Paintless dent repair (PDR) is a cost-effective, insurance-covered solution for minor vehicle dents, avoiding painting and extensive auto glass replacement. Skilled technicians use specialized tools to reverse damage, restoring cars to their original appearance. Cost factors include damage size, accessibility, panel condition, and tool use. Understanding deductibles, claims process, and communication with insurers ensures a seamless journey through paintless dent repair cost and reimbursement for repairs like fender repair.

“Curious about what insurance covers in paintless dent repair costs? This comprehensive guide breaks down everything you need to know. Paintless dent repair (PDR) offers a cost-effective alternative to traditional auto body work, but understanding your insurance coverage is crucial before you begin. We’ll explore common insured damages and cost considerations, plus navigate deductibles and the claims process. By the end, you’ll be equipped with the knowledge to make informed decisions regarding your vehicle’s repair.”

- Understanding Paintless Dent Repair Coverage

- Common Insured Damages and Cost Considerations

- Navigating Deductibles and Claims Process

Understanding Paintless Dent Repair Coverage

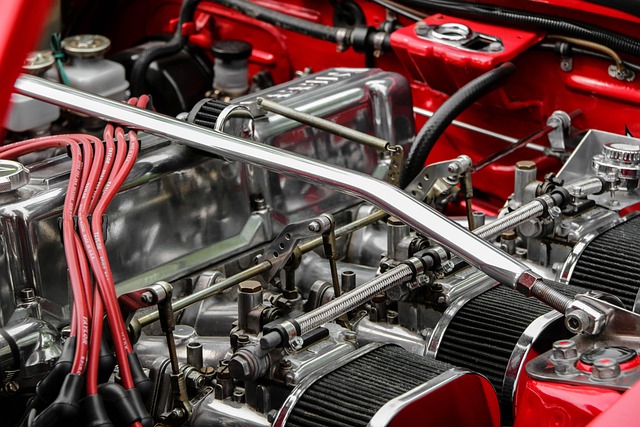

Paintless dent repair (PDR) is a specialized technique used to remove minor dents and dings from vehicle bodies without damaging the paint or requiring extensive auto glass replacement. Understanding what insurance covers in PDR cost is crucial for car owners looking to restore their vehicles efficiently. Many standard auto insurance policies include coverage for PDR, recognizing its effectiveness and minimal invasiveness compared to traditional dent repair methods.

This method involves skilled technicians using specialized tools to gently push the affected area back into place, essentially reversing the damage. As a result, PDR is often more cost-effective than classic car restoration or extensive auto repair services. Insurance companies typically cover PDR costs under comprehensive or collision policies, ensuring that policyholders can get their vehicles back in top shape without incurring significant expenses out of pocket for paintless dent repair cost.

Common Insured Damages and Cost Considerations

In the realm of paintless dent repair, several common insured damages can be covered, offering cost savings compared to traditional car body repair. These include dents, dings, and minor crashes that don’t affect the vehicle’s structural integrity. The process focuses on restoring the car’s original appearance by pushing out damaged panels back to their original shape without the need for painting or replacing parts.

When considering the paintless dent repair cost, several factors come into play. The size and severity of the damage, the accessibility of the affected area, and the overall condition of the vehicle’s panel all influence the price. Additionally, whether the repair is performed by an experienced auto repair shop using specialized tools can also impact the final cost. Understanding these variables helps in budgeting for repairs and ensuring a cost-effective solution for car body repair.

Navigating Deductibles and Claims Process

When considering paintless dent repair cost, understanding your insurance policy’s deductibles and claims process is crucial. Deductibles represent the out-of-pocket expense you’ll incur before insurance coverage kicks in. Before proceeding with any repairs, including fender repair or auto glass replacement, it’s essential to communicate with your insurer to determine these amounts and ensure they align with your budget.

The claims process typically involves filing a report with your insurance company, providing estimates from qualified technicians for the dent repair work required, and potentially supplying photos documenting the damage. Once approved, the insurance provider will either directly pay the repair shop or reimburse you upon completion of the work. Efficient communication and documentation are key to navigating this process smoothly.

When considering paintless dent repair cost, understanding your insurance coverage is key. This article has guided you through the process, from recognizing eligible damages to navigating the claims process. Remember that while paintless dent repair can significantly reduce costs compared to traditional methods, deductibles and out-of-pocket expenses vary. Ensure you review your policy details and connect with your insurer for a clear understanding of what your insurance covers in paintless dent repair cost before making any repairs.