An insurance repair warranty serves as a safety net for policyholders and repair shops, covering additional costs beyond insurance settlements for specified repairs. Adherence to terms by auto body shops and genuine parts usage by insurers ensures high-quality service and trust among stakeholders. Non-compliance leads to contractual breaches, eroded trust, and potential fines/legal action from regulatory bodies, maintaining industry standards and customers' peace of mind.

In today’s complex automotive landscape, ensuring compliance with insurance repair warranties is paramount for both insurers and repair shops. This article delves into the intricacies of insurance repair warranties, exploring key aspects like understanding their basics, the collaborative roles in guaranteeing compliance, and the significant consequences of non-adherence. By examining these factors, we highlight the importance of maintaining high standards in the post-repair process to protect consumers and safeguard business reputations.

- Understanding Insurance Repair Warranty Basics

- Roles in Ensuring Compliance: A Collaboration

- Consequences of Non-Compliance and Enforcement

Understanding Insurance Repair Warranty Basics

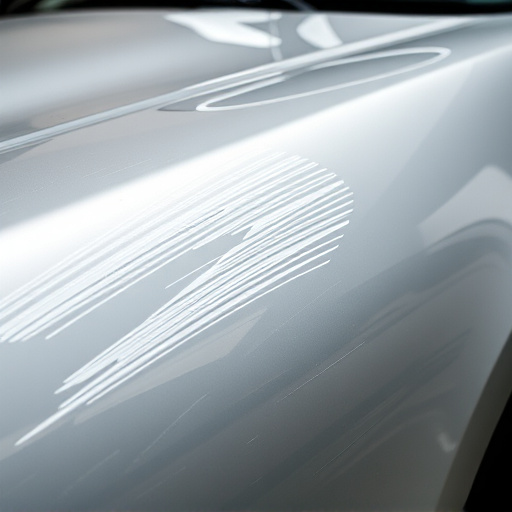

When it comes to insurance repair warranties, understanding the basics is crucial for both policyholders and repair shops. An insurance repair warranty is a promise made by an insurance company or a repair facility to cover the cost of fixing or replacing parts of a vehicle that have been damaged in an insured event, such as an accident or natural disaster. This warranty typically covers labor and materials for a specified period after the repair is completed.

The process usually involves the policyholder taking their vehicle to a licensed and approved repair shop, like those specializing in mercedes benz repair. The shop will then assess the damage, provide an estimate, and initiate the repair work. Once the repairs are done, the insurance company or warranty provider reviews the work and ensures compliance with the terms of the warranty. If all conditions are met, they cover any additional costs not covered by the policyholder’s insurance settlement, ensuring a seamless and cost-effective car repair services experience for the customer.

Roles in Ensuring Compliance: A Collaboration

Ensuring compliance with insurance repair warranties involves a collaborative effort between several key players in the automotive industry. Primarily, this responsibility falls on the shoulders of auto repair shops and garages that undertake the actual fixing and restoration work. These facilities must adhere strictly to the terms and conditions outlined in the warranty, ensuring every repair or replacement is carried out as specified by the insurance provider. This includes using genuine parts, adhering to quality standards, and documenting each step for future reference.

However, it’s not just about shop operations; insurance companies play a crucial role too. They set the guidelines and policies that define what constitutes compliance with their repair warranties. By clearly outlining the process and expectations, insurers enable both policyholders and repair shops to understand their obligations. This collaboration fosters trust and ensures that when policyholders file claims for tire services, collision repair services, or car dent removal, the repairs are not just of high quality but also align perfectly with the terms of their insurance coverage.

Consequences of Non-Compliance and Enforcement

The consequences of non-compliance with insurance repair warranties can be severe for all parties involved. When an auto body shop or repair facility fails to adhere to the terms and conditions outlined in a warranty, it not only violates contractual agreements but also undermines the trust between the insured, their insurance provider, and the service provider. This can lead to damaged relationships and potential legal repercussions. Insured individuals may find themselves paying out-of-pocket for subpar repairs or facing delays in receiving compensation for necessary vehicle restoration, especially if the warranty promises specific services or guarantees.

Enforcement of these warranties is typically handled by a combination of regulatory bodies, insurance companies, and consumer protection agencies. They work together to monitor compliance, investigate complaints, and take appropriate action against non-compliant businesses. This may include fines, legal suits, or blacklisting, especially if the violations are repeated or particularly egregious. Effective enforcement ensures that auto body repairs adhere to high standards, providing customers with peace of mind and quality service, while also promoting ethical business practices within the collision repair industry for vehicle restoration.

Insurers, policyholders, and repair providers all play vital roles in ensuring compliance with insurance repair warranties. By collaborating effectively and adhering to established guidelines, they can facilitate timely and quality repairs, fostering customer satisfaction and maintaining the integrity of the insurance process. Non-compliance, on the other hand, can lead to legal repercussions and damaged reputations, emphasizing the importance of understanding and upholding these warranties.