Before renting a car, review your insurance policy for scope and limitations, especially for negligence or high-risk activities. Verify inclusions and exclusions, consider specialized coverage for premium vehicles, and document existing damages on the rental agreement to avoid disputes. Ensure adequate protection through custom rental car insurance coverage.

“Navigating the world of rental car insurance can be a confusing task, filled with potential pitfalls. In this guide, we’ll help you understand, customize, and avoid mistakes with your rental car insurance coverage. By delving into ‘Understanding Your Policy,’ ‘Customizing Your Coverage,’ and ‘Avoiding Pitfalls,’ you’ll gain crucial insights to ensure comprehensive protection while driving a rented vehicle. Stay informed, stay safe—and remember, every detail matters in securing the right rental car insurance.”

- Understanding Your Policy: What's Covered and What's Not

- Customizing Your Coverage: Additional Protections to Consider

- Avoiding Pitfalls: Common Mistakes and How to Avoid Them

Understanding Your Policy: What's Covered and What's Not

Before hitting the road, it’s imperative to dissect your rental car insurance policy and comprehend both its scope and limitations. Many policies cover basic damages, such as collision and theft, but there are often gaps in coverage for specific situations. For instance, comprehensive or collision coverage typically excludes losses due to negligence, like letting your vehicle roll down a hill or driving through floodwaters.

Moreover, be aware that some policies may not cover high-end accessories, specialized equipment, or luxury vehicle repairs. If you’re renting a premium vehicle or planning to use the car for unconventional activities, verify what’s explicitly included and excluded in your rental car insurance coverage. This proactive step will ensure unexpected costs don’t pop up during your trip, allowing you to focus on enjoying your journey without financial worries.

Customizing Your Coverage: Additional Protections to Consider

When customizing your rental car insurance coverage, it’s essential to consider additional protections beyond the standard options. Many policies offer extras like rental car protection against theft or damage, which can be invaluable if you’re involved in an accident or your vehicle is targeted by thieves. Some even provide coverage for personal belongings stored within the car, safeguarding your valuables from loss or damage.

Beyond these, exploring specialized protections tailored to your needs is wise. For instance, if you frequently rent high-end vehicles like Mercedes Benz, opt for policies that cover luxurious makes and models specifically. This ensures that in case of a collision, you’re not left footing the bill for repairs at a trusted collision repair center or body shop services, keeping your experience smooth and stress-free.

Avoiding Pitfalls: Common Mistakes and How to Avoid Them

Avoiding Pitfalls: Common Mistakes and How to Avoid Them

One of the most common mistakes people make when renting a car is assuming their regular auto insurance covers rental vehicles. While some policies might offer limited rental car coverage, it’s often inadequate for comprehensive protection. To avoid this pitfall, review your policy details carefully before accepting a rental car. Check if your provider offers add-on rental car insurance or consider purchasing a separate policy tailored to cover potential vehicle collision repair costs.

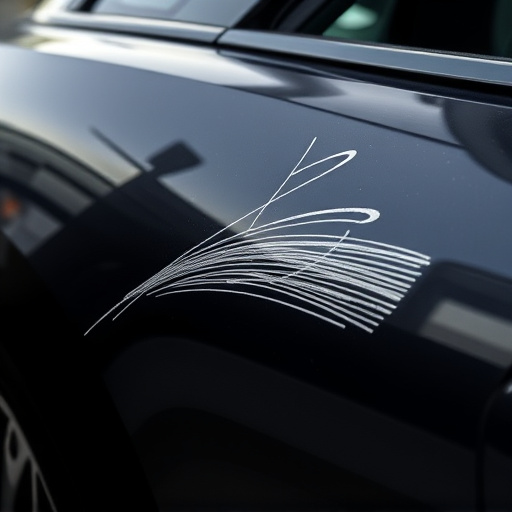

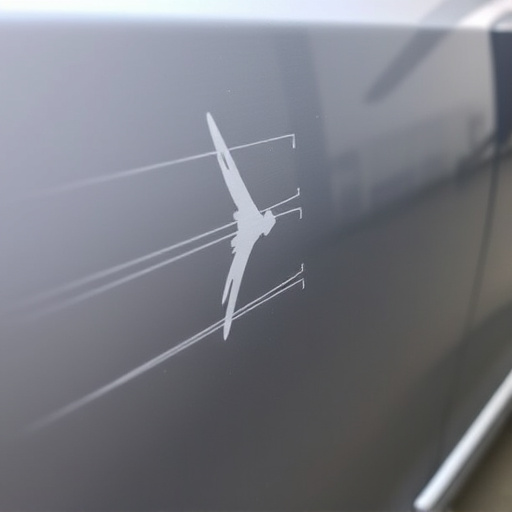

Another mistake is not documenting any existing damages on the rental agreement. It’s crucial to inspect the car thoroughly and note any pre-existing scratches, dents, or other issues. Failure to do so can lead to disputes during the return process, potentially resulting in unwarranted charges for car damage repair. Always take photos as evidence of these conditions and include them in your records for future reference.

When navigating the world of rental car insurance coverage, understanding your policy and customizing it to fit your needs is key. By being aware of common mistakes and taking proactive steps, such as reviewing exclusions and considering additional protections, you can ensure a smooth rental experience. Remember, a well-informed decision can save you from unexpected costs and potential headaches down the road. Always prioritize your peace of mind behind the wheel.