Insurance repair warranties are crucial for vehicle owners, ensuring high-quality repairs after accidents. Auto repair shops, insurance providers, and policyholders collaborate to ensure compliance, with shops performing repairs according to guidelines, documenting work accurately, and adhering to warranty procedures. Effective communication, transparent information about scopes, exclusions, and claims procedures, along with digital tracking systems and photo documentation, enhance customer satisfaction and maintain industry integrity.

In the intricate world of insurance, understanding and adhering to repair warranties is paramount for both insurers and policyholders. This article delves into the fundamentals of insurance repair warranties, exploring who is ultimately responsible for ensuring compliance. We unravel the collaborative efforts involved in maintaining these agreements, highlighting strategies for effective monitoring and enforcement. By understanding these dynamics, stakeholders can navigate the process seamlessly, fostering trust and ensuring fair resolution during repairs.

- Understanding Insurance Repair Warranty Basics

- Roles in Ensuring Compliance: A Collaborative Effort

- Effective Strategies for Monitoring and Enforcing Compliance

Understanding Insurance Repair Warranty Basics

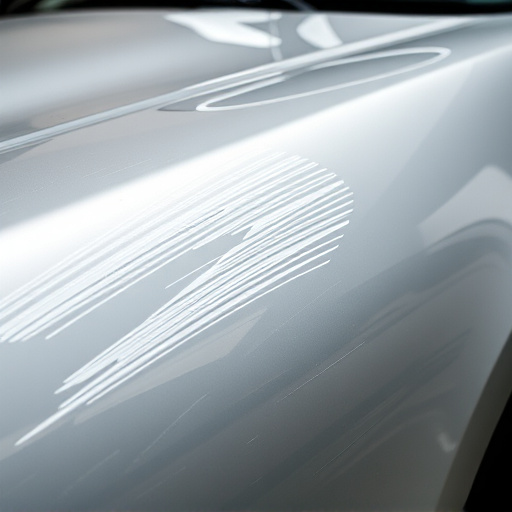

Insurance repair warranties are designed to offer protection for vehicle owners after an accident or damage. These warranties guarantee the quality and longevity of repairs conducted on insured vehicles, ensuring that any issues arising from the repair process are addressed promptly. When a car undergoes frame straightening or car body repair, the warranty becomes a crucial safety net, assuring vehicle owners that their investment is secure.

Understanding the basics of an insurance repair warranty involves grasping its scope and limitations. These warranties typically cover specific repairs for a set period, ensuring peace of mind during the restoration process. Whether it’s automotive repair or intricate car body repair, the warranty guarantees that defects related to workmanship or materials will be rectified without additional cost to the policyholder. This ensures a seamless transition back to safe and reliable vehicle operation following an accident.

Roles in Ensuring Compliance: A Collaborative Effort

Ensuring compliance with insurance repair warranties is a collaborative effort involving multiple stakeholders within the automotive industry. The primary responsibility lies with the auto repair shop, which is tasked with performing repairs according to the specific guidelines and standards set forth by the insurance company and the policyholder’s preferences. Skilled technicians at these shops play a pivotal role in accurately documenting work done, ensuring parts compliance, and adhering to repair procedures outlined in the warranty.

This process requires close coordination between the auto repair shop, insurance providers, and policyholders. Insurance companies provide guidelines and policies that dictate what is covered under the warranty, while policyholders have a say in choosing the repair facility and understanding their rights and responsibilities. Effective communication and transparency among these entities are crucial to guarantee that repairs are done efficiently and within the scope of the insurance repair warranty, ensuring customer satisfaction and peace of mind post vehicle collision repair.

Effective Strategies for Monitoring and Enforcing Compliance

Monitoring and enforcing compliance with insurance repair warranties is a multifaceted process that requires proactive strategies to ensure consumer protection and maintain the integrity of auto body repair and auto glass replacement services. One effective approach involves establishing clear, transparent communication channels between insurance providers, repair shops, and policyholders. This includes providing detailed information about the warranty scope, exclusions, and claims procedures in a language easily understood by all parties involved. Regular updates and reminders about pending repairs, completed work, and any outstanding issues can help keep everyone on track.

Additionally, implementing digital tracking systems for insurance repair warranties allows for real-time monitoring and efficient enforcement. These platforms facilitate the documentation of repair processes, ensuring that all work aligns with the specified standards and guidelines. By leveraging technology, such as photo documentation and progress reports, repair shops are held accountable for their workmanship while policyholders gain peace of mind knowing their claims are being handled effectively. This comprehensive approach addresses potential issues like subpar fender bender repairs or miscommunications regarding auto glass replacement, ultimately enhancing customer satisfaction and trust in the industry.

Insurers, policyholders, and repair professionals all play vital roles in maintaining the integrity of an insurance repair warranty. By understanding their respective responsibilities, these parties can collaborate effectively to ensure compliance, ultimately fostering trust and delivering high-quality service during the restoration process. Implement robust monitoring strategies and consistent enforcement measures to safeguard against fraudulent claims and ensure policyholders receive the benefits promised by their warranties.