Structural safety verification is a crucial risk management tool for insurance companies and policyholders, assessing building integrity post-hazards to guide coverage decisions, including claims for car repairs. This process identifies vulnerabilities, enables tailored coverage options, and ensures fair compensation. To submit documents securely, collect and organize relevant materials, then use file-sharing platforms to transmit them directly to insurers, creating a paperless trail.

Insurance companies place significant emphasis on structural safety verification documentation due to its pivotal role in risk assessment. Understanding this process is essential for both policyholders and underwriters.

Structural safety verification ensures buildings meet safety standards, impacting coverage decisions directly. This article delves into the importance of such verification, exploring how comprehensive documentation influences insurance policies and offers guidance on the secure preparation and submission of these vital documents.

- Understanding Structural Safety Verification's Role in Insurance

- The Impact of Documentation on Risk Assessment and Coverage Decisions

- How to Securely Prepare and Submit Verification Documents

Understanding Structural Safety Verification's Role in Insurance

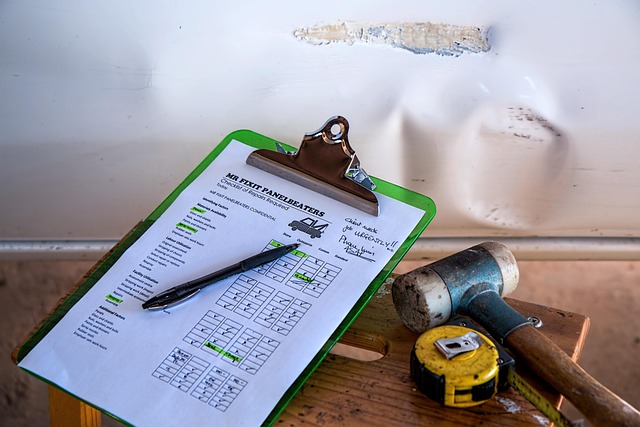

Structural Safety Verification plays a pivotal role in the insurance industry, acting as a critical safeguard for both policyholders and insurers alike. It’s not just about ensuring a building or structure can withstand physical forces; it’s also about mitigating risks associated with structural failures that could lead to substantial losses. Insurance companies demand these verifications to assess the integrity of properties, especially after potential hazards like accidents, natural disasters, or construction defects. This process helps insurers accurately evaluate claims related to property damage, including those from car dent repair or collision repair shops.

By obtaining structural safety verification documentation, insurance providers can make informed decisions regarding coverage and claim settlements. It enables them to distinguish between minor cosmetic issues, like dent removal, and significant structural damages that require extensive repairs or even rebuilding. This meticulous approach ensures that policyholders receive fair compensation while insurers maintain the financial stability required to honor their obligations.

The Impact of Documentation on Risk Assessment and Coverage Decisions

Insurance companies carefully scrutinize structural safety verification documentation to make informed risk assessment and coverage decisions. This comprehensive process involves evaluating the overall integrity and stability of a property, which is crucial for accurately determining potential risks and setting appropriate premiums. Without robust structural safety verification, insurers face increased uncertainty about the financial implications of insuring a particular asset.

For instance, in the context of fleet repair services, car repair shops, or vehicle body shops, insurance providers need detailed reports on the building’s structural components—from its foundation to its roof—to assess vulnerabilities like faulty framing, compromised load-bearing walls, or inadequate reinforcement. These insights enable insurers to offer tailored coverage options that account for specific risks associated with these types of establishments, ensuring both financial protection and peace of mind for business owners and their clients.

How to Securely Prepare and Submit Verification Documents

To securely prepare and submit structural safety verification documents, start by gathering all necessary materials relevant to your project. This includes detailed blueprints, engineering calculations, and any certification from approved professionals or manufacturers. Organize these documents in a clear, digital format for easy access and reference.

Ensure that each piece of documentation is accurately labeled with the project’s unique identifier, date, and version. For automotive body work, luxury vehicle repair, or auto glass replacement projects, include specific details about the materials used, structural changes made, and compliance with industry standards. Before submission, double-check for any missing information or inconsistencies. Use secure file-sharing platforms to transmit these documents directly to your insurance company, maintaining a paperless trail for easy tracking and future reference.

Insurance companies rely on structural safety verification documentation as a critical component in assessing risk and determining coverage. By understanding the importance of this process and knowing how to prepare and submit documents effectively, individuals can ensure their properties are adequately protected. Structural safety verification plays a pivotal role in fostering trust between insurers and policyholders, enabling fair risk assessment and ultimately contributing to more secure communities.