TL;DR: Navigating collision insurance claims requires understanding liability assessment factors like driver negligence, road conditions, and vehicle maintenance. Insurers verify claims with proof of liability, including police reports and witness statements. Promptly providing accurate documentation, such as detailed auto body shop assessments and visual comparisons, strengthens claim validity and speeds up compensation for vehicle repairs or replacement. Maintaining meticulous records of communications and before-and-after data enhances the chances of a positive outcome.

In the realm of collision insurance claims, understanding liability is paramount. When insurers request proof of liability, it’s crucial to know how and when this happens. This article navigates the intricacies of collision insurance claims, focusing on the role of liability proof. We’ll explore strategies for effectively providing evidence to support your claim, ensuring a smoother process in today’s digital era. By understanding these dynamics, folks can foster a seamless experience during what could otherwise be a complex and confusing labyrinthine process.

- Understanding Liability in Collision Insurance Claims

- When and How Insurers Request Proof of Liability

- Strategies for Providing Effective Proof to Support Your Claim

Understanding Liability in Collision Insurance Claims

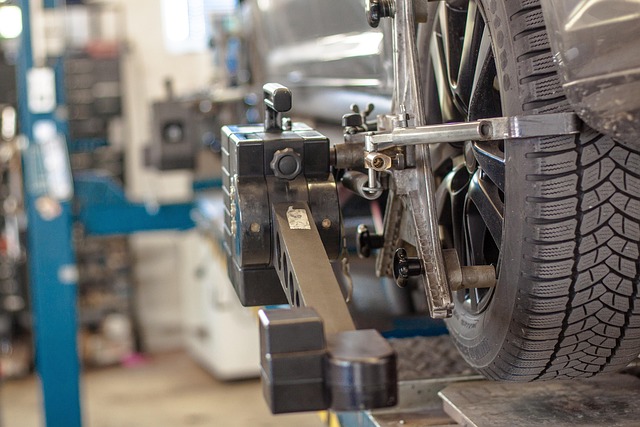

When it comes to collision insurance claims, understanding liability is paramount. Liability refers to the legal responsibility for damages or losses incurred during a collision. In the context of collision insurance, it’s crucial to know that insurers assess fault based on various factors like driver negligence, road conditions, and vehicle maintenance. If a policyholder is deemed at-fault, their insurance coverage will dictate the extent of compensation for damage to their own vehicle and any other party involved.

For instance, if you’re in an accident and need repairs at an auto repair shop, your collision insurance covers the cost of repairing or replacing your vehicle. However, the extent of this coverage depends on your liability. If the accident was primarily your fault due to, say, a momentary lapse in attention, your insurer will deduct a deductible from the claim amount. This is where services like frame straightening and vehicle paint repair come into play—they are part of the repairs covered under collision insurance, but their cost will be subject to the policy’s terms and conditions, including any deductibles.

When and How Insurers Request Proof of Liability

When an insured individual files a collision insurance claim, insurers typically request proof of liability to assess and validate the claim’s validity. This process is crucial in ensuring that the claim adheres to the terms and conditions outlined in the insurance policy. The request for proof usually occurs after the initial claim submission, where the insurer reviews the details and determines if further verification is necessary.

Insurers may ask for documents such as police reports, witness statements, and photographs of the incident scene and damaged vehicle. These pieces of evidence help establish liability, determine fault, and estimate the cost of vehicle bodywork repairs or car repair services required. Promptly providing accurate and comprehensive documentation can streamline the claims process, ensuring faster compensation for the insured party while facilitating efficient vehicle repair.

Strategies for Providing Effective Proof to Support Your Claim

When presenting proof for collision insurance claims, it’s crucial to be thorough and organized. Insurers often require detailed documentation to validate the extent of damage and the cost of repairs, especially in complex cases. One effective strategy is to engage a reputable auto body shop or collision repair center that specializes in accurate assessments and high-quality restoration. These professionals can provide precise estimates and comprehensive reports, including before-and-after photographs and part inventories, which significantly strengthen your claim.

Additionally, maintaining a detailed record of all communication and documentation related to the incident is vital. Keep copies of police reports, medical records (if applicable), and any correspondence with insurance providers or repair facilities. For instance, if you’ve invested in auto detailing services as part of your vehicle’s restoration, ensure these before-and-after comparisons are documented and readily available. Such comprehensive proof not only expedites the claims process but also increases the likelihood of a favorable outcome.

Insurers often demand proof of liability in collision insurance claims to ensure fair compensation. Understanding when and how they request this, along with employing effective strategies to provide robust evidence, can significantly aid in navigating the claims process. By being proactive in gathering and presenting relevant information, policyholders can streamline their claims journey and secure the coverage they deserve for collision-related incidents.