Understanding your specific vehicle needs is key when selecting auto body insurance coverage. Gather essential documents and review policy details for comprehensive protection, including car restoration and minor repairs. Research insurers for efficient claim handling and choose policies offering major and minor auto body work coverage to ensure peace of mind.

Applying for auto body insurance coverage is a crucial step in ensuring your vehicle’s protection. This comprehensive guide will walk you through the process, from understanding your needs to choosing the right policy. First, assess your auto body insurance requirements and gather essential documents. Next, compare policies from various insurers to find the best fit. By following these steps, you’ll be well-equipped to navigate the application process and secure reliable auto body insurance coverage for peace of mind.

- Understanding Auto Body Insurance Coverage Needs

- Gathering Necessary Documents for Application

- Choosing the Right Policy and Insurer for You

Understanding Auto Body Insurance Coverage Needs

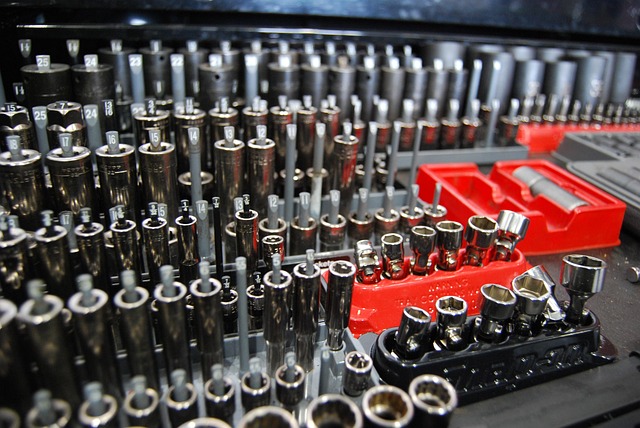

When considering auto body insurance coverage, it’s vital to understand your specific needs. Auto body insurance isn’t just about protecting your vehicle against major accidents; it also encompasses a range of services that extend beyond basic repairs. For instance, comprehensive coverage can include car restoration and specialized vehicle repair services, ensuring your vehicle not only drives safely but looks its best as well.

This type of coverage is particularly beneficial for those who rely on their vehicles for daily activities or even as part of their livelihood. Whether you own a classic car that requires meticulous restoration or simply want peace of mind knowing your regular commute is protected, understanding the scope of auto body insurance coverage can help you make informed decisions when choosing the right policy for your needs.

Gathering Necessary Documents for Application

Before applying for auto body insurance coverage, it’s essential to gather all necessary documents. This includes your vehicle’s registration and proof of ownership, which can typically be found in your car’s glove compartment or through your state’s Department of Motor Vehicles (DMV). Additionally, you’ll need your driver’s license and a valid auto insurance policy from your current provider, if applicable. These documents verify your identity and vehicle details, making the application process smoother.

For auto body repairs like car restoration, auto painting, or even addressing minor issues such as car scratch repair, having comprehensive insurance can be invaluable. Ensure that you understand what is covered under your policy, including deductibles and any exclusions. This knowledge will help you navigate the repair process and ensure you receive appropriate compensation for eligible work.

Choosing the Right Policy and Insurer for You

Choosing the right auto body insurance coverage involves understanding your needs and comparing options from various insurers. Start by assessing the types of damages you typically encounter—from minor fender benders to more extensive bumper repairs or scratch repair. This will help you determine the level of coverage required to adequately protect your vehicle.

Research different insurance providers, considering their reputation for handling claims efficiently and their customer service track record. Look into policies that offer comprehensive coverage for auto body work, ensuring that both major and minor damages are covered. Remember, the right policy should provide peace of mind, knowing that you’re protected when unexpected incidents like a scratch repair or bumper repair occur on the road.

When applying for auto body insurance coverage, understanding your needs, gathering essential documents, and choosing a suitable policy from a reputable insurer are key steps. By following these guidelines, you’ll be well-equipped to protect your vehicle’s repair costs and ensure peace of mind. Remember, the right auto body insurance can make all the difference in smoothly navigating unexpected repairs.