Insurance claim management involves coordinating and managing every aspect of claims from filing to resolution, ensuring fair compensation for losses like collision, dent, and car paint repairs. Claim managers streamline processes, resolve disputes efficiently, and protect interests of insurers and policyholders, enhancing customer satisfaction and building brand trust through accurate documentation and effective negotiation strategies.

In today’s complex business landscape, effective insurance claim management is vital for organizations aiming to mitigate risks and optimize resources. This article delves into why dispute resolution is a key component of this process. We’ll explore the multifaceted role of claim management, highlighting its integral connection to dispute resolution techniques. By understanding these interlinked elements, businesses can streamline processes, enhance efficiency, and achieve positive outcomes in managing insurance claims.

- Understanding Claim Management Role and Scope

- Dispute Resolution: An Integral Component

- Efficient Processes for Positive Outcomes

Understanding Claim Management Role and Scope

Insurance claim management is a crucial process that involves coordinating and managing various aspects related to insurance claims, from initial filing to final resolution. It encompasses a wide scope, ensuring that policyholders receive fair compensation for eligible losses or damages. The role of a claim manager includes overseeing every step of this process, from accepting the claim to handling negotiations, appraisals, and payments. They act as a bridge between the insurance company and the policyholder, facilitating efficient and effective dispute resolution.

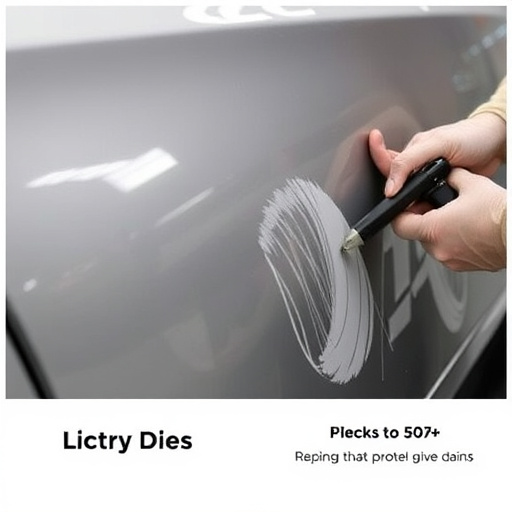

Within this scope, the management of claims related to collision repair, dent repair, and car paint repairs plays a significant part. These services often involve complex procedures and can be costly for policyholders. Skilled claim managers ensure that these processes are streamlined, minimizing delays and potential disputes. They work closely with repair shops, appraisers, and other stakeholders to assess damage, negotiate repairs, and approve payments, ultimately protecting the interests of both the insurance provider and the policyholder while ensuring a seamless recovery experience for those involved in accidents or incidents requiring such services.

Dispute Resolution: An Integral Component

Dispute resolution is an essential component of insurance claim management, acting as a pivotal process that facilitates the smooth and efficient handling of insurance claims. In the context of insurance claim management, dispute resolution involves addressing and resolving any disagreements or conflicts that arise during the claims process. These disputes can encompass various issues such as the validity of a claim, the extent of damages, or interpretation of policy terms.

Effective dispute resolution is crucial for maintaining positive customer relationships, ensuring regulatory compliance, and minimizing financial losses. By efficiently managing disputes, insurance providers can streamline their claims processes, prevent lengthy legal battles, and promote a culture of trust and transparency. This proactive approach to dispute management, including the swift handling of auto collision center or autobody repairs claims, ultimately enhances customer satisfaction and strengthens the overall reputation of the insurance provider.

Efficient Processes for Positive Outcomes

Efficient processes are at the heart of successful claim management, and this is no different when it comes to dispute resolution. By implementing structured workflows and clear communication channels, insurance claim management teams can ensure every step of the process runs smoothly. This includes prompt assessments, accurate documentation, and effective negotiation strategies. The goal is to reach positive outcomes for all parties involved, whether that’s through amicable settlements or alternative dispute resolution methods.

A well-managed claim process not only speeds up repairs, such as addressing a minor car scratch repair or even the intricate luxury vehicle repair, but also fosters better relationships with policyholders and service providers. This holistic approach enhances customer satisfaction, encouraging trust and loyalty in the insurance company’s brand, ultimately contributing to a positive reputation in the industry.

Insurers play a pivotal role in facilitating efficient insurance claim management, which extends beyond processing claims to include dispute resolution. By integrating robust dispute resolution practices into their claim management duties, insurers can enhance customer satisfaction and maintain operational integrity. Through streamlined processes that prioritize effective communication and fair outcomes, insurers can ensure positive experiences for both claimants and policyholders, ultimately strengthening trust in the insurance industry.