The collision insurance claims process starts with damage assessment and documentation by both parties. The policyholder files a claim with evidence, which insurers evaluate. Insurers appraise damages, verify costs, and settle through reimbursement or repairs at trusted workshops. They use advanced tools like 3D scanning and specialized software for accurate assessments, integrating data from vehicle identification numbers (VINs), repair records, and maintenance databases to ensure precise and cost-effective car restoration, benefiting customers with timely compensation.

In today’s world, collision insurance claims play a pivotal role in ensuring swift and fair compensation for vehicle damage. This article delves into the intricate process of collision insurance claims management, focusing on the critical role insurers play in damage assessment and verification. We explore how insurers navigate complex scenarios, utilizing advanced tools and techniques to expedite claim settlements. Understanding these processes is essential for both policyholders and insurers alike, as it fosters transparency and efficiency in managing collision insurance claims.

- Understanding Collision Insurance Claims Process

- Insurer's Role in Damage Assessment and Verification

- Efficient Claim Settlement: Tools and Techniques Employed

Understanding Collision Insurance Claims Process

The collision insurance claims process involves several key steps that insurers and claimants must navigate to ensure a fair and efficient resolution. When a vehicle is involved in a collision, the first step is for both parties to assess the damage. This includes documenting the extent of the harm through photographs and detailed descriptions. Afterward, the policyholder files a claim with their insurance provider, submitting these records as evidence. Insurers then appraise the damages, evaluating the cost of repairs or replacement using industry standards and market rates.

After verification, insurers initiate the settlement process. This may involve directly reimbursing the claimant for repair costs or arranging for car bodywork services at a trusted workshop. In some cases, especially when damage is extensive or there are disputes over liability, negotiations between the insurer and claimant may be required to reach an agreement on compensation, ensuring that all repairs, including scratch repair where necessary, are performed to the satisfaction of both parties.

Insurer's Role in Damage Assessment and Verification

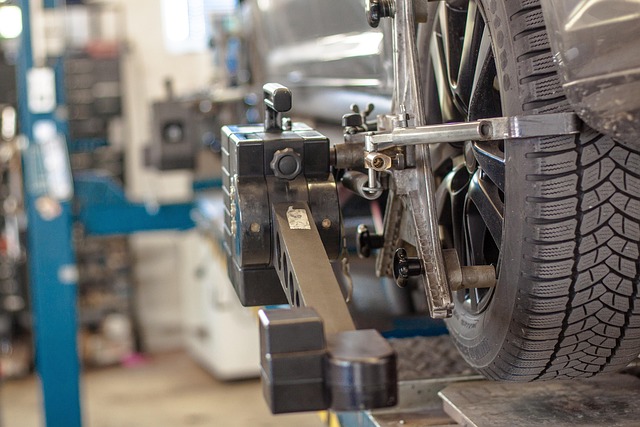

Insurers play a pivotal role in collision insurance claims by facilitating the damage assessment and verification process. When a vehicle is involved in an accident, insurers are responsible for evaluating the extent of the damage to determine the cost of repairs. This involves sending appraisers to inspect the vehicle, often with the assistance of specialized equipment, to ensure accurate assessments.

By working closely with trusted car repair shops and collision repair centers, insurers can verify the quality of the proposed repairs. They also ensure that any repairs conducted are in line with industry standards and safety regulations, thereby protecting both the policyholder and the insurer from fraudulent claims or substandard work. This meticulous process helps maintain the integrity of the claim system and facilitates a smoother recovery process for all parties involved, including those seeking hail damage repair.

Efficient Claim Settlement: Tools and Techniques Employed

Insurers play a pivotal role in ensuring efficient claim settlement for collision insurance claims, employing advanced tools and techniques to verify damage and streamline the process. These include state-of-the-art imaging technology, such as 3D scanning and high-resolution photography, which capture precise details of automotive body work, facilitating accurate assessments.

Additionally, insurers leverage specialized software platforms that integrate data from various sources—including vehicle identification numbers (VINs), historical repair records, and auto maintenance databases—to cross-reference and validate claims. This holistic approach not only ensures the authenticity of collision insurance claims but also promotes cost-effective car restoration processes, ultimately enhancing customer satisfaction by providing timely and comprehensive compensation for damages.

Insurers play a pivotal role in the collision insurance claims process, ensuring fair and swift compensation for policyholders. Through meticulous damage assessment and verification, they employ advanced tools and techniques to streamline claim settlements. By understanding the intricacies of this process, both insurers and policyholders can navigate collisions with greater confidence, knowing their rights and options are clearly defined, leading to a more efficient and effective resolution of collision insurance claims.