Insurers and clients thrive in insurance company negotiations through active listening, clear communication, understanding non-verbal cues, and mutual respect, building trust and resolving complex claims. Effective dialogue strengthens relationships, ensures accurate assessments, addresses concerns, fosters collaboration, and expedites claim settlements.

Insurance company negotiations require clear, strategic communication to ensure successful policy discussions. This article explores the critical role of communication in facilitating effective insurance company talks. We delve into practical strategies for navigating complex conversations, building trust and rapport with clients, and overcoming challenges. By understanding these dynamics, professionals can enhance their negotiation skills, fostering mutually beneficial agreements within the insurance industry.

- Effective Communication Strategies for Insurance Negotiations

- Building Trust and Rapport in Policy Discussions

- Overcoming Challenges: Complex Case Conversations

Effective Communication Strategies for Insurance Negotiations

Insurers and clients alike must master the art of communication to navigate insurance company negotiations successfully. Effective communication strategies are key to ensuring that both parties understand each other’s needs, concerns, and expectations. During discussions, it’s crucial to listen actively, clarify points, and provide concise, yet comprehensive, information. This includes clearly explaining policy terms, coverage options, and potential exclusions to avoid misunderstandings later.

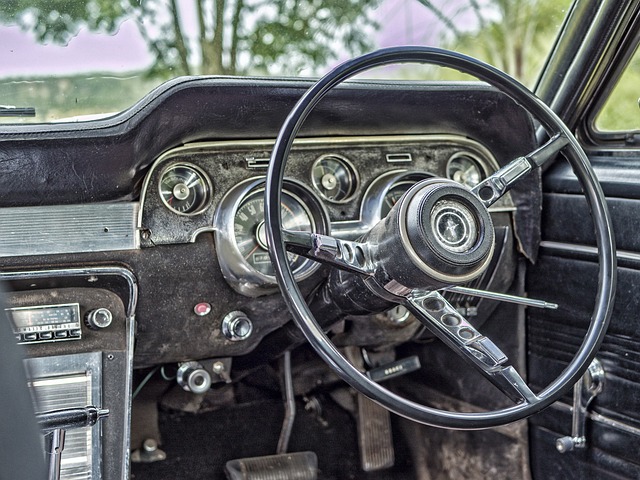

In the context of insurance company negotiations, understanding non-verbal cues and maintaining a respectful tone can significantly impact outcomes, especially when dealing with complex issues like car repair shop claims or fleet repair services. Being empathetic towards the client’s situation while presenting the insurer’s perspective fosters a collaborative environment. This approach not only enhances the negotiation process but also builds trust, leading to more productive relationships between insurers and policyholders.

Building Trust and Rapport in Policy Discussions

In insurance company negotiations, communication serves as the cornerstone for building trust and rapport. Effective dialogue fosters an environment where policyholders feel heard and understood, crucial factors in ensuring satisfaction and long-term loyalty. The tone, clarity, and empathy displayed by insurers can significantly impact how clients perceive their interactions, ultimately shaping their trust in the company’s integrity and reliability.

During policy discussions, focusing on active listening, clear explanations, and personalized attention can go a long way. Insurers who take the time to understand their clients’ unique circumstances and concerns, whether related to unexpected events like vehicle collisions requiring auto body repair or routine policy reviews, are better equipped to offer tailored solutions. This level of engagement not only enhances communication but also strengthens the bond between the insurance company and its policyholders, fostering a sense of partnership rather than mere transactional relationships.

Overcoming Challenges: Complex Case Conversations

Effective communication is paramount when navigating complex conversations during insurance company negotiations. When discussing intricate claims, such as those involving collision damage repair or scratch repairs on vehicles, clear and concise language becomes essential. Insured individuals often find themselves in a delicate situation where their property needs significant restoration work, and effective communication can make all the difference.

During these talks, insurance adjusters and claimants must carefully articulate details about car paint services, panel replacement, and other repair procedures to ensure accurate assessments and fair settlements. Open dialogue allows both parties to address concerns, clarify expectations, and build trust. This process enables a collaborative environment, fostering mutual understanding and potentially expediting the claims resolution, which is beneficial for all involved.

Insurance company negotiations require a blend of strategic communication techniques, trust-building, and the ability to navigate complex conversations. By employing effective communication strategies, such as active listening, clear explanation of policies, and open dialogue, professionals can enhance client relationships and achieve mutually beneficial outcomes. Building rapport fosters an environment conducive to honest discussions, while addressing challenges head-on ensures every aspect of a policy is thoroughly understood. Ultimately, mastering these skills in insurance company talks not only facilitates smoother transactions but also strengthens the bond between insurer and insured.