Auto Body Shop Insurance is a vital safety measure for vehicle repair centers, protecting against risks like accidents and property damage. This specialized policy covers both physical damages and liability claims, including medical expenses and legal fees. Tailored policies are essential to cover injuries, damages, facilities, equipment, and inventory, ensuring stability and continuity in an industry demanding precision and safety. Comprehensive coverage enables efficient claim management, preserving financial stability, operations, and reputation, ultimately facilitating the provision of quality car repair services.

Auto body shop insurance is a crucial safety net that protects your business from unexpected financial burdens. In an industry where accidents and damage are part of the landscape, ensuring comprehensive coverage can safeguard your shop’s future. This article delves into the essential aspects of auto body shop insurance, exploring what it covers and why adequate protection is vital for long-term success. By understanding claims navigation and potential risks, you can secure a resilient foundation for your business.

- Understanding Auto Body Shop Insurance: What It Covers

- The Importance of Adequate Coverage for Your Business

- Navigating Claims and Safeguarding Your Shop's Future

Understanding Auto Body Shop Insurance: What It Covers

Auto Body Shop Insurance is a crucial safety net for any business specializing in vehicle repair and restoration. This specialized insurance policy is designed to protect against potential risks and financial losses that can arise from operating an auto body shop. When it comes to understanding what it covers, this insurance provides comprehensive protection for various aspects of the business.

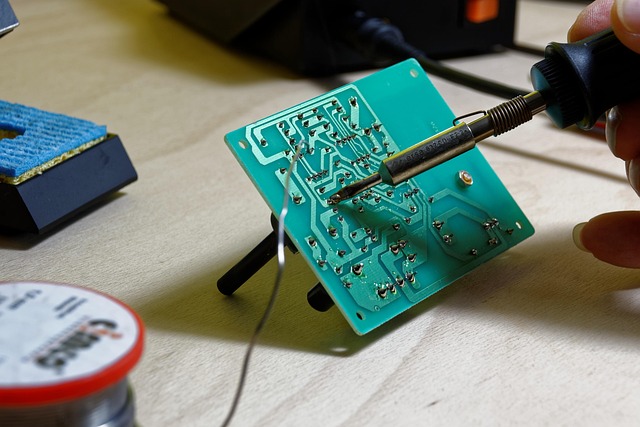

It typically includes coverage for property damage caused by accidents involving vehicles in the shop’s possession or under repair. This is essential for businesses like Mercedes Benz repair centers where high-value cars are handled regularly. The policy also offers liability protection against claims related to personal injury, including medical expenses and legal fees, which can be significant if a client slips or gets injured on the premises during vehicle repair services. Additionally, frame straightening services, a critical part of many auto repairs, are often specifically covered, ensuring that businesses offering this specialized service are protected from financial setbacks due to equipment malfunctions or mishaps.

The Importance of Adequate Coverage for Your Business

Running an auto body shop involves dealing with a range of risks and potential expenses. From the moment customers bring their vehicles in for auto glass repair or auto body work, to the intricate process of auto body painting and beyond, every step requires careful consideration and protection. This is where auto body shop insurance steps in as a vital shield.

Adequate coverage ensures your business is protected against unforeseen events such as accidents, natural disasters, property damage, and legal liabilities. It’s crucial to choose an insurance policy that covers the specific needs of your auto body shop, including liability for any injuries or damages caused during repairs, as well as coverage for your facilities, equipment, and inventory. Investing in comprehensive auto body shop insurance is not just a smart business decision; it’s essential for maintaining stability and continuity in an industry where precision, safety, and reliability are paramount.

Navigating Claims and Safeguarding Your Shop's Future

Navigating claims is a critical aspect of running an auto body shop. With the right auto body shop insurance in place, businesses can safeguard their future and minimize disruptions. When a claim occurs, whether it’s due to property damage, liability issues, or worker injuries, having adequate coverage ensures that your shop can cover repair costs, legal fees, and any settlements without compromising its financial stability. This protection is crucial for maintaining operations and preserving the reputation of your car bodywork services.

Auto body shop insurance also offers peace of mind by providing a safety net against unexpected events. By understanding the scope of your coverage and knowing how to file a claim efficiently, you can streamline the process and focus on delivering quality car repair services. This proactive approach allows your business to continue thriving, ensuring that any future challenges are met with resilience and financial security.

Auto body shop insurance is an indispensable asset for any business in the automotive repair sector. By understanding what it covers, recognizing its importance, and knowing how to navigate claims, owners can safeguard their shops’ future prosperity. Investing in comprehensive auto body shop insurance is a strategic move that fosters peace of mind, ensuring your business is protected against potential risks and financial losses.