Rental car insurance coverage is vital for travelers, offering liability, collision, and comprehensive protection against unexpected costs. Standard policies often exclude theft, vandalism, and specific vehicle types, so understanding limitations is key. Rental companies offer add-on packages to fill gaps, but reviewing your agreement and comparing with personal auto policy is essential. Inspecting the car upon receipt, maintaining it per contract terms, and promptly reporting issues are best practices. Knowing local driving laws ensures a smooth experience and avoids penalties affecting coverage.

Before hitting the road, understanding your rental car insurance coverage is crucial. This guide breaks down the essentials of rental car insurance, helping you navigate potential pitfalls. We explore what’s typically covered and what often falls outside standard policies. Additionally, we provide valuable tips to maximize protection and ensure a seamless rental car experience. By arming yourself with knowledge, you can confidently hit the open road.

- Understanding Rental Car Insurance Coverage Basics

- What's Not Covered by Standard Policies

- Tips for Maximizing and Protecting Your Rental Car Experience

Understanding Rental Car Insurance Coverage Basics

Rental car insurance coverage is a crucial aspect often overlooked by travelers. It’s essential to understand what your policy includes and excludes before you pick up that rental car. The basics involve comprehending liability, collision, and comprehensive coverage. Liability covers damages to other vehicles or properties; collision protection pays for repairs to the rental vehicle in case of an accident; and comprehensive insurance steps in for damage from events like theft, natural disasters, or vandalism.

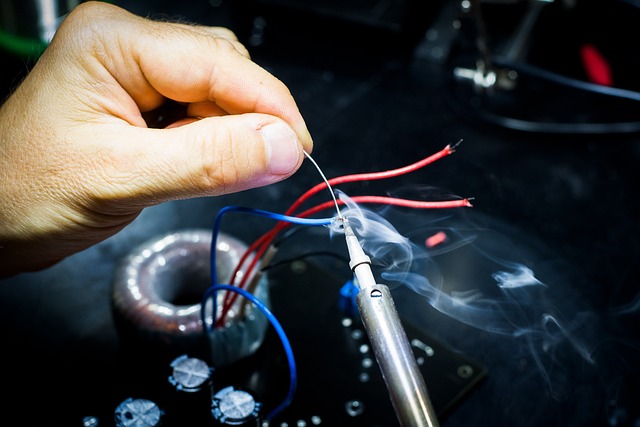

Knowing these ins and outs is vital to avoid unexpected financial burdens. For instance, if you opt out of collision coverage but are at fault in a crash, you might be responsible for paying for vehicle repair services or even auto frame repair costs out of pocket. Conversely, having the right rental car insurance coverage can ensure that damages are covered, leaving you with peace of mind during your travels.

What's Not Covered by Standard Policies

Many standard rental car insurance policies don’t cover all potential incidents or damages. Common exclusions include liability for theft, vandalism, or damage to certain types of vehicles, such as luxury or sports cars. Additionally, standard policies usually do not cover the cost of personal belongings lost or stolen from the rented vehicle. If you’re renting a car for an extended period or planning to drive in areas with higher crime rates, it’s essential to understand these limitations.

Knowing what’s not covered is crucial when considering your rental car insurance options. It encourages responsible driving and helps prevent financial surprises if an incident occurs. Often, rental companies offer additional coverage packages that can fill these gaps, including comprehensive and collision insurance, which cover various damages and theft. Familiarizing yourself with these details ensures you’re adequately protected and aware of any potential out-of-pocket expenses.

Tips for Maximizing and Protecting Your Rental Car Experience

Before picking up your rental car, take the time to review your rental agreement and understand your rental car insurance coverage. Compare it with your personal auto insurance policy to ensure you’re not paying for redundant protection. If gaps exist, consider purchasing additional coverage from the rental company, especially for comprehensive and collision damage. This proactive step can save you significant out-of-pocket expenses in case of a vehicle collision repair or unexpected damages.

Maximizing your rental car experience also involves being mindful of the vehicle’s condition upon receipt. Conduct a thorough inspection, noting any existing dings, scratches, or dents for potential later dispute resolution. Regularly clean and refuel the vehicle as per the contract terms to avoid additional fees. If you encounter any issues during your trip, promptly report them to the rental company. Additionally, familiarizing yourself with local driving laws and regulations will ensure a smooth experience, avoiding penalties that could impact your rental car insurance coverage.

Before you hit the road, understanding your rental car insurance coverage is crucial. By familiarizing yourself with what’s included and what’s not, you can maximize protection and avoid unexpected costs. Remember, knowing the basics and staying informed will ensure a smoother, more protected rental car experience.