Options

In the realm of auto body shop insurance, each state or region presents its own unique landscape of coverage requirements and options. Understanding these variations is crucial for car body shops to ensure they are adequately protected against potential risks and liabilities. For instance, some states mandate specific types of liability coverage, such as property damage or personal injury, while others offer optional extras like coverage for specialized equipment or business interruption.

Knowing the state-specific mandates is just as important as exploring available options. Requirements may include minimum limits for bodily injury and property damage liability, as well as distinct rules for deductibles and exclusions. For instance, states with high auto accident rates might demand higher liability limits to account for increased claims. Additionally, certain regions might offer tailored coverage for specific risks like natural disasters or vehicle theft, which can be crucial for shops operating in such areas. This nuanced approach ensures that each auto body shop, from bustling urban centers to tranquil suburban regions, has access to suitable insurance solutions catering to their unique operational needs and surrounding environments, ultimately facilitating seamless business operations and peace of mind.

Additional Considerations for Comprehensive Protection

When it comes to auto body shop insurance, comprehensive protection goes beyond the standard policies. Beyond covering the costs of repairing or replacing vehicles after accidents (including collision center services), this extended coverage considers various other scenarios. For instance, it might include protection against natural disasters, such as storms or floods, which can cause significant damage to both vehicles and shop infrastructure. Additionally, some policies account for business interruption should a covered event force the auto body shop to close temporarily, helping to offset lost revenue during the recovery period.

Furthermore, comprehensive insurance may also cover liability arising from incidents unrelated to car accidents, such as property damage or personal injury caused by the shop’s activities (including auto body services). This includes scenarios like a customer slipping and falling on the premises due to a car scratch repair mishap. Ensuring these additional aspects of protection is vital for auto body shops to maintain adequate insurance coverage, thereby safeguarding their business interests and clients’ peace of mind.

When operating an auto body shop, understanding and adhering to local insurance requirements is paramount. Each state or region may have unique mandates, but by being aware of these essential coverage options, business owners can ensure they provide comprehensive protection for their operations, employees, and customers. By carefully considering the state-specific regulations outlined in this article, you’ll be well on your way to securing the right auto body shop insurance.