In a digital age with improved consumer access to information, traditional insurance company negotiations are being reevaluated. Policyholders now empower themselves with knowledge about policy terms and potential costs. Advanced technologies allow for direct claim processes, yet skilled negotiators remain valuable, especially for specialized repairs. Effective communication is key; gathering comprehensive incident details, presenting clear impacts, maintaining a respectful tone, and advocating for rights firmly but politely lead to favorable outcomes in insurance company negotiations.

Is haggling over rates and claims still a valuable strategy when dealing with insurance companies? In an era of streamlined digital services, traditional bargaining power in insurance claims has evolved. This article explores whether insurance company negotiations remain relevant, delving into the shifting trends shaping the industry. We provide effective communication strategies to navigate these changes, ensuring you make informed decisions in an increasingly diverse landscape.

- Traditional Bargaining Power in Insurance Claims

- Evolving Trends: Is Negotiation Still Relevant?

- Strategies for Effective Communication with Insurers

Traditional Bargaining Power in Insurance Claims

In traditional insurance company negotiations, the bargaining power dynamic is often skewed in favor of the insurer. This historical advantage stems from the asymmetry of information and the high value placed on peace of mind by policyholders. However, with evolving consumer awareness and a better understanding of their rights, individuals are increasingly questioning whether expending time and energy on these negotiations remains worthwhile.

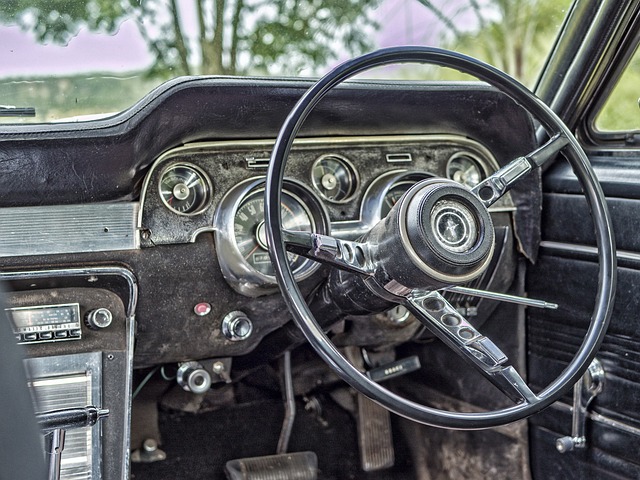

While car bodywork and car body repair remain significant aspects of insurance claims, especially in cases involving classic car restoration, the process has become more transparent. Policyholders now have access to detailed information about policy terms, deductibles, and potential out-of-pocket expenses. This shift empowers them to make informed decisions, negotiate with more confidence, and demand fair compensation for their losses, whether it’s for a damaged vehicle or extensive restoration work.

Evolving Trends: Is Negotiation Still Relevant?

In today’s digital age, where information is readily accessible, many consumers question the value of traditional insurance company negotiations. The evolving landscape of car body restoration and automotive repair has seen a shift in power dynamics between insurers and policyholders. With advanced technologies and streamlined online processes, individuals can now compare quotes, file claims, and even access virtual assessments without direct interaction with an insurance representative. This transformation raises the question: is the time-honored practice of negotiating with insurance companies still relevant?

Despite the digital revolution, negotiation remains a crucial aspect of navigating the complexities of insurance claims, especially for specialized services like frame straightening. Skilled negotiators can leverage their knowledge and understanding of automotive repairs to secure better settlements. While some might opt for quicker, paper-based processes, those who invest time in mastering negotiation techniques can achieve significant savings and ensure their interests are protected during what could be a challenging and emotional period, especially after an accident involving their vehicle.

Strategies for Effective Communication with Insurers

When engaging in insurance company negotiations, effective communication is key to achieving a favorable outcome. The first step is to gather all relevant information about the incident, including detailed records of damages – whether it’s for your health, property, or vehicle. For instance, if you’re dealing with a car repair shop due to a dent removal claim, ensure you have quotes from multiple reputable shops to support your case.

During negotiations, present your facts clearly and concisely. Explain the impact the incident has had on your life and why a specific settlement amount is necessary for your recovery. It’s beneficial to use specific examples – such as the time and money spent on auto repair services – to illustrate your point. Maintain a respectful tone while firmly advocating for your rights, as this can help build rapport and potentially lead to more productive conversations with the insurance company representatives.

In an era where digital platforms and automated processes are reshaping the insurance landscape, questioning the value of direct negotiations with insurance companies is understandable. However, despite evolving trends, effective communication and strategic negotiation remain vital tools for policyholders seeking fair compensation. By understanding traditional bargaining power dynamics and adopting innovative strategies, individuals can navigate complex interactions with insurers, ensuring they receive the best possible outcome for their claims. Thus, while the approach may have evolved, insurance company negotiations are far from obsolete, continuing to play a crucial role in securing adequate coverage and benefits.