Direct Repair Agreements (DRAs) streamline vehicle repair processes by creating direct partnerships between insurance companies and pre-approved shops, eliminating intermediaries. This initiative benefits all parties: insurers gain control, shops secure guaranteed business, and policyholders receive faster claim processing and quicker repairs, especially for urgent cases. DRAs enhance transparency, reduce costs, and foster trust, positioning authorized repair services as reliable and quality options.

Direct Repair Agreements (DRAs) are transforming claim processing, especially within the automotive industry. By fostering collaboration between insurers, repairers, and policyholders, DRAs streamline the claims process, reducing delays significantly. This article explores the simple yet powerful concept of DRAs and their multifaceted benefits. We’ll delve into how they optimize operations, enhance customer satisfaction, and contribute to a more efficient, responsive insurance ecosystem, making them an essential component of modern claim management strategies.

- Understanding Direct Repair Agreements: A Simple Concept

- The Impact on Claim Processing: Delays Reduced

- Benefits Beyond Processing: Enhanced Customer Experience

Understanding Direct Repair Agreements: A Simple Concept

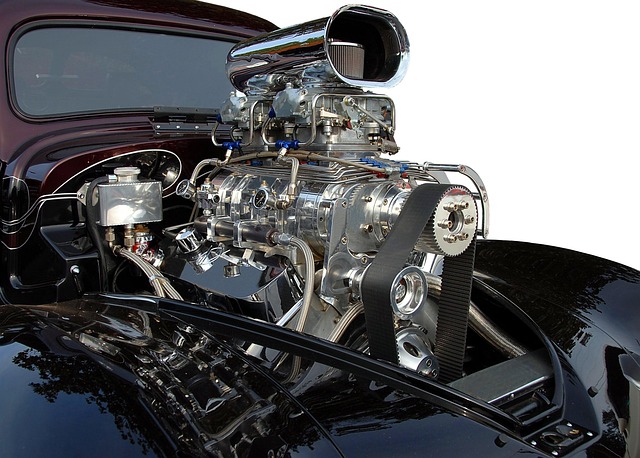

Direct Repair Agreements (DRAs) are a relatively simple yet powerful concept designed to streamline the process of vehicle repairs, particularly in cases of hail damage repair. In essence, these agreements establish a direct relationship between insurance companies and pre-approved car repair shops, eliminating unnecessary intermediaries. When a policyholder files a claim for hail damage repair, their insurance provider facilitates the process by coordinating with a network of trusted repair facilities, ensuring a swift and efficient resolution.

By implementing DRAs, insurance providers gain a level of control over the repair process, fostering a collaborative environment between insurers and car repair shops. This partnership benefits both parties and policyholders alike. For repair shops, it means guaranteed business and a streamlined workflow, as they become an integral part of the insurance company’s network. As for policyholders, direct repair programs can significantly reduce claim processing delays, allowing them to get their vehicles back in top condition much faster, which is especially crucial when dealing with urgent vehicle repairs.

The Impact on Claim Processing: Delays Reduced

The implementation of direct repair agreements (DRAs) has significantly transformed the landscape of claim processing, particularly in the realm of collision repair services and vehicle restoration. By fostering collaboration between insurance providers, auto shops, and policyholders, DRAs streamline the entire process, leading to a substantial reduction in delays.

In traditional scenarios, claims often faced bottlenecks due to complex coordination among various parties. However, with DRAs, authorized repair facilities become an integral part of the network, enabling faster communication and decision-making. This structured approach ensures that car bodywork repairs or vehicle restoration processes are initiated promptly, minimizing the time typically spent on paperwork, authorization, and waiting for shop availability. As a result, policyholders benefit from quicker turnaround times, reduced costs, and an overall enhanced experience when availing collision repair services.

Benefits Beyond Processing: Enhanced Customer Experience

Implementing a direct repair agreement (DRA) offers significant advantages that extend far beyond streamlining claim processing. By fostering strong partnerships between insurance providers, authorized repair facilities, and policyholders, DRAs enhance the overall customer experience in several ways. For one, it expedites the car body repair process, ensuring vehicle owners get their cars back on the road faster. This prompt service not only saves time but also minimizes the inconvenience associated with being without a vehicle.

Moreover, DRAs promote transparency and cost-effectiveness in auto body services. Policyholders benefit from pre-negotiated rates, which eliminates hidden fees and provides peace of mind. This level of clarity in pricing encourages trust between customers and repair facilities, fostering a long-term relationship based on reliability and quality service. As a result, policyholders are more likely to choose the same facility for future vehicle repairs, creating a loyal customer base for authorized repair services.

Direct repair agreements, or DRAs, are a game-changer in streamlining claim processing. By fostering collaboration between insurers, repair shops, and policyholders, these programs significantly reduce delays often caused by complex coordination. Not only do DRAs enhance efficiency, but they also improve the customer experience, ensuring faster repairs and reduced costs. Implementing such agreements is a strategic move for insurance providers to deliver timely services, build trust with clients, and maintain a competitive edge in today’s market.