Understanding deductibles is crucial for glass repair insurance. Higher deductibles lower monthly costs but require upfront payment, while lower deductibles offer swift protection with higher premiums. Choosing the right balance depends on budget and risk preference for auto or classic car glass repairs, considering coverage scope varies among providers. Tailoring policies to individual needs ensures protection and minimizes long-term costs.

When it comes to protecting your property from unforeseen glass repairs, understanding your glass repair insurance policy is paramount. This article delves into the crucial aspect of deductibles, exploring why they matter and how they impact your financial protection. We’ll guide you through glass repair coverage intricacies, helping you navigate risks and savings. By the end, you’ll be equipped to make informed decisions, ensuring the right glass repair insurance policy for your needs.

- Understanding Deductibles: The Financial Foundation

- Glass Repair Coverage: What's In and What's Out

- Balancing Risk and Savings: Choosing the Right Policy

Understanding Deductibles: The Financial Foundation

Understanding deductibles is essential when considering any type of insurance policy, especially for something as valuable and fragile as your vehicle’s glass. In the context of glass repair insurance, a deductible acts as the financial foundation between you and the insurer. It’s the amount you agree to pay out-of-pocket for repairs before your insurance coverage kicks in. This means that if you have a policy with a $500 deductible, for instance, you’ll be responsible for paying the first $500 towards any glass repair or replacement claims.

Knowing this financial threshold is crucial because it directly impacts how much protection your auto glass repair or classic car restoration coverage provides. A higher deductible typically means lower monthly premiums, which can be beneficial for those on a tight budget. However, it’s important to remember that in the event of a claim, you’ll need to cover the initial expense. Conversely, a lower deductible results in higher premiums but offers more immediate financial protection during unforeseen incidents involving your vehicle’s glass or vehicle paint repair.

Glass Repair Coverage: What's In and What's Out

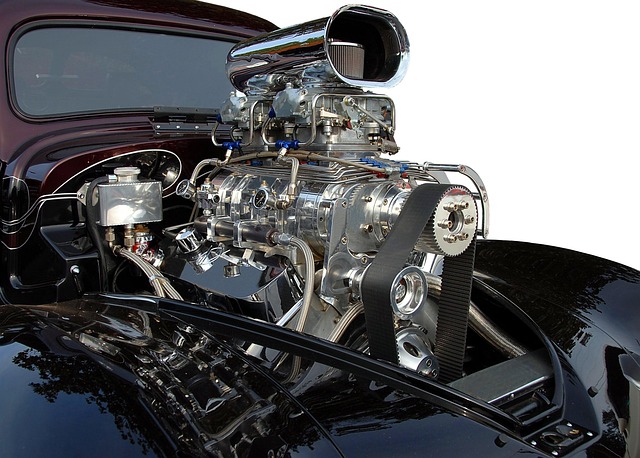

Glass repair insurance policies offer specialized coverage for one of a vehicle’s most vulnerable components. However, understanding what’s included and excluded is crucial before settling on a plan. Many policies cover basic glass repair or replacement due to accidents, natural disasters, or vandalism. This can include side windows, rear windows, and even windshields in some cases. The scope of coverage varies among providers, so it’s important to read the fine print.

While car body repair, vehicle dent repair, and automotive restoration services are not typically part of standard glass repair insurance policies, they might be included under comprehensive or collision coverage, which often requires a higher deductible. Comprehensive plans usually cover damage from non-driving related incidents like falling debris or animal encounters. Collision coverage, on the other hand, applies to accidents involving another vehicle or object, and may also require deductibles that need to be paid out of pocket before insurance steps in.

Balancing Risk and Savings: Choosing the Right Policy

When considering a glass repair insurance policy, understanding the balance between risk and savings is paramount. These policies are designed to protect against unforeseen incidents that can lead to costly repairs or replacements. However, different deductibles offer varying levels of coverage and financial burden. A higher deductible typically translates to lower premiums, encouraging proactive maintenance and responsible claims management. Conversely, a lower deductible provides more immediate financial protection but may result in slightly higher monthly payments.

The ideal policy strikes a delicate balance, aligning with your financial comfort level and the likelihood of glass damage. For instance, if you live in an area prone to severe weather or have a history of minor accidents, a lower deductible might be preferable. Conversely, if you’re a safe driver and maintain regular vehicle checks, opting for a higher deductible could save you money over time, especially when considering related services like collision repair centers or car dent removal. Ultimately, choosing the right glass repair insurance policy involves assessing your risk tolerance and making an informed decision that fits your needs and budget.

When considering a glass repair insurance policy, understanding deductibles is key. These financial benchmarks play a crucial role in balancing risk and savings, ensuring you’re protected without breaking the bank. By carefully reviewing your options and choosing a policy that aligns with your needs, you can safeguard against unexpected glass repair costs while making informed decisions. Remember, the right glass repair insurance policy acts as a symphony of protection and cost-efficiency, offering peace of mind in the face of potential damage.