Understanding out-of-pocket repair costs is crucial for vehicle owners, as it involves budgeting for varying expenses based on damage severity, from simple dent removal to complex collision body restoration. Allocating 1% to 2% of your car's value annually for repairs and seeking accurate estimates from reputable shops helps in financial preparedness. Efficient management through dedicated budget lines, emergency funds, and strategic planning ensures smooth navigation of these costs without straining finances.

Applying out-of-pocket repair costs to your budget is a crucial step towards effective financial management. This guide breaks down the process into three key sections: understanding these unexpected expenses, strategically incorporating them into your monthly budget, and implementing strategies for efficient financial control during repairs. By the end, you’ll be equipped to navigate these challenges with confidence.

- Understanding Out-of-Pocket Repair Costs

- Incorporating Repairs into Your Monthly Budget

- Strategies for Effective Financial Management During Repairs

Understanding Out-of-Pocket Repair Costs

Out-of-pocket repair costs refer to the expenses that vehicle owners are responsible for paying out of their own pocket when it comes to fixing their cars, trucks, or other vehicles. These costs can vary widely depending on the type and extent of the damage. For instance, a simple auto dent repair might cost just a few hundred dollars, while more complex procedures like car body restoration following a collision could run into thousands. Understanding these out-of-pocket expenses is crucial for budgeting purposes, as it helps in preparing for unexpected repairs and ensuring financial stability.

Knowing what constitutes out-of-pocket repair costs also allows drivers to differentiate between optional enhancements and necessary fixes. Collision repair services, for example, are often covered by insurance policies under certain circumstances, but the deductible amount and any excess fees remain the owner’s responsibility. By being aware of these costs, individuals can make informed decisions about their vehicle maintenance and effectively incorporate these expenses into their long-term financial planning.

Incorporating Repairs into Your Monthly Budget

Incorporating out-of-pocket repair costs into your monthly budget is a proactive step towards financial stability and preparedness. Start by assessing the average expenses associated with vehicle maintenance, including routine services and unexpected repairs like car bodywork fixes. Allocate a realistic portion of your monthly income to cover these costs. Many experts suggest setting aside at least 1% to 2% of your vehicle’s value annually for repairs, which can be easily incorporated into your regular budget.

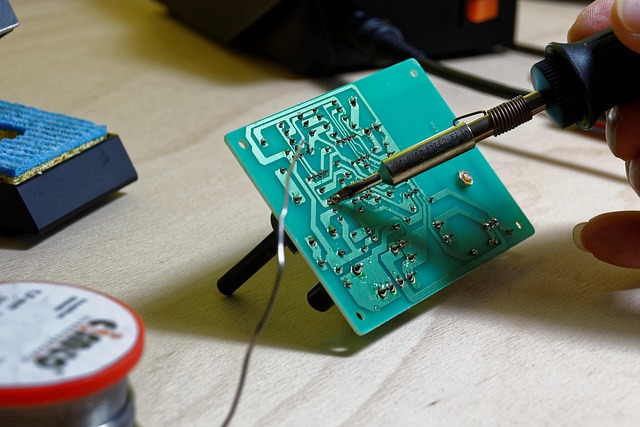

Consider visiting a reputable vehicle body shop to get accurate estimates for common repair tasks. By understanding the typical out-of-pocket expenses, you can adjust your budget accordingly and avoid being caught off guard by sudden vehicle repair bills. Regular budgeting for these costs ensures that when an unexpected repair arises, it’s treated as part of your planned expenses rather than a financial strain.

Strategies for Effective Financial Management During Repairs

When dealing with unexpected out-of-pocket repair costs for your vehicle, efficient financial management becomes crucial. The first step is to create a dedicated budget line item specifically for auto repair services or vehicle maintenance. This ensures that you’re prepared and can cover repairs promptly without adding to existing financial strains. Regularly assess your savings and consider setting aside a portion each month to build an emergency fund for exactly these unforeseen expenses.

Additionally, prioritizing and planning are essential strategies. If you know certain repairs, like car paint services, tend to be costlier, factor that into your budget. Consider scheduling non-essential but planned maintenance during periods of lower financial stress to avoid the shock of out-of-pocket repair costs. By being proactive and prepared, you can navigate these expenses with less hassle, ensuring your vehicle stays reliable while maintaining a healthy financial outlook.

Applying out-of-pocket repair costs to your budget is a proactive step towards financial stability. By understanding and incorporating these costs, you can avoid unexpected financial strain. Effective strategies for managing repairs allow you to stay within your budget while ensuring necessary maintenance. Remember, regular planning and thoughtful budgeting will make managing out-of-pocket repair costs a seamless part of your financial routine.