R&R (Remove and Replace) is a cost-effective insurance claims process for minor accidents, involving damage assessment, removal of affected areas, and replacement with new or refurbished parts while adhering to insurer standards. These include specific repair methods, quality standards, and documentation requirements like OEM parts use and comprehensive estimates from certified auto body shops. Successful R&R depends on skilled technicians, clear communication, detailed estimates, and digital documentation for visual accountability.

In today’s competitive market, understanding R&R (Remove and Replace) processes is paramount for insurance providers aiming to stay ahead. This article delves into the intricacies of R&R, offering a comprehensive guide for navigating this critical aspect of risk management. We’ll explore key components of insurance provider requirements, share effective strategies for meeting R&R standards, and provide valuable insights to ensure your organization remains compliant and competitive.

- Understanding R&R: A Basic Overview

- Key Components of Insurance Provider Requirements

- Effective Strategies for Meeting R&R Standards

Understanding R&R: A Basic Overview

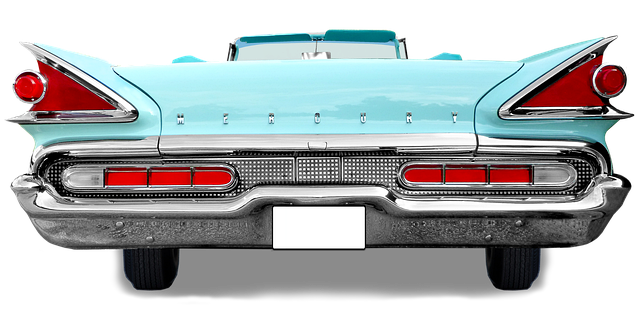

R&R, or Remove and Replace, is a fundamental process in the insurance claims landscape, particularly when it comes to repairs after minor accidents like fender benders. It’s a cost-effective approach used by insurance providers to settle claims efficiently, ensuring that vehicle owners receive quality repairs while maintaining control over expenses. This method involves assessing the damage, removing the affected area, and then replacing it with new or refurbished parts.

Whether it’s a minor car scratch repair or more extensive Mercedes Benz repair, the R&R process remains consistent. Insurers collaborate closely with trusted repair shops to streamline the work, ensuring that repairs meet specific standards and guidelines. By embracing this strategy, insurance providers can facilitate faster claim resolutions, enhance customer satisfaction, and promote a culture of responsible vehicle maintenance.

Key Components of Insurance Provider Requirements

When dealing with R&R (remove and replace) processes involving insurance claims, understanding the key components of insurance provider requirements is essential. These requirements vary across providers but generally include detailed specifications for damage assessment, repair methods, and quality standards. For instance, many insurance companies mandate the use of original equipment manufacturer (OEM) parts or their equivalents for vehicle restoration to ensure compatibility and longevity.

Additionally, insurers often have specific guidelines for documenting repairs, such as requiring comprehensive estimates from certified auto body shops. They may also specify that scratch repair and other aesthetic enhancements must align with the vehicle’s make, model, and year to maintain its original value. These stringent requirements are designed to protect both the insurance provider and the policyholder, ensuring that repairs are carried out efficiently and effectively while adhering to high standards of quality and safety.

Effective Strategies for Meeting R&R Standards

To effectively meet R&R (remove and replace) standards, insurance providers must implement robust strategies that ensure thoroughness and quality in autobody repairs. The process involves a meticulous approach to evaluating and replacing damaged car bodywork components. One key strategy is to employ certified auto body technicians who are skilled in the latest techniques and technologies for both removal and replacement. This includes utilizing specialized tools and equipment to safely disassemble and inspect the affected areas, ensuring that any hidden damage is accurately identified.

Additionally, establishing clear communication channels with insured individuals throughout the repair process fosters transparency and trust. Providing detailed estimates and outlining the steps involved in autobody repairs helps set reasonable expectations. Incorporating digital imaging and documentation can further enhance accountability by offering visual evidence of the condition of the car bodywork before, during, and after the R&R procedures are completed, thereby ensuring that all parties are satisfied with the outcome and adhering to industry standards for automotive body work.

In conclusion, understanding and effectively managing R&R (remove and replace) processes is pivotal for both businesses and insurance providers. By grasping the key components of insurance provider requirements and implementing successful strategies to meet R&R standards, entities can ensure compliance, mitigate risks, and streamline operations. This comprehensive approach not only protects against potential losses but also fosters a robust and reliable risk management ecosystem.