Implementing standardized protocols, advanced digital tools, and efficient communication revolutionizes total loss assessment for auto body repairs. This approach minimizes delays through swift inspections using clear checklists, rapid data capture with digital imaging and 3D scanning, and transparent discussions among insurers, repair facilities, and policyholders. Standardized documentation templates and digital documentation tools further expedite the process, ensuring accurate, up-to-date information accessible to all parties. The result is improved coordination, faster decision-making, and timely compensation for customers, while insurance providers benefit from streamlined claims processing.

In the realm of insurance, minimizing delays in total loss case processing is paramount for swift compensation and client satisfaction. This article guides you through proven strategies to streamline the initial assessment process, enhance communication and collaboration among stakeholders, and implement efficient documentation practices. By adopting these methods, insurers can optimize their operations, ensuring a more seamless experience for policyholders during challenging times. Key focus areas include digitalizing assessments, fostering open dialogue, and standardization of documentation procedures, all geared towards expediting total loss assessments.

- Streamlining the Initial Assessment Process

- Enhancing Communication and Collaboration

- Implementing Efficient Documentation Practices

Streamlining the Initial Assessment Process

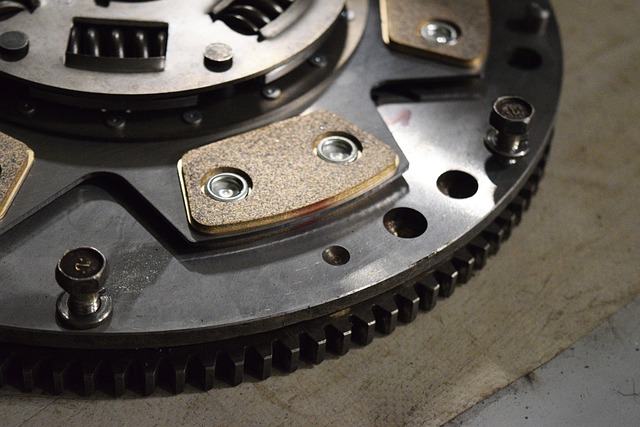

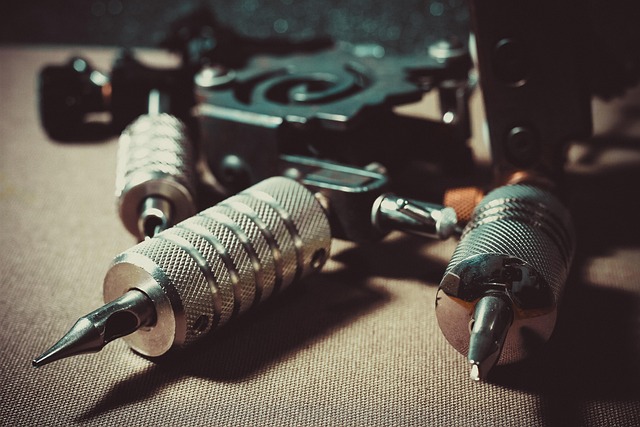

Streamlining the initial assessment process is a key strategy to significantly reduce delays in total loss case processing. Traditionally, this stage can be time-consuming, involving detailed inspections and documentation for each vehicle damaged beyond repair. However, implementing standardized assessment protocols and utilizing advanced digital tools can dramatically improve efficiency. By establishing clear checklists and guidelines for auto body damage evaluation, insurers can ensure a thorough yet swift examination of the vehicles. Additionally, integrating digital imaging and 3D scanning technologies allows for rapid capture and analysis of vehicle conditions, enabling faster decision-making without compromising accuracy.

This streamlined approach not only expedites the total loss assessment process but also paves the way for more effective coordination between insurers, repair facilities, and policyholders. As a result, automotive repair and auto body painting services can commence promptly, minimizing further delays and ultimately benefiting all parties involved. Efficient handling of initial assessments sets the tone for the entire claims process, ensuring timely compensation and faster restoration of vehicles to their pre-accident condition.

Enhancing Communication and Collaboration

Effective communication and collaboration are essential elements in streamlining the total loss assessment process. When handling total loss cases, seamless coordination between various stakeholders is key to minimizing delays. Insurers, repair facilities, and policyholders must work in harmony to facilitate a swift evaluation and settlement. Regular updates and clear communication channels ensure everyone involved is aligned with the latest information regarding the vehicle’s condition, necessary repairs, and estimated costs. This proactive approach helps prevent misunderstandings and delays that often arise from lack of communication.

By establishing open lines of dialogue, stakeholders can efficiently discuss complex matters such as auto frame repair or vehicle repair services needed after a total loss assessment. This collaborative effort ensures that the policyholder receives accurate information about their coverage, potential out-of-pocket expenses, and the overall timeline for getting their vehicle repaired to its pre-incident condition. Such transparency builds trust and enhances the overall customer experience, even in challenging situations like dealing with total loss assessments.

Implementing Efficient Documentation Practices

Efficient documentation practices are a cornerstone in reducing delays during total loss assessments. Streamlining the way information is collected and recorded can significantly speed up the claims process. Firstly, standardizing document templates ensures all necessary data is captured consistently, eliminating the need for repeated data entry and minimizing errors. This standardization should include detailed specifications of vehicle damage, including photos and descriptions of each affected area.

Secondly, digital documentation tools offer a practical solution by enabling quick data input, secure storage, and easy sharing. These systems facilitate real-time updates, ensuring everyone involved in the assessment process has access to the latest information. By implementing these efficient practices, auto repair services can enhance their total loss case processing, providing smoother experiences for both customers and insurance providers alike.

By streamlining the initial assessment process, enhancing communication among stakeholders, and implementing efficient documentation practices, it’s feasible to significantly reduce delays in total loss case processing. These strategies not only expedite claims handling but also foster a more transparent and effective insurance experience for all parties involved. Remember that optimizing these steps can lead to quicker settlements, improved customer satisfaction, and better overall operational efficiency.