Direct Repair Programs (DRPs) are collaborative initiatives between insurers, repair shops, and stakeholders that streamline collision repair processes. These programs enhance efficiency, reduce costs, and improve customer satisfaction by establishing direct connections between insurers and auto body repair centers, leading to faster claim processing, reduced administrative burdens, improved transparency, and quality repairs. Insurers play a pivotal role in DRPs by offering pre-approved facilities, efficient claims management, and risk assessment, ultimately saving policyholders time and money while maintaining high-quality standards through careful network selection, monitoring, and communication.

“Insurers play a pivotal role in the success of Direct Repair Programs (DRPs), streamlining auto collision repairs. This article delves into the intricate web of DRP implementation, highlighting the insurer’s key responsibilities. We explore how these programs benefit policyholders and repair shops, while also addressing challenges. By understanding the insurer’s role in facilitating efficient, cost-effective, and quality repairs, we can enhance consumer satisfaction and vehicle restoration through effective DRP management.”

- Understanding Direct Repair Programs: An Overview

- The Key Role of Insurers in DRP Implementation

- Benefits and Challenges: How Insurers Can Enhance the Program

Understanding Direct Repair Programs: An Overview

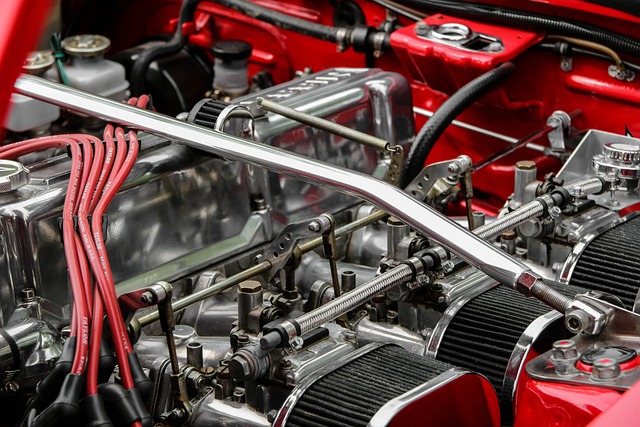

Direct Repair Programs (DRPs) are collaborative initiatives between insurers, repair shops, and other stakeholders aimed at streamlining the process of vehicle collision repair. These programs prioritize efficiency, cost-effectiveness, and customer satisfaction by establishing clear protocols and relationships among all involved parties. In essence, DRPs facilitate a more direct connection between insurers and auto body repair centers, bypassing intermediate entities.

This streamlined approach offers numerous benefits, including faster claim processing times, reduced administrative costs, and improved transparency throughout the repair process. By fostering strong partnerships and standardized procedures, DRPs ensure that vehicle owners receive quality bumper repair and auto body repair services without compromising on safety or aesthetics. The implementation of DRPs is particularly beneficial in managing the aftermath of vehicle collisions, where swift and accurate repairs are crucial for getting vehicles back on the road promptly.

The Key Role of Insurers in DRP Implementation

Insurers play a pivotal role in the successful implementation of Direct Repair Programs (DRPs). Their expertise and resources are indispensable when it comes to facilitating efficient auto maintenance and car dent repair processes. By establishing DRPs, insurers streamline the claims settlement process, ensuring that policyholders can avail quick and reliable services from approved car body shops.

This collaborative approach not only benefits policyholders by offering them convenient options for car body shop selection but also enhances overall customer satisfaction. Insurers’ involvement in DRP implementation fosters trust and transparency, as policyholders are assured of receiving quality repairs at certified workshops, thereby reducing the hassle often associated with traditional claims settlement methods.

Benefits and Challenges: How Insurers Can Enhance the Program

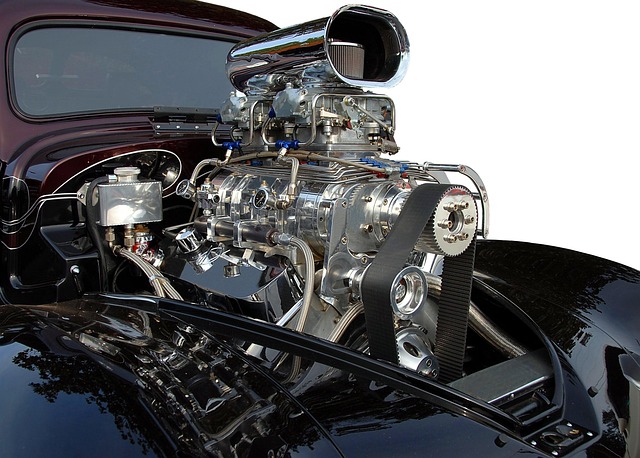

Insurers play a pivotal role in Direct Repair Programs (DRPs), offering both unique benefits and challenges. On the positive side, their involvement streamlines the process of vehicle paint repair and automotive collision repair by providing pre-approved repair facilities and networks. This ensures that policyholders can access quality auto collision repair services promptly without the hassle of choosing a repair shop. Insurers’ expertise in risk assessment and claims management also contributes to cost savings for all parties involved, making DRPs more efficient.

However, challenges arise when balancing the need for streamlined repairs with maintaining high-quality standards. Insurers must carefully select and monitor repair facilities within their networks to ensure they meet required standards, particularly for intricate vehicle paint repair tasks. Additionally, managing expectations of policyholders while adhering to regulatory requirements adds complexity. Effective communication, continuous improvement in processes, and a strong focus on customer satisfaction are essential strategies for insurers to enhance the DRP experience.

Insurers play a pivotal role in the successful implementation and enhancement of Direct Repair Programs (DRPs). By facilitating efficient claim processing, encouraging the use of approved repair facilities, and promoting customer satisfaction, insurers can significantly improve the overall effectiveness of DRPs. While challenges exist, such as ensuring quality control and managing costs, strategic partnerships between insurers and repair providers can overcome these obstacles. Ultimately, optimizing DRPs benefits both consumers and the insurance industry by streamlining repairs, reducing fraud, and fostering a more robust, resilient automotive ecosystem.