Unexpected home and vehicle repairs can strain finances, but low-interest repair financing options provide a safety net. These options fund essential maintenance, encourage proactive upkeep, offer flexible payment plans, and include benefits like transparent pricing and discounts, easing financial burdens for both homeowners and auto owners while ensuring timely, cost-effective repairs.

Homeowners often face the challenge of unexpected repairs, but limited budgets can create a financial hurdle. Enter low-interest repair financing options—a game-changer for those seeking to maintain their homes without breaking the bank. This article explores how these financing alternatives provide a financial lifeline, enabling homeowners to unlock access to much-needed repairs. Beyond interest savings, we delve into the broader benefits that contribute to long-term cost efficiency and home value preservation.

- Low-Interest Loans: A Financial Lifeline for Homeowners

- Repair Financing: Unlocking Access to Much-Needed Repairs

- Benefits Beyond Interest: How These Options Help Save Money

Low-Interest Loans: A Financial Lifeline for Homeowners

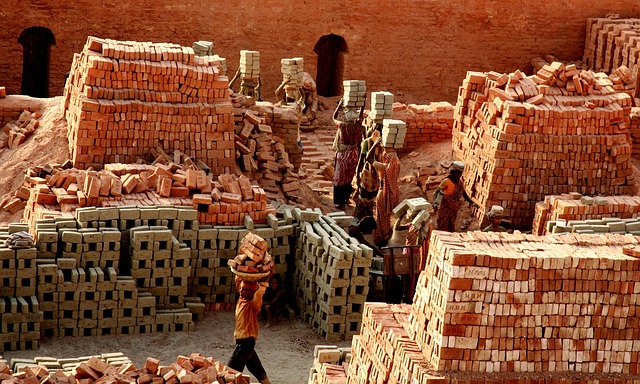

For many homeowners, unexpected repairs can be a significant financial burden. This is where low-interest repair financing options step in as a savior. These loans offer a much-needed relief from the strain of costly emergency fixes, especially for essential home maintenance. With attractive interest rates and flexible repayment terms, homeowners can now access the funds required to address various issues without breaking the bank.

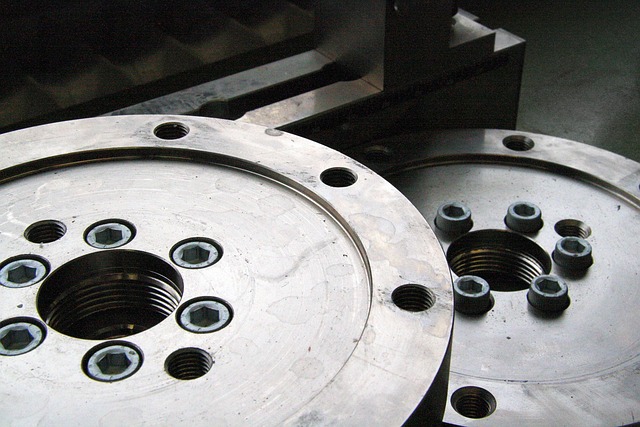

Whether it’s a leaky roof, faulty plumbing, or structural repairs, low-interest loans provide a financial lifeline. Unlike traditional borrowing options, these financing choices prioritize affordability and accessibility. Homeowners can focus on getting the necessary work done without worrying about accumulating high-interest debt. Moreover, this approach encourages proactive maintenance, as individuals are more inclined to address issues promptly when they have access to affordable repair financing options, such as car bodywork or paintless dent repair solutions, keeping their properties in top condition.

Repair Financing: Unlocking Access to Much-Needed Repairs

Repair financing options have become a game-changer for many individuals and businesses, especially when it comes to accessing essential automotive repairs. In today’s digital era, where immediate solutions are expected, low-interest repair financing can be a lifeline for those facing unexpected vehicle issues. With these financing options, customers can unlock the much-needed services at an affordable cost, ensuring their vehicles remain reliable on the roads.

Whether it’s an auto body shop dealing with complex bodywork or an automotive repair center requiring specialized tools and parts, repair financing provides a safety net. It allows them to offer competitive pricing and flexible payment plans, attracting a broader customer base. This approach fosters trust and encourages folks to prioritize their vehicle maintenance, as they can spread out the costs without breaking the bank.

Benefits Beyond Interest: How These Options Help Save Money

When considering repair financing options, it’s easy to focus solely on the interest rates. However, there are significant benefits that go beyond low-interest rates. These repair financing options offer savings strategies that can help manage and reduce overall expenses for various repairs, including tire services, automotive restoration, and automotive collision repair.

Many financing plans provide flexible payment terms, allowing you to spread out costs over time. This means you don’t have to pay for substantial upfront fees or face unexpected financial strain after a major repair. Additionally, some programs may include perks like no hidden fees, transparent pricing, and even discounts on parts or services, further enhancing the savings. By choosing these financing options, individuals can make necessary repairs without compromising their budgets.

Low-interest repair financing options prove invaluable for homeowners seeking to enhance their living spaces. By offering accessible and affordable funding, these solutions facilitate much-needed repairs without placing a strain on personal finances. Beyond interest savings, repair financing options empower individuals to create safer, more comfortable environments while effectively managing their budgets. Embracing these opportunities can thus lead to substantial long-term financial benefits and improved quality of life.