Auto body insurance coverage is vital protection for vehicles against damages beyond wear and tear, offering repairs, parts replacement, and restoration. Comprehensive auto body insurance shields drivers from unexpected expenses due to accidents, natural disasters, vandalism, or theft, providing peace of mind and swift vehicle return for both personal and business owners, especially crucial for luxury or unique models.

Comprehensive auto body insurance is more than just a safeguard; it’s a peace of mind game-changer. When you’re on the road, accidents can happen, and having comprehensive coverage means protecting not just your vehicle, but also your financial well-being. This article delves into the intricate benefits of choosing thorough auto body insurance, exploring how it safeguards your investment and provides a safety net for unexpected repairs. From protecting against environmental hazards to covering incidents beyond mechanical failures, understanding these advantages is key to making informed decisions.

- Protecting Your Investment: Auto Body Insurance Coverage

- Peace of Mind: Comprehensive Benefits Unlocked

- Beyond Repair: Understanding Complete Protection

Protecting Your Investment: Auto Body Insurance Coverage

When it comes to protecting your vehicle, auto body insurance coverage is an essential component often overlooked by drivers. This type of coverage is designed to safeguard your investment in case of damage beyond regular wear and tear. Whether it’s a fender bender or a more severe accident, comprehensive auto body insurance ensures that the repairs are not just patchy but thorough. It covers the cost of parts replacement and professional restoration, ensuring your vehicle regains its pre-accident condition.

Auto body work can be expensive, especially for those who own classic cars or unique vehicle models. With comprehensive coverage, you can access specialized services like classic car restoration without worrying about the financial burden. This includes repairs for dents, scratches, crushed panels, and even auto glass replacement. By choosing this type of insurance, drivers can ensure their vehicles are not only drivable but also maintain their aesthetic value and historical integrity in the event of damage.

Peace of Mind: Comprehensive Benefits Unlocked

Having comprehensive auto body insurance coverage provides an unparalleled sense of peace of mind. When you’re protected against a wide range of potential vehicle damages, from fender benders to severe accidents, it means less financial stress and more time to focus on what matters most. No longer do you have to worry about the overwhelming cost of repairs or replacement parts. Comprehensive coverage ensures that your vehicle’s bodywork, whether it’s minor scuffs or significant damage, is taken care of with ease.

This type of insurance acts as a shield, safeguarding you from unexpected auto repair expenses near me. It covers various incidents beyond typical accidents, including natural disasters like floods and storms, vandalism, and even theft. By having comprehensive coverage, you’re not just insured against the common; you’re protected against the unforeseen. This peace of mind allows drivers to enjoy their journeys without constant worry, knowing that their vehicle’s wellbeing is in capable hands.

Beyond Repair: Understanding Complete Protection

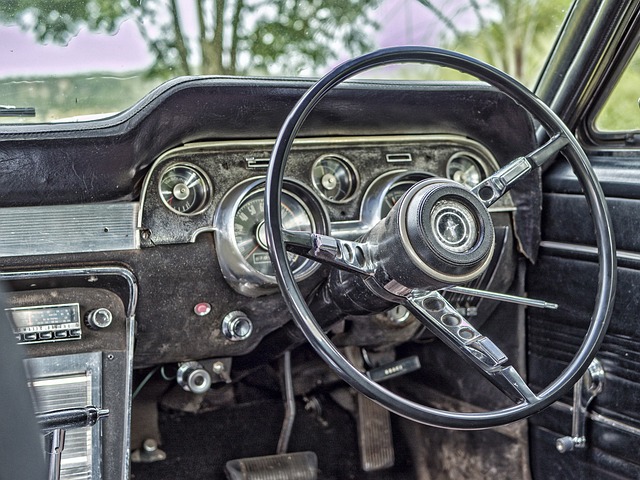

When it comes to protecting your vehicle, especially a luxury one, comprehensive auto body insurance coverage is an absolute necessity. It’s designed to go beyond mere cosmetic repairs and offer complete protection against a wide range of potential damages. Beyond fixing scratches or dents, this type of coverage ensures that even major auto body repairs, such as those required for fleet vehicles or high-end cars, are fully covered.

Comprehensive insurance picks up the tab for unexpected events like accidents, natural disasters, vandalism, and even theft. This includes not just the exterior but also the intricate interiors and mechanical components of your vehicle. For business owners with fleets, this can be a lifesaver, as fleet repair services often come with specialized needs that standard insurance might not cover. Comprehensive coverage provides peace of mind, ensuring that no matter what happens, your luxury vehicle repair costs will be manageable, and you’ll get back on the road safely and quickly.

Comprehensive auto body insurance coverage is a wise investment for anyone looking to safeguard their vehicle and their peace of mind. By understanding the benefits outlined in this article, from protecting your investment to gaining valuable peace of mind, it’s clear that comprehensive coverage offers a complete solution for all your auto repair needs. So, why wait? Take control of your automotive future with enhanced protection today.