Understanding insurance coverage for vehicle crash repair is vital. Comprehensive and collision coverage address various damages, with specific services like car paint and tire care crucial for restoration. Policyholders should know deductibles and out-of-pocket costs. Insurance companies facilitate repairs by inspecting, estimating, and coordinating with trusted body shops, streamlining the process from reporting to post-repair return. Partnerships between insurers and mechanics expedite repairs like fender benders and auto glass replacements, enhancing the vehicle crash repair experience.

“In the event of a vehicle crash, understanding your insurance coverage and the claims process is crucial for a smooth repair experience. This article serves as your guide through the intricacies of vehicle crash repair claims. We’ll explore essential aspects such as understanding insurance coverage for vehicle damage, navigating the step-by-step claims process, and fostering collaboration between insurers and mechanics. By delving into these topics, you’ll be better equipped to handle and resolve vehicle crash repairs efficiently.”

- Understanding Insurance Coverage for Vehicle Damage

- The Claims Process: Step-by-Step Guide

- Repairing Relationships: Insurer-Mechanic Collaboration

Understanding Insurance Coverage for Vehicle Damage

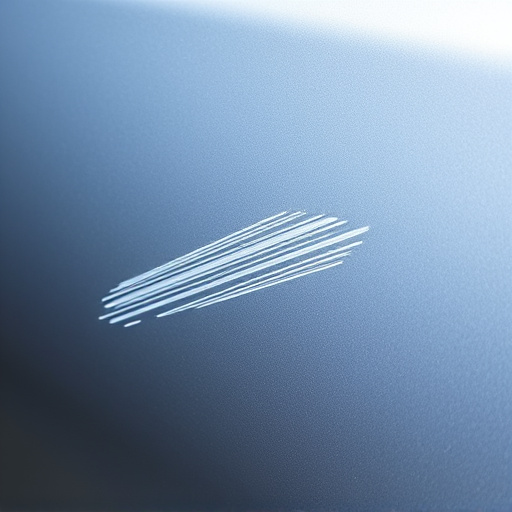

When it comes to vehicle crash repair, understanding your insurance coverage is paramount. Different types of insurance policies offer varying levels of protection for various aspects of vehicle damage. Comprehensive and collision coverage are two common components of auto insurance that specifically cater to vehicle crash repair needs. Comprehensive insurance covers damages from events other than a collision, such as natural disasters or vandalism, while collision coverage kicks in during accidents involving another vehicle or object.

Knowing your policy’s specifics is crucial when navigating the vehicle crash repair process. This includes recognizing what services are covered, like car paint services to restore the vehicle’s aesthetic appeal after a dent or scratch, and tire services if an accident causes damage to your tires. For more extensive repairs that require car paint repair, understanding your deductible and out-of-pocket expenses is essential. Insurance companies typically process claims by inspecting the damages, estimating repair costs, and facilitating the repair process with trusted body shops, ensuring a seamless experience for policyholders in their time of need.

The Claims Process: Step-by-Step Guide

The claims process for vehicle crash repair starts with a report of the incident to your insurance provider. This is typically done immediately after the crash, ensuring all necessary details are accurately recorded. The insured party will need to provide their policy details and contact information, along with a description of what happened.

Next, the insurance company assigns an adjuster to review the claim and assess the damage. They will inspect the vehicle, often with the help of specialized technicians, to determine the extent of repairs required for various components like tire services, dent repair, or car paint repair. The adjuster will then provide a preliminary estimate for the repair costs. If needed, they might also organize a rental car while your vehicle is in the shop. Once approved, the insurance company facilitates the actual repair process by paying the designated auto body shop directly, ensuring a smooth transition back to having a fully restored vehicle on the road.

Repairing Relationships: Insurer-Mechanic Collaboration

In the aftermath of a vehicle crash repair claim, repairing relationships between insurers and trusted mechanics is crucial. This collaboration ensures that fender benders and auto glass replacements are handled efficiently, leading to faster vehicle restoration for policyholders. Insurers often work closely with auto collision centers to streamline the process, fostering trust and ensuring quality workmanship.

By establishing these partnerships, insurers can maintain their reputation while providing comprehensive service. Mechanics, in turn, benefit from insured clients’ trust, steady work flow, and the opportunity to specialize in specific repairs. This mutual reliance strengthens the bond between all parties involved, making vehicle crash repair a smoother process for everyone.

Insurance plays a pivotal role in facilitating efficient and fair vehicle crash repair processes. By understanding your coverage, following a structured claims process, and fostering collaboration between insurers and mechanics, you can ensure a smoother journey during challenging times. Remember, knowledge is power – the more you understand about how insurance works, the better equipped you’ll be to navigate the path to vehicle crash repair success.