Rental car insurance coverage options vary widely, from basic liability to comprehensive plans that protect against collisions, theft, and natural disasters. Understanding these choices is crucial for renting, as it allows you to select the right balance between cost and peace of mind for your road trip. Comprehensive coverage offers broader protection, while basic coverage typically excludes damage to the rented vehicle. Optional policies include protection against theft, vandalism, and auto maintenance packages.

Understanding the right rental car insurance coverage is essential for a stress-free travel experience. This guide navigates the different types of coverage available, helping you choose what suits your needs best. From basic liability to comprehensive protection, we demystify these policies. Learn about optional add-ons and riders that can further safeguard your rental vehicle. By the end, you’ll be equipped with the knowledge to make informed decisions, ensuring peace of mind on the road.

- Types of Rental Car Insurance Coverage Explained

- Understanding Basic and Comprehensive Coverage

- Navigating Additional Policies and Riders

Types of Rental Car Insurance Coverage Explained

Rental car insurance coverage comes in various forms, each offering distinct levels of protection for travelers and vehicle owners. The primary types include liability coverage, collision coverage, comprehensive coverage, and personal injury protection (PIP). Liability covers damages to other parties or their property during an accident, protecting you from potentially high legal fees and medical bills. Collision coverage is designed to protect against damage to your rental car itself, including repairs to the vehicle’s bodywork, whether due to an accident or other incidents.

Comprehensive coverage goes beyond collision by protecting against a wide range of non-collision events, such as theft, vandalism, natural disasters, or even animal encounters that may cause car damage. Personal Injury Protection (PIP) is crucial for safeguarding against medical expenses and lost wages in the event of an accident. Understanding these options is essential when renting a vehicle, as it allows you to choose the right level of protection, balancing cost with peace of mind, and ensuring you’re prepared for any unforeseen circumstances while on the road.

Understanding Basic and Comprehensive Coverage

Rental car insurance coverage is a crucial aspect to consider when renting a vehicle. Understanding the distinction between basic and comprehensive coverage is essential for making an informed decision.

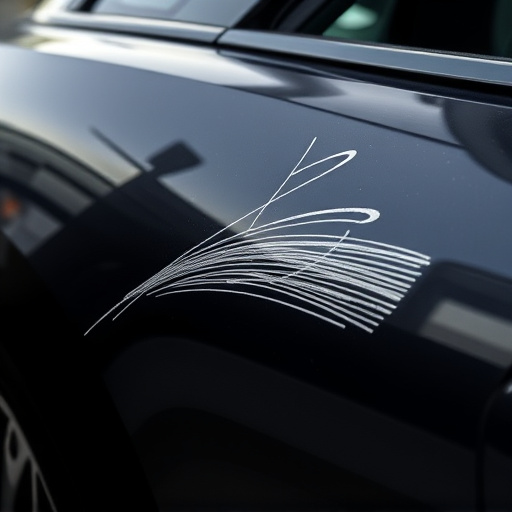

Basic rental car insurance typically covers damages or losses incurred during the rental period, but it has limitations. This type of coverage usually includes liability protection, which safeguards against claims from third parties in case of an accident. However, it may not cover damage to your rental car itself, such as accidents caused by your own negligence or theft and vandalism. On the other hand, comprehensive rental car insurance offers broader protection, encompassing not only liability but also damage to the vehicle. This includes situations like collisions with other vehicles, natural disasters, or even car dent removal due to minor accidents. Comprehensive coverage essentially provides peace of mind, ensuring that unexpected incidents won’t significantly impact your finances, and you can enjoy your rented vehicle without constant worry, knowing it’s protected by a robust insurance plan.

Navigating Additional Policies and Riders

When exploring rental car insurance coverage, one often encounters a variety of additional policies and riders that can enhance or modify the base coverage. These optional extras are designed to cater to different needs and preferences, ensuring a more tailored protection experience. For instance, some policies offer comprehensive coverage, going beyond the standard liability and collision damage by including provisions for theft, vandalism, and even natural disasters.

Riders such as auto maintenance packages can be particularly beneficial, providing peace of mind during your rental period. These can cover unexpected repairs or routine service visits, potentially saving you from significant out-of-pocket expenses. Moreover, specific models like Mercedes Benz collision repair may be available as add-ons for luxury vehicle rentals, reflecting the specialized needs and higher value of such assets. Other services, such as paintless dent repair, offer a cost-effective alternative to traditional body shop repairs, ensuring your rental car retains its aesthetic appeal during and after your trip.

When considering rental car insurance coverage, understanding the various options available is key to making an informed decision. By familiarizing yourself with basic and comprehensive coverage, as well as navigating additional policies and riders, you can ensure that you’re adequately protected while on the road. Remember, the right coverage can provide peace of mind and financial safeguard, so take a dive into these details before securing your next rental vehicle.