Understanding your insurance policy is crucial for efficiently managing car window repair after an accident or damage. Comprehensive and collision coverage cater to non-collision and collision incidents, respectively, but may exclude specialized repairs like previous collisions not disclosed, cleaning/decontamination, and full window assembly replacements. Documenting damage thoroughly with photos and records helps streamline the process and increase claim success rates.

“Uncover the hidden secrets your car insurance policy holds regarding window repairs. In this comprehensive guide, we’ll take you through the seven key points every driver should know. From understanding coverage to navigating claims, we break down what car window repair costs are and aren’t insured. Learn how to maximize your benefits, avoid common exclusions, and ensure efficient repairs. Get ready to protect your vehicle’s windows and stay informed about your insurance rights.”

- Understanding Your Policy: What Does Insurance Cover?

- Common Exclusions: What Car Window Repair Costs Aren't Covered

- Maximizing Your Benefits: Tips for Effective Claims and Repairs

Understanding Your Policy: What Does Insurance Cover?

Understanding Your Policy: What Does Insurance Cover?

When it comes to car window repair, your insurance policy is designed to provide peace of mind. However, navigating the specifics can be tricky. It’s crucial to understand what exactly your coverage entitles you to, especially after a vehicle collision repair or even a simple chip that requires fixing. Your insurance may cover a wide range of services, from replacing cracked windshields to repairing minor chips and cracks. This includes both comprehensive and collision coverage, which cater to different types of damages. Comprehensive typically covers non-collision related incidents like weather damage, while collision repair deals with accidents and their aftermath.

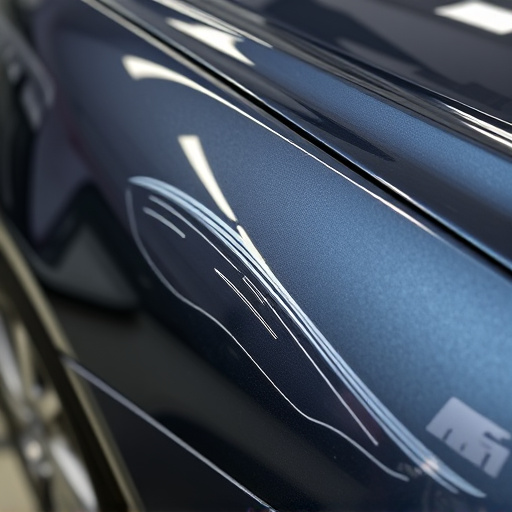

Delving deeper, insurance policies often include provisions for frame straightening, a process that realigns damaged metal to its original shape after a severe collision. This is crucial for ensuring your vehicle maintains its structural integrity and safety standards. Remember that deductibles apply to claims, so be sure to review yours. Moreover, some policies may have exclusions or limitations on certain types of repairs, so it’s essential to read your policy carefully. By understanding what your insurance covers, you can efficiently navigate car window repair processes, ensuring a smooth experience even in challenging situations.

Common Exclusions: What Car Window Repair Costs Aren't Covered

When it comes to car window repair, understanding what your insurance does and doesn’t cover is crucial. While comprehensive and collision coverage typically includes protection for shattered or cracked windows, there are common exclusions to be aware of. Many policies won’t cover repairs if your vehicle has been involved in a previous collision, especially if the damage was not properly disclosed or repaired. Additionally, certain high-end or specialized window types might not be included in standard coverage.

Other expenses often left out of car window repair insurance include cleaning and decontaminating the area around the damage, as well as any costs associated with replacing complete window assemblies rather than just the broken parts. It’s also important to note that deductibles still apply, meaning you’ll need to pay a set amount out of pocket before your insurance kicks in. This is true even for comprehensive and collision coverage, which might lead some policyholders to consider supplementary protection or additional auto body restoration plans to cover these gaps in coverage.

Maximizing Your Benefits: Tips for Effective Claims and Repairs

Maximizing Your Benefits: Tips for Effective Claims and Repairs

When it comes to car window repair, understanding your insurance policy is key. To make the process smoother and ensure you receive the best possible outcome, it’s essential to familiarize yourself with the coverage details. Start by reviewing your policy documents, paying close attention to exclusions and deductibles. Remember, not all damages are covered, so knowing what’s included in car window repair benefits is crucial.

For efficient claims handling, document all damage thoroughly. Take before-and-after photos of the affected area, including any cracks or chips. Keep records of repairs undertaken, especially when involving auto body work. This detailed approach will help streamline the vehicle repair process and ensure your insurance company understands the extent of the damage, maximizing your chances of a successful claim.

When it comes to car window repair, understanding your insurance policy is key. By knowing what’s covered and what isn’t, you can maximize your benefits and navigate the claims process effectively. Remember, while insurance typically covers damages like broken or shattered windows, there may be exclusions for hail damage or incidents not related to a collision. Stay informed, follow expert tips, and take proactive steps to ensure your car window repairs are seamless and cost-efficient.