Insurance Company Negotiations: A Proactive, Persistent Approach

Navigating insurance company negotiations for claims like car body restoration or dent repair requires persistence and preparation. Policyholders should understand their policy, document damage thoroughly, and maintain a patient yet firm attitude during discussions. By aligning with the insurance company's requirements and showcasing thorough understanding of the claim, policyholders increase chances of securing fair compensation, covering repairs and associated costs. This strategy, backed by real-world success stories, emphasizes the power of persistence in achieving favorable outcomes.

In the intricate dance of insurance company negotiations, persistence stands as an unwavering strategy. It’s not always about brute force; rather, it’s a calculated approach that understands the inherent value of patience and persistence. This article explores why this trait pays off in spades. From unraveling the art of understanding policy language to mastering negotiation tactics and delving into compelling case studies, we uncover how persistence transforms ordinary conversations with insurance companies into favorable outcomes.

- Understanding the Power of Persistence in Insurance Claims

- Strategies to Cultivate a Successful Negotiation Mindset

- Case Studies: When Persistence Leads to Favorable Outcomes

Understanding the Power of Persistence in Insurance Claims

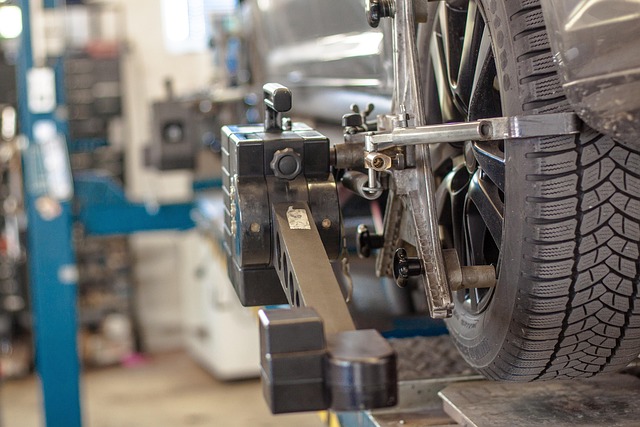

In the realm of insurance company negotiations, persistence can be a powerful ally for policyholders. Many individuals often approach these discussions with an initial sense of urgency, hoping to secure swift compensation for their claims, such as a vehicle dent repair or car body restoration after an accident. However, understanding that insurance companies have their own processes and guidelines is key. They may have specific criteria for collision repair and the approval of expenses varies across different policies and circumstances.

By demonstrating persistence, individuals can navigate these complexities more effectively. It involves not getting discouraged by initial rejections or delays but rather viewing them as stepping stones towards a fair resolution. Persistent policyholders are better equipped to gather all necessary documentation, follow up on claims progress, and understand their rights under the policy. This proactive approach ensures that their efforts towards car body restoration or collision repair align with the insurance company’s requirements, ultimately increasing the chances of a successful outcome.

Strategies to Cultivate a Successful Negotiation Mindset

Cultivating a successful negotiation mindset is key when navigating insurance company negotiations. One effective strategy is to prepare thoroughly; understand your policy, the scope of damage (like those in a car collision repair or auto frame repair), and your rights as a claimant. This knowledge equips you to present your case clearly and confidently.

Additionally, maintain a patient and persistent attitude throughout the process. Insurance negotiations can be intricate and sometimes involve complex procedures such as automotive repair assessments. Stay calm under pressure, reiterate your position firmly but respectfully, and avoid rushing into decisions. Remember, persistence often leads to favorable outcomes, ensuring you receive fair compensation for any damages, including those from auto frame repairs or car collision repairs.

Case Studies: When Persistence Leads to Favorable Outcomes

In the high-stakes world of insurance company negotiations, persistence is a powerful tool that can lead to favorable outcomes. Case studies from various industries demonstrate this vividly. For instance, consider a scenario where a policyholder needs compensation for extensive auto body restoration after an accident. Despite initial rejections by the insurance company, the policyholder’s unwavering determination led them to present compelling evidence, including expert opinions and detailed repair estimates. Through persistent dialogue and a thorough understanding of their rights, they eventually secured a settlement that covered not only the restoration costs but also additional expenses related to rental cars and medical bills.

Similarly, in the realm of vehicle dent repair, a customer’s persistence paid off against what seemed like an unfair denial. By thoroughly researching the policy terms and providing irrefutable proof of the extent of damage, they successfully negotiated with the insurance company. This resulted in a claim approval that covered both the initial repair costs and the labor involved, ensuring not just the restoration of their vehicle but also their satisfaction. These examples underscore the importance of persistence in insurance negotiations, where staying firm yet respectful can lead to outcomes that go beyond the expected compensation for auto body restoration, car dent repair, or any other damage.

Insurers often view persistent and well-informed claimants as more credible, leading to better outcomes in negotiations. By employing strategies like thorough documentation, understanding policy terms, and maintaining a calm, respectful tone, individuals can navigate insurance company negotiations effectively. Case studies demonstrate that persistence pays off, resulting in higher settlements and a smoother claims process. Embracing these tactics empowers individuals to advocate for themselves and secure favorable agreements with insurance companies.