Adopting insurance repair standards is a strategic move for body shops, ensuring quality, safety, and communication among insurers, policyholders, and experts. Compliance leads to optimized operations, reduced errors, and improved customer satisfaction by meeting or exceeding industry expectations. Effective implementation demands open communication, standardized forms, well-trained staff, and updated equipment. Skipping crucial steps can lead to non-compliant repairs, structural issues, and claim rejections; professionals must stay updated, train regularly, and maintain detailed records.

“Unleash the full potential of your insurance repair process with advanced tips on using insurance repair standards. This comprehensive guide delves into the fundamentals, best practices, and common pitfalls of effective implementation. By understanding and adhering to these standards, you’ll streamline operations, enhance customer satisfaction, and ensure fair, accurate repairs. Discover actionable strategies to optimize your processes, avoid costly mistakes, and elevate your industry standing through informed adherence to insurance repair standards.”

- Understanding Insurance Repair Standards: A Foundation

- Best Practices for Efficient Implementation

- Common Pitfalls and How to Avoid Them

Understanding Insurance Repair Standards: A Foundation

Understanding insurance repair standards is a fundamental step for anyone involved in the automotive industry, particularly those working in car body shops or specializing in automotive repair and restoration. These standards act as a set of guidelines to ensure that repairs are carried out to a high level of quality and safety. They provide a consistent framework that facilitates effective communication between insurers, policyholders, and repair professionals, ensuring everyone is aligned on the expected outcomes.

For car body shop owners and managers, familiarizing themselves with these standards can significantly enhance their operations. It enables them to streamline processes, reduce errors, and improve overall customer satisfaction. By adhering to insurance repair standards, automotive repair experts can ensure that every car body restoration project meets or exceeds industry benchmarks, fostering trust and reliability among clients and insurers alike.

Best Practices for Efficient Implementation

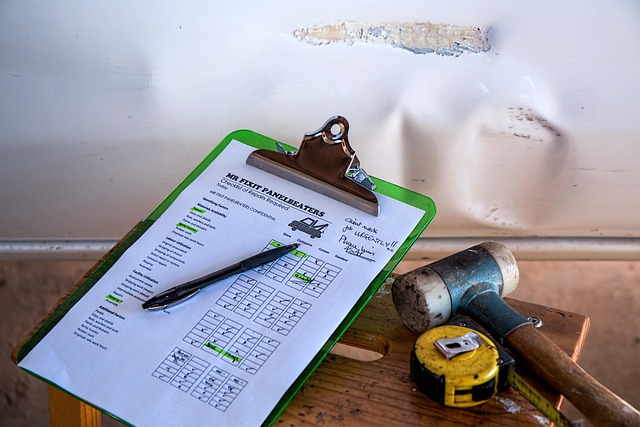

Implementing insurance repair standards effectively requires a strategic approach to ensure seamless and accurate repairs. One of the best practices is fostering open communication between all parties involved—insurers, repair shops, and policyholders. Clear dialogue helps set expectations, ensures compliance with industry standards, and facilitates faster resolution. Using standardized forms and procedures streamlines the process, reducing administrative burdens and potential errors.

Additionally, investing in well-trained staff and up-to-date equipment is crucial for efficient luxury vehicle repair or scratch repair services. Stay updated on the latest insurance repair standards and incorporate them into your workflow. This enables your team to handle complex claims accurately, maintaining the value of vehicles, whether they are regular or high-end models.

Common Pitfalls and How to Avoid Them

Many professionals often overlook the intricacies involved in adhering to insurance repair standards when handling car damage repairs. This can lead to several common pitfalls that impact both the quality of work and customer satisfaction. One significant mistake is failing to thoroughly understand the specific guidelines set by insurance companies, which vary across providers. Each has its unique processes and expectations, so staying informed about these standards is crucial. Skipping this step might result in repairs that don’t meet the required criteria, causing delays and potential claims rejection.

Another pitfall occurs when collision repair centers deviate from the recommended practices during the automotive repair process. Using subpar parts or employing unskilled labor can compromise the structural integrity of vehicles, leading to long-term issues like rust or mechanical failures. Additionally, not documenting each step meticulously can make it challenging to track progress and ensure compliance. To avoid these traps, professionals must stay updated on industry trends, regularly train staff, and maintain detailed records for every repair process.

Mastering insurance repair standards is a powerful tool for ensuring fair and effective damage assessments. By understanding these standards, implementing best practices, and steering clear of common pitfalls, professionals can enhance their processes, promote accuracy, and ultimately protect policyholders’ interests. Incorporating these advanced tips into your workflow will empower you to navigate complex repairs with confidence and maintain the highest level of integrity in your industry.