Insurance Repair Standards (IRS) are essential guidelines for vehicle repairs, ensuring quality, safety, and asset preservation. Policyholders should understand these standards to make informed decisions when filing claims, navigating inspections that assess damage using industry tools, and comparing repairs against original specifications. Adherence to IRS guarantees accurate, efficient, and safe car damage repairs, streamlining claims processes and restoring vehicles to pre-incident condition. Selecting body shops committed to IRS ensures quality workmanship, smooth communication, and protection of policyholders' interests.

Discover how to seamlessly navigate the claims process by understanding and applying insurance repair standards. This guide breaks down the crucial steps of assessing damage accurately, ensuring your repairs align with industry benchmarks. Learn the ins and outs of the claim process, from documenting evidence to following specific reparation guidelines for a smoother, more efficient recovery. Maximize your compensation by knowing your rights and adhering to these essential insurance repair standards.

- Understanding Insurance Repair Standards

- Assessing Damage: Steps to Take

- The Claim Process: Following Reparation Guidelines

Understanding Insurance Repair Standards

Insurance Repair Standards (IRS) are a set of guidelines designed to ensure that repairs on insured properties, including vehicles, meet specific quality and safety criteria. These standards play a pivotal role in maintaining the value and integrity of assets after damage or loss. When filing an insurance claim for vehicle repairs, understanding IRS is essential. This knowledge empowers policyholders to make informed decisions, ensuring their claims are handled efficiently and effectively.

By familiarizing yourself with these standards, you can better navigate the claims process. For instance, IRS often dictate the methods and materials used in repairs, particularly for complex components like car paint services or auto collision center work. This ensures that vehicle repair services align with industry best practices, guaranteeing both functionality and aesthetics post-restoration.

Assessing Damage: Steps to Take

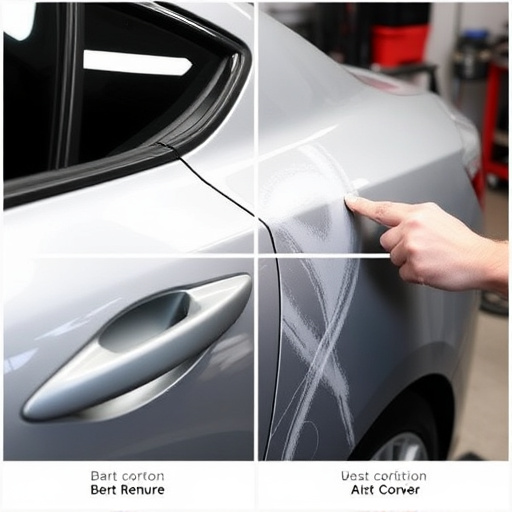

When assessing damage for an insurance claim, the first step is to thoroughly inspect the vehicle, identifying all visible and potential hidden issues. This involves a detailed walk-around, examining each panel, trim, and component for signs of impact, deformity, or stress. Using industry-standard tools, such as measuring tapes, angle gauges, and digital cameras, document the extent of the damage.

Take particular note of any discrepancies from the vehicle’s original specifications, especially when it comes to automotive repair services like bumper repair or Mercedes Benz collision repair. Compare the damaged areas with untouched parts to gauge the magnitude of the incident. This meticulous process ensures that all repairs adhere to insurance repair standards, facilitating a smoother claims process and ensuring the vehicle is restored to its pre-incident condition.

The Claim Process: Following Reparation Guidelines

When filing an insurance claim for car damage repair, adhering to established insurance repair standards is crucial. These guidelines ensure that repairs are done accurately and efficiently, minimising the hassle for both policyholders and insurers. The process typically begins with assessing the extent of the vehicle’s frame straightening requirements and other necessary repairs. Once determined, these standards dictate the procedures and techniques employed by a reputable vehicle body shop to restore your car to its pre-accident condition.

Following these repair guidelines is essential to ensure the safety and quality of the work. It also facilitates smooth communication between policyholders, insurers, and the body shop, streamlining the claim process. Remember that insurance repair standards are in place to protect your interests and guarantee a job well done. Therefore, when choosing a vehicle body shop, look for one that not only follows these standards but also has a proven track record of successful car damage repairs.

Applying insurance repair standards to your claim ensures a structured and fair restoration process. By understanding these guidelines, assessing damages accurately, and adhering to the claim procedure, you can effectively navigate the repairs and achieve a successful outcome. Incorporating these practices promotes transparency and helps in obtaining the best possible compensation for your insured property.