Insurance company negotiations are complex due to contrasting financial goals and intricate automotive repairs. Body shops specializing in paintless dent repair must master industry jargon, understand insurer claim processes, and navigate bureaucracy to secure fair compensation based on standards for tasks like dent removal. By doing so, they foster positive relationships with insurance adjusters, streamline claims settlements, and ensure reasonable reimbursement rates for quality services, regardless of program involvement.

“In the intricate world of insurance company negotiations, body shops must navigate complex dynamics to secure fair compensation. This article uncovers the essential elements for success, delving into the unique challenges faced by these businesses. We explore the role of insurance adjusters and their strategies, emphasizing the importance of thorough preparation—from documentation to benchmarking. Furthermore, it highlights effective communication techniques, including active listening and empathy, as powerful tools to build relationships and achieve mutually beneficial agreements.”

- Understanding Insurance Company Negotiation Dynamics

- – The role of insurance adjusters and their negotiation strategies

- – Common challenges faced by body shops during negotiations

Understanding Insurance Company Negotiation Dynamics

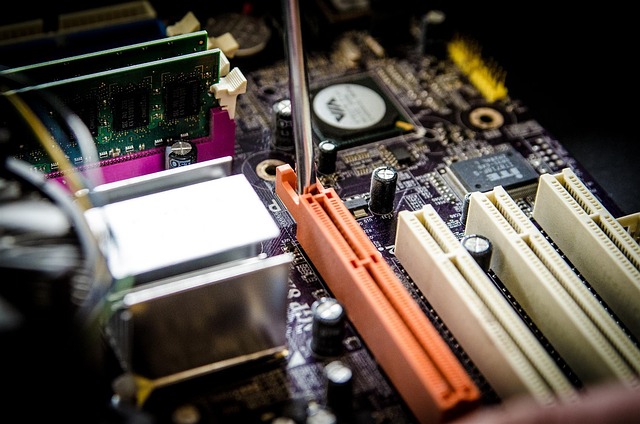

When engaging in negotiations with insurance companies, body shops must understand the unique dynamics at play. Insurance company negotiations are intricate due to the complex nature of automotive repairs and the financial implications for both parties. Insurers have specific processes and guidelines they adhere to when assessing claims, which can sometimes create a sense of frustration for collision repair centers seeking fair compensation for their services.

Body shops involved in paintless dent repair or collision repair often need to navigate these negotiations effectively to secure the best outcomes for their business and clients. This involves understanding the insurer’s claim settlement procedures, including how they value repairs, especially when it comes to tasks like dent removal. By demonstrating expertise and a solid grasp of industry standards, body shops can more confidently advocate for their work, ensuring they receive reasonable reimbursement rates for quality services provided.

– The role of insurance adjusters and their negotiation strategies

Insurance adjusters play a pivotal role in facilitating negotiations between insurance companies and collision repair shops. Their primary responsibility is to assess the damage incurred by vehicles involved in accidents, which directly impacts the claims process. During negotiations, they employ strategic tactics to reach agreements that benefit both parties.

These adjusters are well-versed in auto collision repair processes, allowing them to understand the costs associated with various types of repairs, including bumper repair and more complex body work. Their negotiation strategies often involve presenting detailed estimates from reputable collision repair shops, ensuring fair pricing while managing the insurance company’s financial interests. This balanced approach is crucial in maintaining positive relationships between insurers, repair facilities, and policyholders, ultimately streamlining the claims settlement process for all involved, be it a direct repair program or third-party involvement.

– Common challenges faced by body shops during negotiations

Body shops often encounter several challenges when engaging in negotiations, particularly with insurance companies. One significant hurdle is understanding the intricate details and terminology used by insurers, which can be confusing for non-industry professionals. This language barrier may lead to misunderstandings and miscommunications, impacting the outcome of the negotiation negatively. For instance, terms related to auto frame repair or Mercedes Benz repair standards might differ between body shops and insurance assessors, causing disagreements on the scope of work and costs.

Another common challenge is navigating the bureaucracy and complex processes involved in insurance company negotiations. Insurers often have strict protocols and guidelines that must be followed precisely. Body shops need to invest time in learning these procedures, ensuring they provide accurate estimates and documentation to avoid delays or rejections. The pressure to meet deadlines while maintaining quality work can be daunting, especially when dealing with high-value claims for luxury vehicle repairs like auto detailing.

In navigating complex insurance company negotiations, understanding the dynamics and challenges is key for body shops. By recognizing the crucial role of insurance adjusters and their strategic approaches, shops can effectively counter common hurdles. Armed with this knowledge, they can foster more productive discussions, ensuring fair compensation for their services. Mastering these negotiations is a game-changer, allowing body shops to thrive in an ever-evolving industry landscape.