Understanding collision insurance claims process is vital for policyholders and insurers. Insurers assign adjusters to assess vehicle damage accurately, distinguishing cosmetic from structural issues. Using advanced tools like digital platforms, high-res imaging, AI, and 3D scanning streamlines damage assessment, verification, and decision-making. These innovations foster transparency, reduce costs, and improve customer satisfaction by facilitating personalized services like recommending local repair shops.

Insurers play a pivotal role in the collision insurance claims process, ensuring fair compensation for vehicle damage. When a crash occurs, understanding the intricate steps of collision insurance claims is crucial for all parties involved. This article delves into the verification of collision damage, highlighting the insurer’s responsibilities and the tools they employ for efficient claims management. By exploring these aspects, we aim to provide insights into how insurers navigate the complex landscape of collision insurance claims.

- Understanding Collision Insurance Claims Process

- Verifying Damage: Insurer's Role and Responsibilities

- Efficient Claims Management: Tools and Technologies Used by Insurers

Understanding Collision Insurance Claims Process

When a collision occurs, whether it’s a minor fender bender or a severe accident, understanding the collision insurance claims process is crucial for both policyholders and insurers. The journey begins when an insured individual files a claim with their insurance provider after a covered event, such as a car accident. The insurer then assigns a claims adjuster to review and assess the damage to the vehicle, which involves meticulously examining the car bodywork to determine the extent of the harm.

This process is vital in ensuring fair compensation for necessary repairs or, in some cases, the cost of classic car restoration. Insurers use their expertise to differentiate between cosmetic issues and structural damage, helping to expedite the claims settlement. Efficient handling of collision insurance claims not only provides financial relief for policyholders but also facilitates the timely repair or replacement of vehicles, including intricate vehicle dent repair work.

Verifying Damage: Insurer's Role and Responsibilities

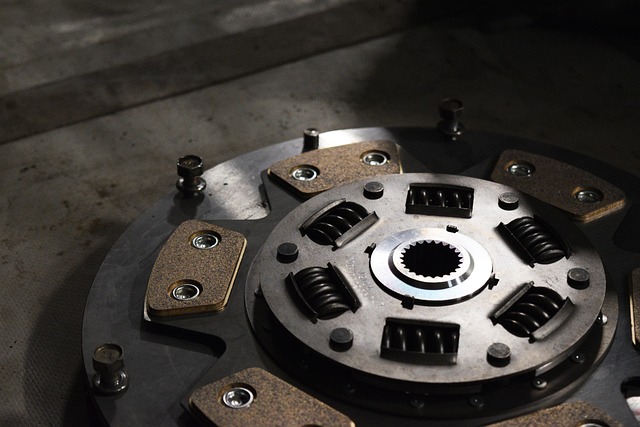

When it comes to collision insurance claims, verifying damage is a critical step for insurers. They are responsible for assessing the extent of the harm to vehicles, which involves both visual inspections and, in some cases, employing advanced technology like 3D scanning or thermal imaging. This meticulous process ensures that only legitimate and accurately documented damages are compensated, protecting both the insurer’s interests and those of the policyholder.

Insurers play a pivotal role in facilitating the vehicle repair process after a collision. They collaborate with trained professionals, including auto painting specialists and car body restoration experts, to ensure that repairs meet industry standards. By upholding these standards, insurers contribute to maintaining the safety and aesthetic appeal of vehicles on the road. This commitment to quality not only supports the overall automotive industry but also instills confidence in policyholders that their claims will be handled fairly.

Efficient Claims Management: Tools and Technologies Used by Insurers

Insurers play a pivotal role in efficient claims management for collision insurance claims, leveraging advanced tools and technologies to streamline the process. Digital platforms and software solutions have significantly transformed the way collision insurance claims are handled. These systems enable quick assessment of damage, facilitating faster decision-making and processing times. With the help of high-resolution imaging, 3D scanning, and AI-powered diagnostic tools, insurers can accurately verify collision damage, whether it’s a dented fender or a complex engine malfunction.

Integrated software solutions also enhance communication between insurers, car body shops, and car repair shops. Real-time data sharing ensures that everyone involved has access to the latest information, promoting transparency and efficiency. This interconnected ecosystem helps in managing expectations, setting accurate repair timelines, and ultimately, reducing costs for both insurers and policyholders. Moreover, these technologies enable insurers to offer more personalized services, such as recommending trusted local car repair shops for bumper repair or other necessary services, enhancing customer satisfaction in the collision insurance claims process.

Insurers play a pivotal role in the collision insurance claims process, ensuring that damage assessments are accurate and claims are managed efficiently. By leveraging advanced tools and technologies, they streamline claims management, offering a seamless experience for policyholders. Understanding the insurer’s responsibilities in verifying damage is essential for effective collision insurance claims management, ultimately fostering trust and satisfaction among customers.