Low-interest repair financing options provide affordable solutions for unexpected costs in automotive restoration and home repairs, easing financial strain, promoting faster service & better vehicle maintenance, and ensuring essential projects get done without breaking the bank.

In today’s digital era, home repairs and upgrades can be a financial burden. However, low-interest repair financing options offer a lifeline, providing homeowners with flexible and budget-friendly solutions. This article explores the benefits of these financing options, focusing on how they facilitate essential home improvements without breaking the bank. By delving into the advantages and various forms, we aim to guide folks in navigating these opportunities for a more comfortable and secure living space.

- Low-Interest Loans: A Financial Lifeline for Repairs

- Advantages of Flexible Repair Financing Options

- Budget-Friendly Solutions for Essential Home Upgrades

Low-Interest Loans: A Financial Lifeline for Repairs

Low-interest loans for repairs offer a financial lifeline for homeowners and business owners alike, providing an affordable solution to cover unexpected costs. In today’s economic climate, sudden repair needs can be financially burdensome, especially for major issues that require significant investment. Traditional financing options often come with high-interest rates, making it challenging for individuals to manage the added financial strain. However, low-interest repair financing options change this dynamic, allowing folks to access the funds they need without the hefty interest payments that can accumulate over time.

This is particularly beneficial in sectors like automotive restoration, where specialized services such as Mercedes Benz repair may involve substantial costs. Low-interest loans enable car owners to get their vehicles back on the road safely and reliably without breaking the bank. Similarly, for collision repair services, these financing options ensure that damaged vehicles can be restored efficiently, minimizing downtime and potential losses for businesses relying on their fleets.

Advantages of Flexible Repair Financing Options

Low-interest repair financing options offer a range of advantages that make it easier for individuals to access and afford necessary vehicle repairs. One of the key benefits is the flexibility they provide, allowing drivers to spread out payments over time rather than facing a substantial upfront cost. This is particularly advantageous when dealing with unexpected repairs, such as a bumper repair or collision damage, ensuring that a minor mishap doesn’t lead to significant financial strain.

Additionally, these financing options often cater specifically to the needs of collision repair shops, enabling them to offer competitive pricing and faster turnaround times. By accepting flexible payment terms, repair shops can attract more customers, including those who might otherwise delay essential repairs due to cost concerns. This results in better vehicle maintenance and safety, with benefits extending to both individuals and the overall road safety landscape, especially when considering tasks like vehicle dent repair.

Budget-Friendly Solutions for Essential Home Upgrades

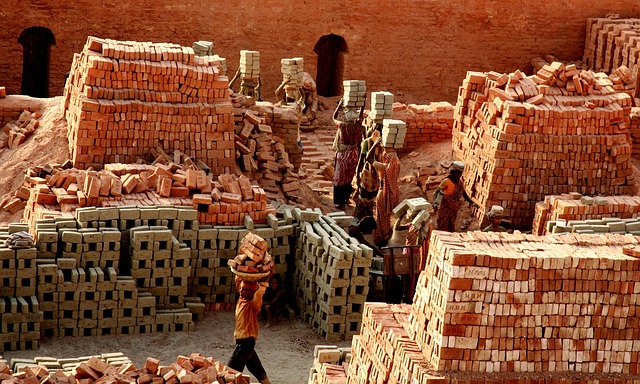

When it comes to essential home upgrades, keeping up with repairs and maintenance can often feel like a financial burden. However, low-interest repair financing options offer budget-friendly solutions that make these necessary tasks more manageable. With these flexible funding choices, homeowners can access the capital needed for projects ranging from roof replacements to kitchen remodels, without breaking the bank.

By availing of repair financing, individuals can avoid the stress of saving up for lengthy periods or compromising their emergency funds. These options provide a practical approach to funding home improvements, ensuring that critical repairs are addressed promptly and efficiently. Whether it’s fixing a leaky faucet, updating outdated electrical systems, or even tackling a classic car restoration, low-interest financing makes it possible for property owners to invest in the upkeep of their living spaces without significant financial strain.

Low-interest repair financing options have proven to be a game-changer, offering homeowners affordable solutions for essential upgrades. By leveraging these flexible funding sources, folks can navigate the labyrinthine process of home repairs without breaking the bank. In today’s digital era, accessing budget-friendly repair financing has never been easier, enabling folks to create a vibrant tapestry of comfort and safety in their living spaces. Remember that when considering repair financing options, it’s crucial to explore various lenders and choose terms that align with your financial capabilities.