Successful frame repair for insurance claims starts with a detailed vehicle damage assessment by skilled technicians using advanced tools. Comprehensive documentation and high-quality photography ensure accurate evaluation, expediting claim processing and repair. Choose a reputable automotive body shop with experience, certifications, good reviews, cost transparency, and clear communication for a seamless frame repair process.

Frame repair is often a crucial step in the insurance claim process, especially after accidents. This comprehensive guide breaks down the essential steps involved. From assessing damage and documenting evidence through meticulous inspections and photography, to choosing a qualified repair shop, each phase ensures your vehicle’s structural integrity and facilitates a smoother insurance claim. Learn how to navigate this process effectively for successful frame repair coverage.

- Assess Damage: Inspecting Your Vehicle for Frame Issues

- Document and Photograph: Gathering Evidence for Insurance

- Choose a Repair Shop: Finding a Qualified Professional for Frame Repair

Assess Damage: Inspecting Your Vehicle for Frame Issues

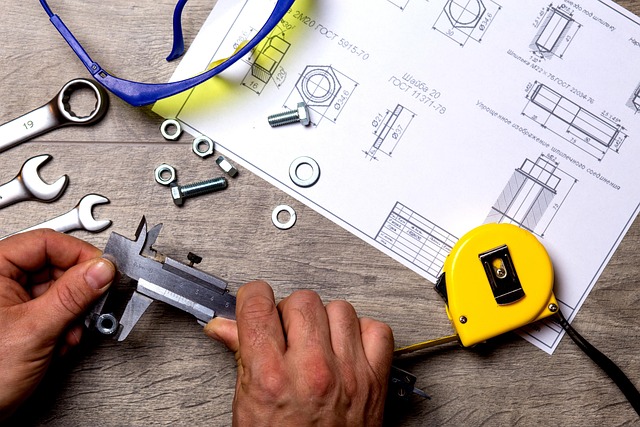

When dealing with a potential frame repair for insurance claims, the initial step involves a thorough assessment of the vehicle’s damage. This critical process entails inspecting every inch of your car’s frame to identify any structural abnormalities or misalignments. Skilled professionals will look for signs such as dents, bends, twists, or gaps in the frame rails and body panels.

During this inspection, they may also employ advanced diagnostic tools to measure and document the extent of the damage, ensuring that only authorized automotive repair services are performed, specifically targeting vehicle body repair when necessary. This meticulous assessment is vital in determining the scope of work for frame repair, ensuring that your insurance claim is processed accurately and promptly.

Document and Photograph: Gathering Evidence for Insurance

When it comes to frame repair for insurance claims, documentation and photography are crucial steps that form the backbone of the process. The first step is to meticulously document the damage sustained by the vehicle. This involves taking detailed notes about the extent of the frame damage, including any deformities or misalignments. It’s equally important to photograph the damaged areas from various angles; these images serve as concrete evidence for insurance companies when assessing the claim.

In an automotive body shop, skilled technicians will use these records to accurately determine the necessary repairs, be it a minor bumper repair or more complex frame straightening. These steps ensure that the insurance company understands the scope of work required and can process the claim efficiently. Proper documentation and photography are vital for a smooth vehicle repair process and a successful insurance claim.

Choose a Repair Shop: Finding a Qualified Professional for Frame Repair

When it comes to frame repair for insurance claims, choosing a qualified professional is crucial. Start by researching reputable car repair shops with experience in automotive body work and frame restoration. Look for shops that have positive reviews and certifications from recognized organizations. This ensures they possess the necessary skills and equipment to handle complex frame repairs accurately.

Consider factors like location, cost estimates, and communication when selecting a shop. It’s important to choose a car repair shop that is convenient for you and transparent in their pricing. Good communication with the shop will help ensure a smooth insurance claim process, as they can guide you through every step of the frame repair, providing detailed reports and updates.

When navigating the frame repair for insurance claim process, a thorough assessment of damage, comprehensive documentation with photos, and choosing a qualified repair shop are essential steps. By following these guidelines, policyholders can ensure their vehicle’s restoration to pre-accident condition while smoothly managing their insurance claims. This strategic approach facilitates a seamless transition from accident to repair, ultimately expediting the entire process.